12 February 2016

Q3FY16 Results Update | Sector: Healthcare

Sun Pharma

Buy

BSE SENSEX

22,986

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

6,981

SUNP IN

2,406.6

2,041.6 / 29.9

1,201/706

14/12/12

4,590

45.3

CMP: INR848

TP: INR975(+15%)

Strong results; multiple triggers to drive growth

Financials & Valuation (INR b)

Y/E Mar

2016E 2017E 2018E

Sales

283.0 336.0 361.6

EBITDA

82.5 111.8 128.9

Adj. PAT

47.8

69.6

93.8

Core EPS (INR)

19.9

28.9

39.0

EPS Gr. (%)

0.9

66.3

18.0

BV/Sh. (INR)

120.3 146.3 178.3

RoE (%)

17.5

21.7

24.0

RoCE (%)

21.8

30.0

30.8

P/E (x)

42.7

29.3

21.7

P/BV (x)

7.1

5.8

4.8

Estimate change

TP change

Rating change

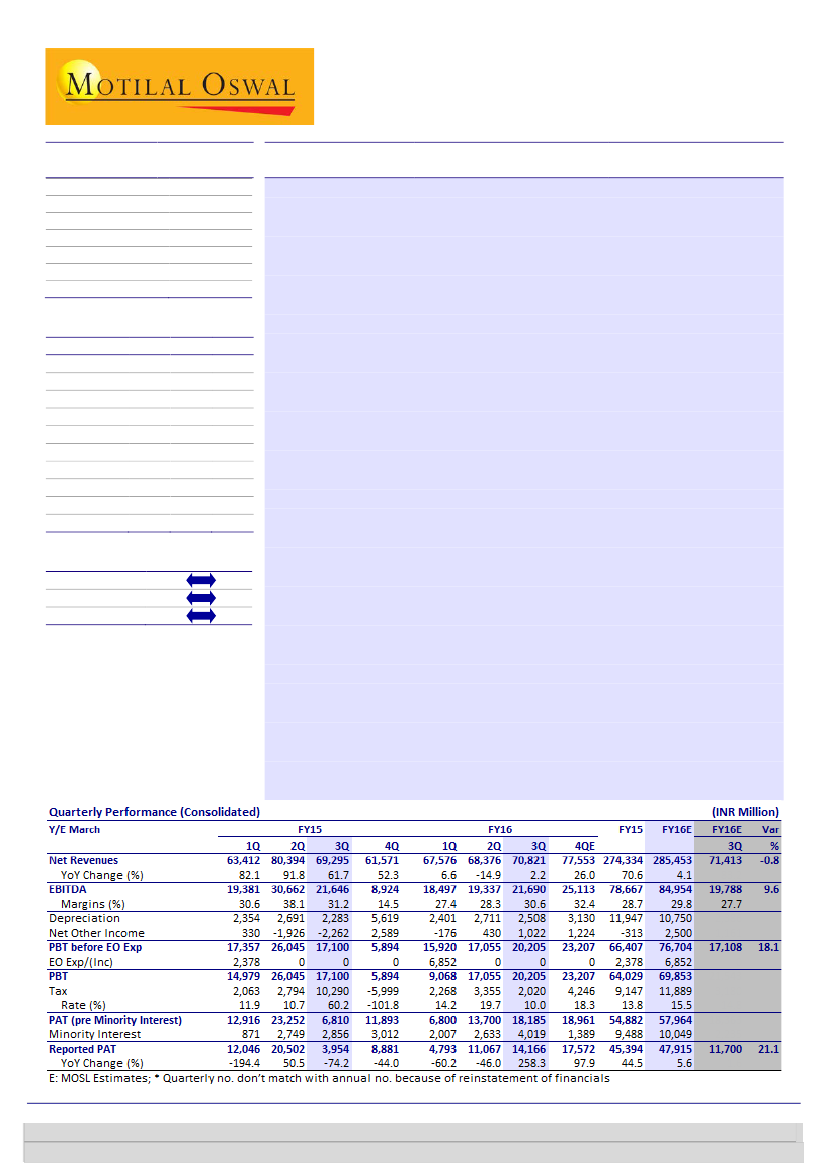

SUNP’s reported sales of INR70.8bn (in-line with est) with better than expected

EBITDA margins of 30.6% (vs est of 28%) and PAT of INR14.2b (vs INR11.1b in 2Q).

Positive surprise on profitability is on the back of better product mix, other

operating income and lower tax. We expect EPS for SUNP to double by FY18 to

INR39 (v/s INR20 in FY15)— primarily on the back of limited competition for

generic Gleevec, RBXY integration benefits, ramp-up of specialty products (Keveyis/

Xenazine/ Xelpros/ Elepsia XR) and mid-teens growth in India branded business.

US business- Gleevec to drive near term growth:

US sales stood at USD486m in 3Q

and were down 5% QoQ primarily due to one-time sales of ~USD40m in 3Q

partially offset by strong Taro performance (up 22% QoQ). Management plans to

complete the remediation measure shortly and will be asking US FDA for re-

inspection in 1Q FY17E. Currently we have built resolution by 2H FY17. We expect

US sales growth in medium term to be driven by Gleevec FTF, ramp-up of speciality

business products (Xenazine, Keveyis, etc).

Domestic business- recovery in growth to continue.

Domestic business revenue

grew at ~8% YoY. Growth was impacted due to withdrawal of bonus offers in the

acute segment. Having said that, revenue growth improved sequentially in 3Q (vs

1% YoY in 2Q) as the impact of promotional cuts moderated. According to AIOCD,

secondary sales growth was at ~10% YoY in 3Q signaling better growth ahead.

Earnings call takeaways:

(a)MK-3222 Phase-3 data to come out by April,(b)

Gleevec market share expected to reach ~30% during FTF, (c) Halol remediation is

on track and expects re-inspection in near term, (d)MK-3222 is likely to be filed in

CY17, (e)SUNP is on track to achieve USD300m Ranbaxy synergy by FY18E.

Multiple triggers, coupled with recent weakness, provide valuation upside:

Sun

Pharma is one of our top picks in Indian pharma with TP of INR975 @ 25x FY18E

P/E (@10% discount to historical average). Our buy rating is based on the back of

multiple triggers (MK-3222 Phase-3 data, Gleevec launch, RBXY integration benefits

and Keveyis ramp-up), superior execution track record, high RoIC (30%) and cash-

rich balance sheet (USD1b net cash). Post strong 4Q numbers, we have increased

our FY16 EPS by 5-6%. We estimate EPS CAGR of 26% over FY15-18 despite hike in

R&D and tax rate (tax rate @ 20% in FY18 v/s 14% in FY15).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 3982 5584

Amey Chalke

(Amey.Chalke@MotilalOswal.com); +91 22 39825423