11 February 2016

Q3FY16 Results Update | Sector: Consumer

Page Industries

Buy

BSE SENSEX

22,952

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

6,976

PAG IN

11.2

121.8 / 1.8

16,995/9,871

-11/-7/13

181

49

CMP: INR10,878

TP: INR14,000(+29%)

In-line performance; 10% volume growth in a soft market environment

Financials & Valuations (INR b)

Y/E Mar

2016E 2017E 2018E

17.9 22.3 28.0

Net Sales

3.8

4.7

6.1

EBITDA

2.4

3.0

3.9

PAT

212.6 265.8 349.1

EPS (INR)

21.0 25.0 31.3

Gr. (%)

453.1 586.0 760.5

BV/Sh (INR)

46.9 45.4 45.9

RoE (%)

41.5 42.5 45.1

RoCE (%)

51.2 40.9 31.2

P/E (x)

32.0 26.0 20.1

EV/EBITDA (x)

Estimate change

TP change

Rating change

3%

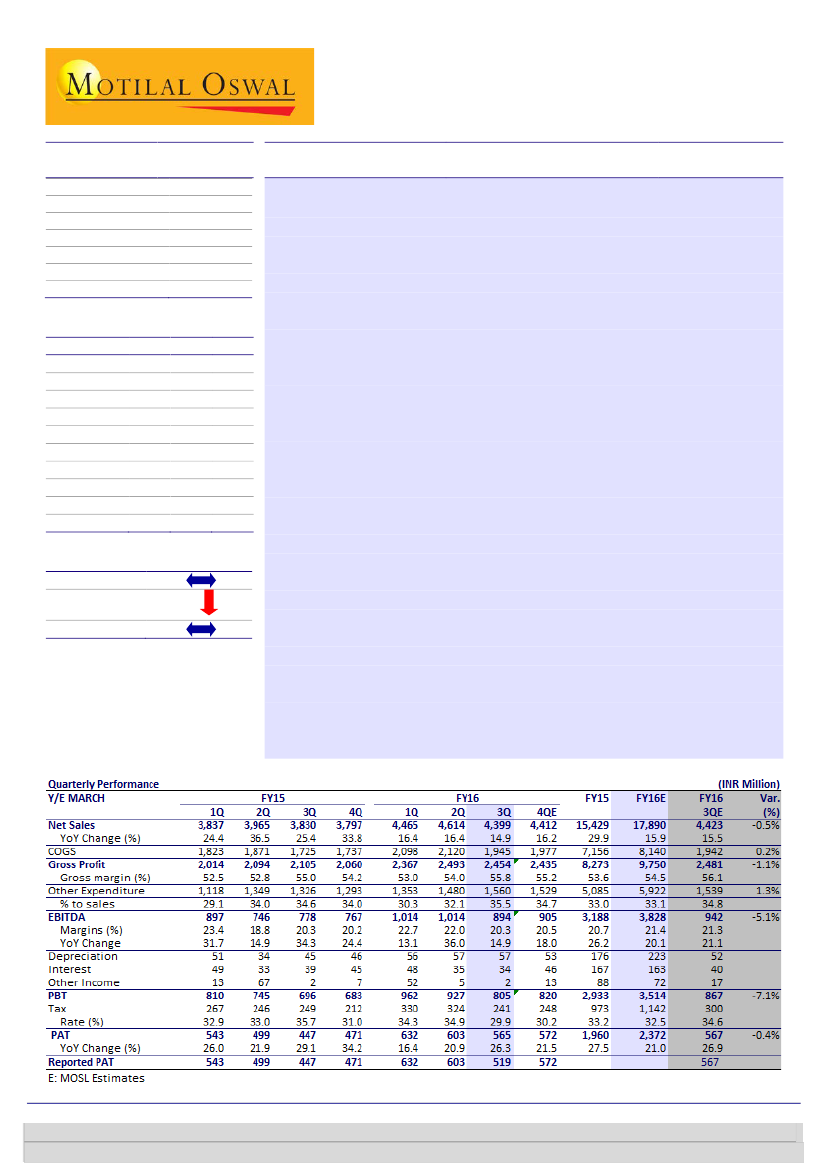

Page Industries 3QFY16

net sales grew 14.9% YoY to INR4.4b (est. INR4.4b)

with 10.6% volume growth. EBITDA grew 14.9% YoY to INR894m and Adj. PAT

grew 26.3% YoY to INR565m (est. INR567m) after adjusting for differential

bonus liability of INR65.1m for 1HFY16. As per management, market

environment continues to be soft with broad based slowdown across regions.

3QFY16 volumes grew 10.6% YoY

(9MFY16 volumes up 10.5%) with pricing

component being 3.9% (4.8% for 9MFY16). Men’s Innerwear, women’s

innerwear and leisure wear segment posted 13.6%, 26.5% and 11.3% growth

respectively with volume growth of 10.1%, 19.9% and 3.9% respectively.

Leisure wear segment volumes were impacted due to withdrawal of

consumer/trade offers.

Gross margin expanded 80bps YoY

to 55.8% (est. 56.1%). However higher

employee costs (up 20% YoY due to differential bonus liability of INR22.3m in

3QFY16) and higher other expenses (up 10bps YoY) resulted in flattish EBITDA

margin YoY to 20.3% (est. 21.3%). Lower tax rate (down 590bps YoY) due to

certain exemptions resulted in Adj. PAT growth of 29.9% YoY to INR565m (est.

INR567m).

Management interaction takeaways:

i) Leisure wear segment volumes have

stabilized and the segment is now posting double digit growth, ii) Generally

PAGE takes price hikes in January, but it is awaiting clarity on GST (it could

initiate ~8% price hike post budget), iii) Tax rate for FY16 should trend at

9MFY16 levels.

Valuation and view:

Page 3QFY16 results were largely in-line with our

estimates; however we have tapered our estimates (2-3%) for FY17E/FY18E to

factor in moderation in sales (demand revival yet to see pick up) and lower tax

rates. We believe, Page offers a compelling, capital-efficient long-term lifestyle

play on the premiumizing innerwear category. A widening product and brand

portfolio, coupled with distribution expansion will aid share expansion and

drive multiple years of growth, in our view. Maintain

Buy

with a revised target

price of INR14,000 (40x FY18E EPS – three year average P/E).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(manish.poddar@motilaloswal.com); +91 22 3027 8029/

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com)