15 February 2016

Q3FY16 Results Update | Sector: Others

Jain Irrigation

Buy

BSE SENSEX

23,554

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol m

Free float (%)

S&P CNX

7,163

JI IN

443.1

24.5 / 0.4

79 / 50

-9/-4/1

281

71.3

CMP: INR54

TP: INR68(+28%)

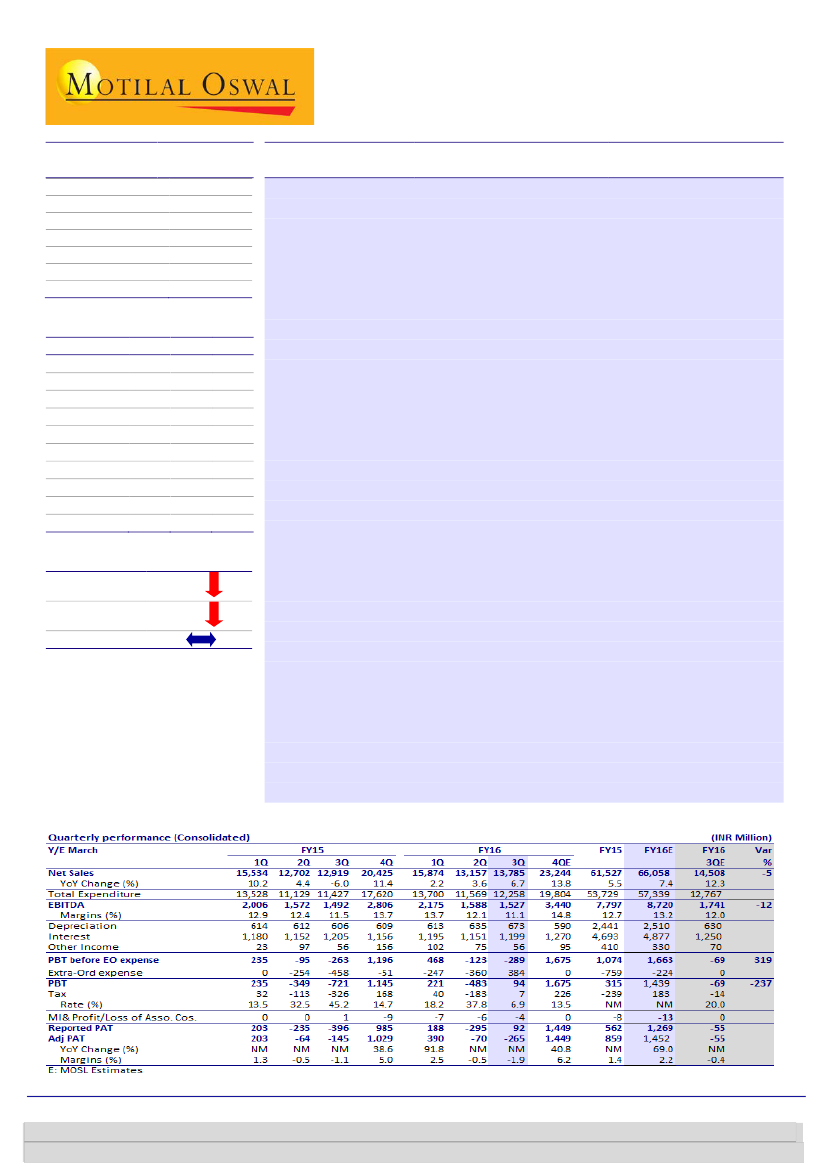

Results below estimates; de-leveraging on track

Results below estimates:

JI reported overall revenue of INR13.8b (est. of

INR14.5b), marking a 6.7% YoY growth. EBITDA stood at INR1.5b (est. of

INR1.7) in 3QFY16, with EBITDA margins at 11.1% (est. of 12%), a contraction of

40bp. During the quarter, forex gain stood at INR384m. Consequently, adjusted

PAT for the quarter stood at a loss of INR265m (est. a loss of INR55m) as

against a loss of INR145m in 3QFY15.

Growth led by overseas business:

Growth was led by exports which grew

11.3%. Contribution of overseas markets in consolidated revenue was at

50.5%. On a consolidated basis, MIS business grew 7.9% YoY, while food

processing grew 11.3% YoY and piping business grew 13.1% YoY. On a

standalone basis, MIS grew 6% where retail grew 14%, exports grew 9% while

projects business de-grew 21.7%. Projects business is generally lumpy and

newer contracts were still under negotiation. Piping business grew 12.8% led

by PE piping which grew 23.8%, food processing grew 1.6% led by onion

dehydration of 76.7% while fruit processing business de-grew 15.4%. Strong

growth in onion is due to base effect where onion as raw material was not

available last year. Margins in MIS business were sub-20%. The fund raising of

USD120m transaction is expected to completely by 4Q and should go towards

deleveraging.

3QFY16 sees food processing foray into B2C:

JI recently launched their first

branded retail product called “AamRus” under the brand name of “Jain

FarmFresh”. This was in-line with plans to enter the B2C business. JI has also

signed an MOU at the Make in India week with Hindustan Coca Cola Beverages

(HCCB) and Maharashtra government to partner for orange processing,

marking JI’s extension with HCCB into orange segment.

Valuation and view:

We expect 10.4% revenue CAGR, and 13% EBITDA CAGR

over FY15-18, translating into EPS growth from INR1.9 in FY15 to INR7.6 in

FY18. We cut our estimates by 11%/20%/23% for FY16/FY17/FY18 to factor in

lower topline growth and higher interest costs. Maintain

Buy

with a TP of

INR68, 9x FY18E EPS (rolled over to FY18).

Financials & Valuations (INR b)

2016E 2017E 2018E

Y/E Mar

66.1

73.7

82.7

Net Sales

8.7

10.0

11.2

EBITDA

1.5

2.8

3.9

PAT

3.1

5.4

7.6

EPS (INR)

69.0

73.0

39.6

Gr. (%)

65.5

64.0

70.7

BV/Sh (INR)

5.7

8.9

11.3

RoE (%)

10.3

12.0

13.4

RoCE (%)

17.0

9.8

7.1

P/E (x)

0.8

0.8

0.8

P/BV (x)

Estimate change

TP change

Rating change

-23%

-17%

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +912239825422/Kaustubh

Kale

(Kaustubh.Kale@MotilalOswal.com); +912230102498

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.