16 February 2016

Q3FY16 Results Update | Sector: Fertilizers

PI Industries

Buy

BSE SENSEX

23,192

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

7,048

PI IN

137.1

79 / 1.2

786/552

-7/0/23

160

41.6

CMP: INR576

TP: INR755 (+31%)

Levers intact; Growth momentum to continue

Financials & Valuations (INR b)

Y/E Mar

2016E 2017E 2018E

21.2

26.1

31.6

Net Sales

4.4

5.6

7.0

EBITDA

2.9

3.7

4.7

PAT

21.0

26.9

34.3

EPS (INR)

16.9

28.0

27.5

Gr. (%)

82.4 103.9 131.5

BV/Sh (INR)

28.4

28.9

29.2

RoE (%)

36.4

38.5

40.5

RoCE (%)

27.3

21.3

16.7

P/E (x)

7.0

5.5

4.4

P/BV (x)

Estimate change

TP change

Rating change

3%

6%

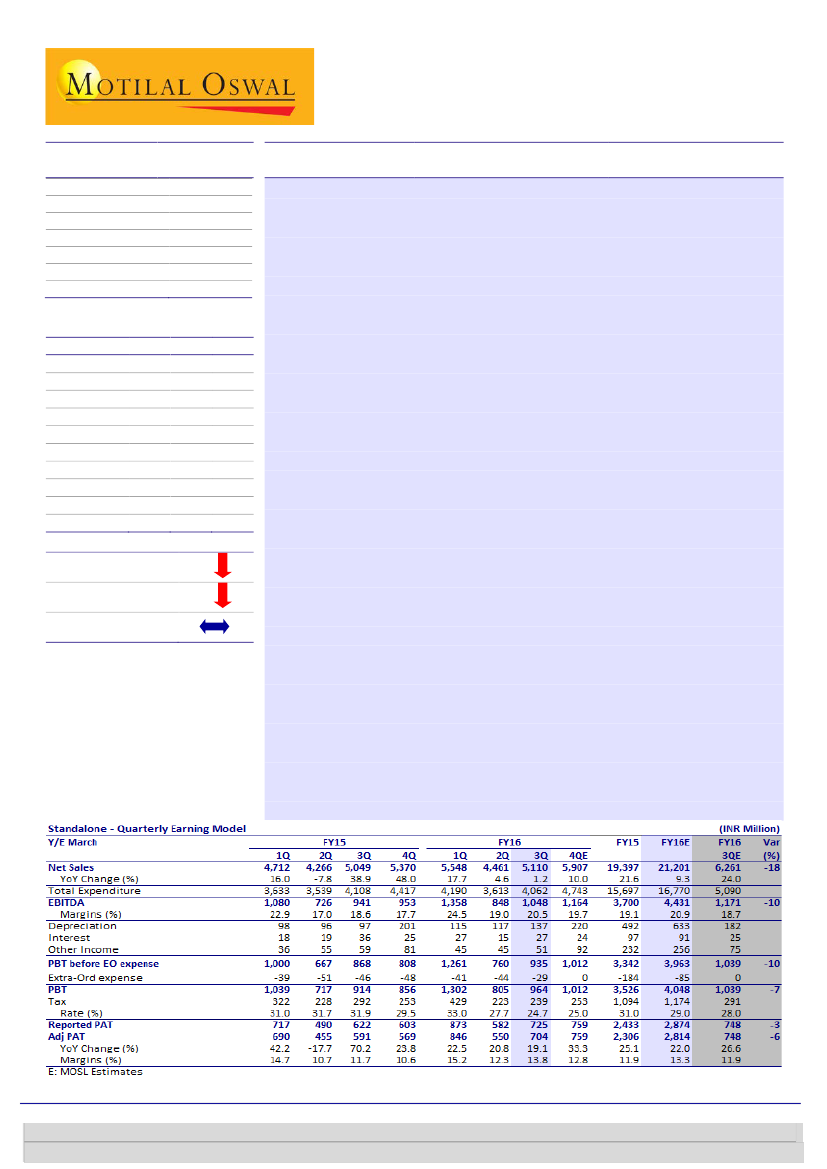

Revenue growth below estimate:

PI reported overall revenue of INR5,110m (est.

INR6,261m) in 3QFY16, a 1.2% YoY growth led by CSM business which grew 9%

while agri business de-grew 13% due to lower acreages in rabi. CSM business

showed moderate performance due to deferred procurement schedules from

global customers on account of higher inventory at customer end, impacting

geographies like USA, Brazil and Australia.

EBITDA margin expands 190bp:

EBITDA margin expanded 190bp to 20.5% (est.

18.7%), led by better mix of revenues as share of high margin CSM increased to

72% in 3QFY16 from 68% in 3QFY15 also aided by better product mix and cost

efficiencies. EBITDA stood at INR1,048m (est. INR1,171m), up 11.4% YoY. Tax rate

was lower at 24.7% (31.9% in 3QFY15) due to tax benefits on account of Jambusar

facility. Adj. PAT grew 19% to INR704m (est. INR748m) in 3QFY16.

CSM order book grows 28% QoQ:

Order book stood at USD780m, growing 28%

QoQ from USD610m in 3QFY16. Management highlighted that the same is

executable over next 3-4 years. The increase in order book was from both existing

as well as newer molecules. Jambusar Phase III began operations in Jan 2016 and

thus both Phase II and III are now operational (income tax exempt for first 5 years);

coupled with commercialization of 1-2 molecules every year, and execution of

order book should drive CSM revenue going ahead. PI launched Bio Vita X and

Vibrant (addressable market of INR13b) during the quarter which shall keep

momentum for domestic business going forward. Recently launched products

currently contribute ~15% of revenues, signifying growth potential for ramp up.

Management highlighted that Nominee Gold should continue to post strong

growth since opportunity is huge while penetration is 10% (as against potential for

30%), also dynamics for rice are still favorable as compared to corn and cotton.

Valuation and view:

We cut our estimates by 4.5%/5.2%/3.2% for FY16/FY17/FY18

to factor in back-ended recovery in CSM and agro. With best-in-class capital

efficiency (40% RoCE), insignificant debt-to-equity and robust growth outlook (18%

revenue CAGR and 24% PAT CAGR), we believe PI is one of the best plays on India’s

agri sector and CSM opportunities. We believe mix change in favor of the R&D-

intensive CSM business would continue to drive rerating for the stock. We maintain

Buy

rating with a target price of INR755, 22x FY18E EPS (rolled over to FY18).

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +912239825422/Kaustubh

Kale

(Kaustubh.Kale@MotilalOswal.com); +912230102498

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.