Gateway Distriparks

BSE SENSEX

25,603

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

7,847

GDPL IN

108.7

30.8 / 0.5

400 / 206

1/-11/-15

82

74.8

28 April 2016

Q4FY16 Results Update | Sector: Logistics

CMP: INR284

TP: INR437(+54%)

Buy

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Net Sales

10.5

12.1

14.2

EBITDA

2.5

3.0

3.9

PAT

1.2

1.6

2.4

EPS (INR)

11.4

14.3

21.9

Adj. EPS (INR)

8.7

10.8

15.9

Adj EPS Gr. (%)

-31.3

24.7

46.9

BV/Sh (INR)

114.0 120.0 131.8

RoE (%)

10.1

12.2

17.4

RoCE (%)

7.6

10.5

15.0

P/E (x)

24.9

19.8

13.0

P/BV (x)

2.5

2.4

2.2

Estimate change

TP change

Rating change

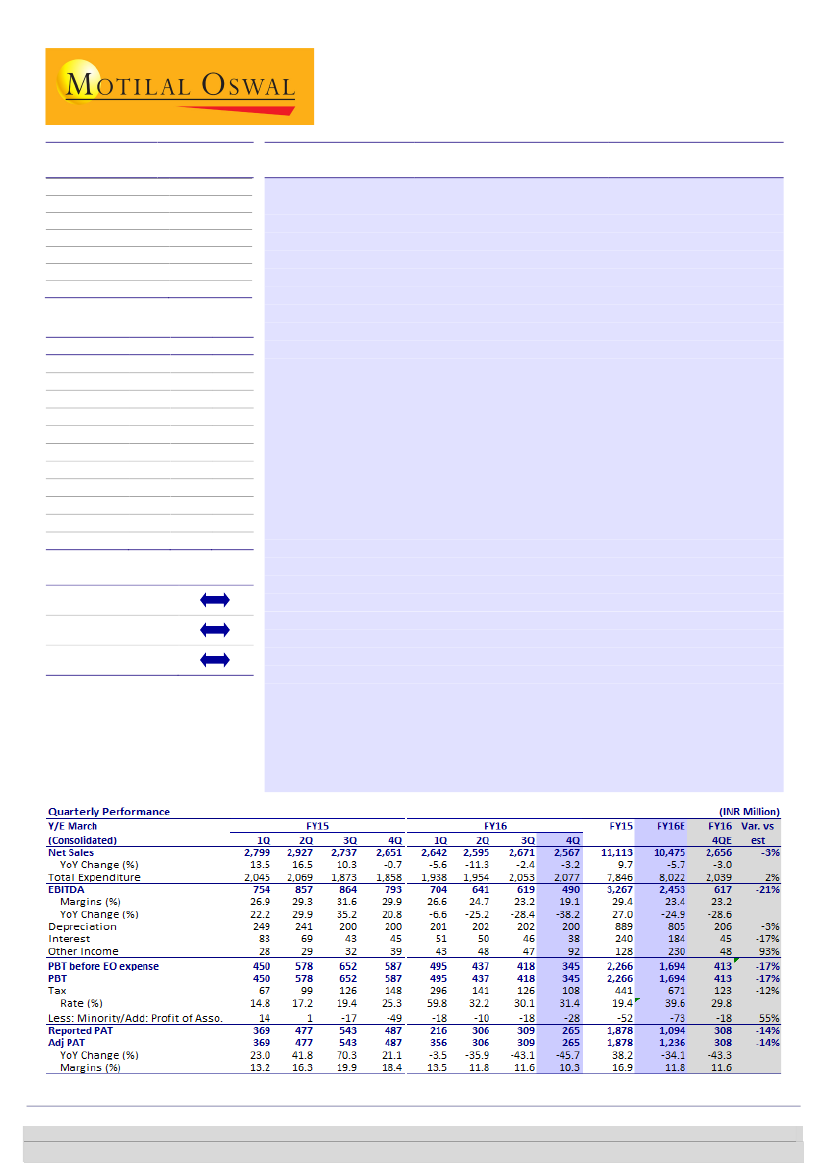

Results below estimates; macro revival key to volume uptick; Completion of Viramgam

terminal to boost Rail division’s margin

GDPL’s reported adjusted EBITDA came in at INR569m (vs. our estimate of INR617m; -38%

YoY and -21% QoQ) and PAT at INR265m (vs. our estimate of INR308m; -46% YoY and -14%

QoQ). The EBITDA was adjusted for operating income of INR79m, which was reported

under other income. While volume was largely in line, profitability was impacted by lower

realization and one-off expenses. FY16 PBT stood at INR1.7b (-24% YoY), though PAT at

INR1.1b was down 41% YoY due to a higher effective tax rate of ~40% (vs. 19.4% in FY15).

Rail volumes flat QoQ, but profitability impacted by continued EXIM imbalance

Rail division reported an EBITDA of INR350m (est. INR382m; -28% YoY and - 8% QoQ)

Container volumes stood at 50,675 TEU (vs. our est. of 51,210; -15% YoY and -1% QoQ).

Rail realization stood at INR36,318/TEU (+16% YoY and -2% QoQ). The EBITDA/TEU

declined to INR6,901 (vs. our estimate of INR7,450; -15% YoY and -8% QoQ), with the

decline driven by increased EXIM imbalance and lower double stacking in 4QFY16.

The completion of Viramgam terminal (in Gujarat) will increase double stacking and

result in ~5% savings in rail haulage charges, well ahead of the DFC completion.

GDPL is well placed to benefit from an economic recovery as its current ICD capacity

can handle a four-fold increase in volume without any significant capex. We estimate a

25% EBITDA CAGR through FY18, driven by higher volume and margin expansion.

CFS division impacted by a suspension at Mumbai CFS and weak macro environment

Consolidated CFS EBITDA stood at INR219m (est. INR235m; -33% YoY and -11% QoQ).

Consolidated volume stood at 85.4K (vs. our estimate of 85K; -7% YoY and flat QoQ).

Realization came in at INR8,565/TEU (vs. our estimate of INR8,887/TEU; -5% YoY/QoQ),

while the EBITDA/TEU stood at INR2,565 (-29% YoY and -10% QoQ).

Valuation and view

Our FY16-18 volume CAGR assumptions for Rail and CFS divisions stand at ~13%. We

value Gateway Distriparks on a SOTP-based fair value of INR437/share, which includes

INR409/share for its core business on a DCF basis (WACC: 12.2%, TGR: 4%) and

INR28/share for Snowman, post 25% discount.

The key events to watch out for will be (a) EXIM growth, (b) margin improvement led

by completion of the Viramgam terminal, and (c) clarity on the Blackstone stake

purchase by the company.

The stock trades at 17.9x FY18E adjusted EPS of INR15.9 (adjusted for Blackstone’s

stake of 49% in rail). The company’s dividend yield stands at 2-3%. Maintain

Buy.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Rajat Agarwal

(Rajat.Agarwal@MotilalOswal.com); +91 22 3982 5558

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.