Allcargo Logistics

BSE SENSEX

23,554

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol m

Free float (%)

S&P CNX

7,163

AGLL IN

252.1

40.3 / 0.6

218 / 128

-10/12/15

46

30.1

15 February 2016

Q3FY16 Results Update | Sector: Logistics

CMP: INR160

TP: INR243(+52%)

Buy

Macros keep EBITDA/PAT subdued, CFS shines; high FCF keeps balance

sheet strong

Financials & Valuations (INR b)

2016E 2017E 2018E

Y/E Mar

Net Sales

56.2

67.6

74.2

EBITDA

5.3

6.4

7.2

PAT

2.9

3.6

4.4

EPS (INR)

11.5

14.4

17.4

Gr. (%)

20.8

25.0

21.1

BV/Sh (INR)

85.5

98.1 113.3

RoE (%)

14.3

15.7

16.5

RoCE (%)

15.2

17.5

19.1

P/E (x)

13.9

11.1

9.2

P/BV (x)

1.9

1.6

1.4

Estimate change

TP change

Rating change

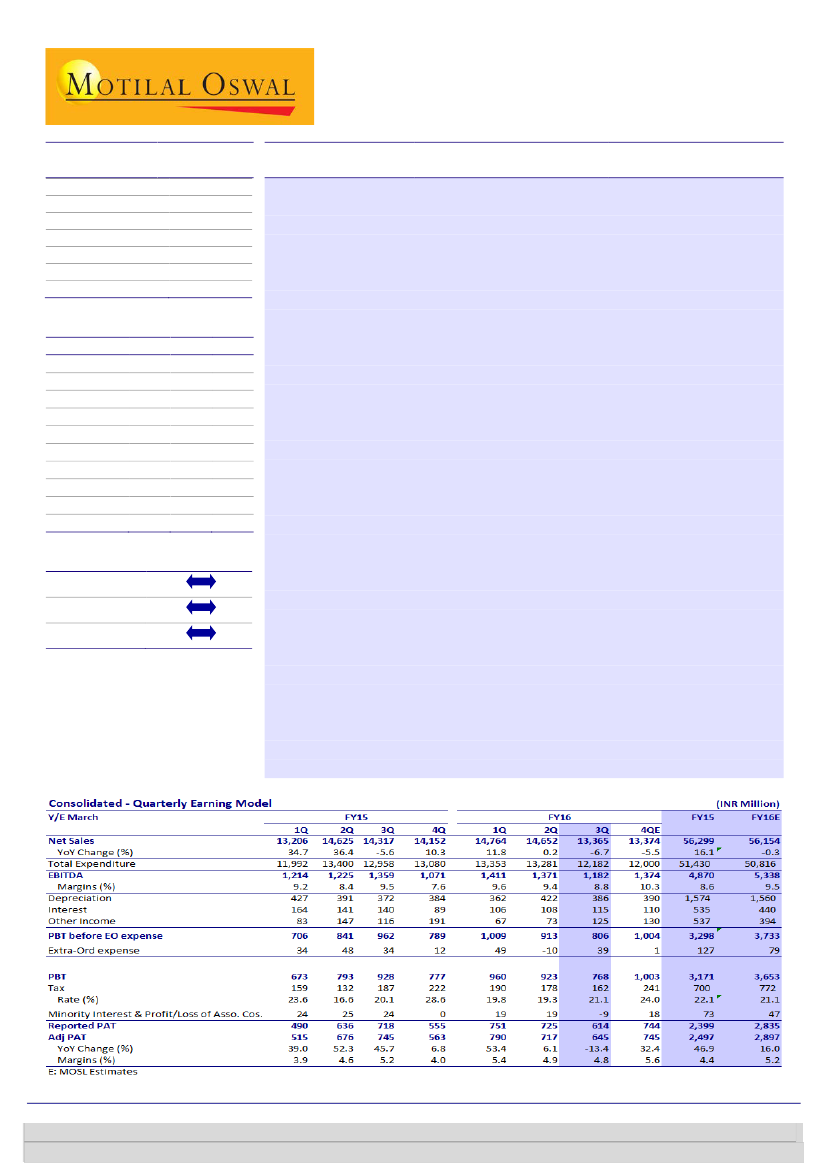

AGLL’s revenue declined 7% YoY and 9% QoQ to INR13.4b in 3QFY16 primarily

impacted by decline in MTO business. Reported EBITDA stood at INR1.2b (-13%

YoY, -14% QoQ); margins declined to 8.9% in 3QFY16 from 9.5% in 3QFY15. PAT

stood at INR0.6b (-14% YoY, -15% QoQ). For 9MFY16, Allcargo’s PAT grew 13% YoY

and its balance sheet continues to remain strong with debt/equity of 0.14 (net debt

of INR2.9b).

MTO volumes up 8% YoY in tough operating environment:

In the backdrop of

excess shipping capacity, Allcargo’s MTO volumes were decent with volumes at

116,168 TEUs (+8% YoY, -1% QoQ) in 3QFY16. Revenues stood at INR11b (-9%

YoY, -11% QoQ) primarily due to decline in freight rates (a pass through

component). While, EBIT stood at INR539m (-12% YoY, -14% QoQ) and margin

at 4.9% (5.1% in 3QFY15, flat QoQ), impacted by expansion costs for new

offices in Americas, Middle East & South East Asia.

CFS business performing strongly:

CFS volumes stood at 74,251 TEUs (+5%

YoY, flat QoQ). CFS revenue stood at INR1.2b (+8.5% YoY, flat QoQ).

Realizations stood at INR15,461/TEU as compared to INR14,566/TEU in

2QFY16. Realizations increased in 3QFY16 primarily due to handling of special

cargo and long standing containers. EBIT/TEU stood at INR5,172/TEU as

compared to INR4,570INR/TEU in 2QFY16 driven by improved efficiencies.

P&E business margins impacted by ship repairs:

While P&E revenue increased

6% YoY to INR1,399m, EBIT declined 45% to INR94m, impacted by (a)

additional depreciation on two new ships that were acquired in 2QFY16, (b)

repair of two ships and (c)INR110m derivative income in 3QFY15. Its crane

utilization continues to be above 90%.

Valuation and view:

We estimate EBITDA/PAT CAGR of 15%/23% through FY15-18E and return

ratios are expected to improve from ~13% to 17%-19% driven by improvement

in margins and reduction in capex intensity in the business.

We value Allcargo Logistics at 14x FY18E EPS, and arrive at a target price of

INR243. Maintain buy. The stock trades at 10.6x FY18EPS.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Rajat Agarwal

(Rajat.Agarwal@MotilalOswal.com); +91 22 3982 5558