3 May 2016

4QFY16 Result Update | Sector: NBFC

Cholamandalam Invst. & Fin.

BSE SENSEX

25230

Equity Shares (cr)

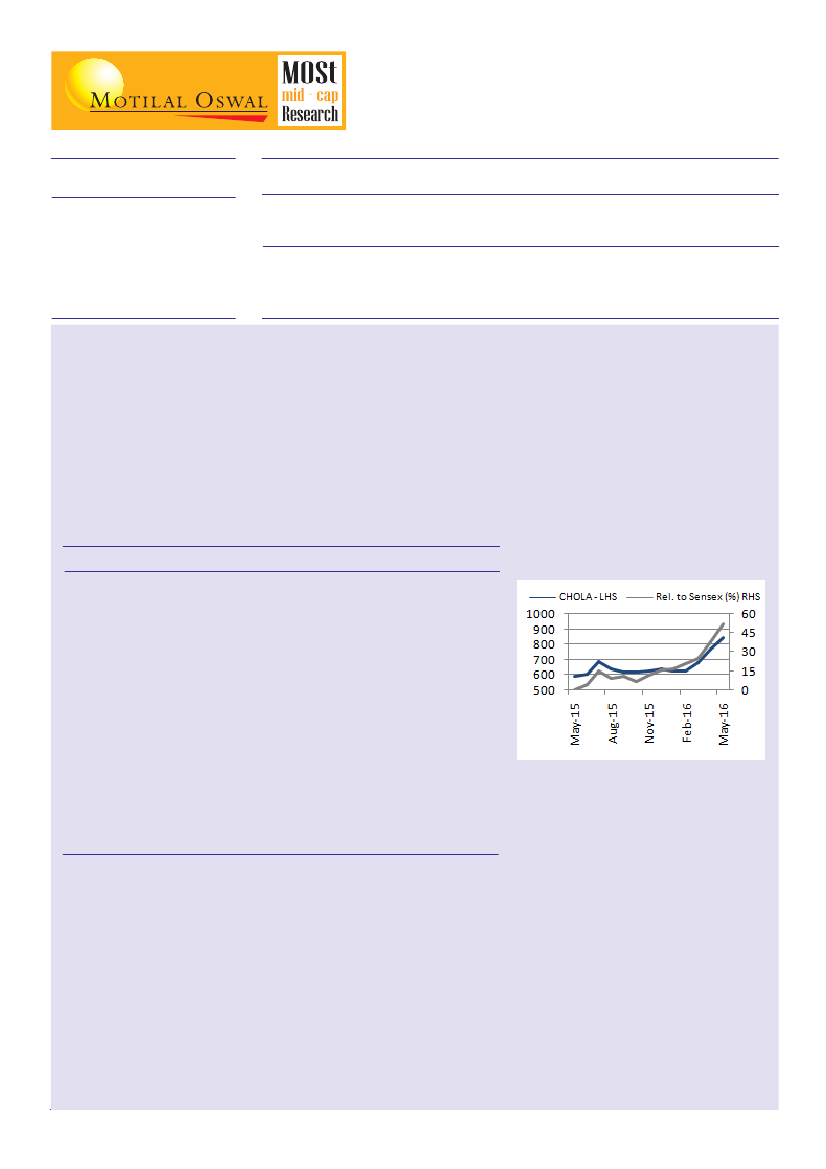

52-Week Range (Rs)

1,6,12 Abs.Perf.(%)

M.Cap. (Rs cr)

M.Cap. (US$ b)

S&P CNX

7747

15.6

860/552

16/35/44

12,170

182

CMP: INR846

YEAR NET INC PAT

END

FY16

FY17E

FY18E

EPS

(INRCr) (INRCr) (INRCr)

2142

2630

3136

567

768

986

36

49

63

TP: INR1000 (+18%)

EPS

Gr.(%)

31

36

28

PE

(X)

23.3

17.2

13.4

ABV

(INR)

221

268

331

P/BV

(X)

3.6

3.0

2.5

P/ABV ROAA

(X)

3.9

3.2

2.6

(%)

2.3

2.6

2.7

BUY

ROAE

(%)

16.7

19.0

20.1

Result Highlights: Above est; Acceleration in AUM growth & low OPEX leads to strong beat in profits (+42%

YoY); Strong disbursement growth of 41%

Chola's Net Income grew by 33% to INR 602cr backed by AUM growth of 17% to INR 29,815cr and 150bp expansion

in NIM to 9.4%. PAT has grown by 41% YoY to INR 148cr aided by lower OPEX growth at 11%.

A recovery in the CV industry (50% of Chola's AUM) has translated into resumption of growth for Chola. Disbursements

growth bounced back to a strong 41% which is a 14 quarter high led by 47% growth in Vehicle Finance and 16%

growth in Home Equity (LAP). Consequently AUM growth was at a 6 quarter high of 17%. The LCV/SCV loan book

(35% of Chola's AUM) witnessed 8% growth in AUM after declining for 5 quarters. We expect the turnaround in AUM

growth for LCV/SCV to sustain going forward as the industry comes out of a three year downturn combined with

transport operators witnessing highest capacity utilisation since FY12. GNPAs declined QoQ to 3.5% against 4.3%

on 4 month basis.

4QFY15

452

3QFY16 4QFY16

543

215

328

107

221

75

146

14

38

8.5

40

4.3

2.1

16.7

602

208

395

99

296

104

192

17

41

9.4

34

3.5

2.8

21.5

YoY

33

9

51

70

46

54

42

QoQ

11

(3)

20

(8)

34

38

32

FY15 FY16

1,729 2,142

749

845

YoY

24

13

32

32

33

36

31

INRCr

Net Income

Operating Expenses 190

Operating Profit

Provisions

Profit Before Tax

Tax Provisions

Net Profit

Loan Growth (%)

Disbursements (%)

NIMs (%)

C/I Ratio (%)

261

58

203

68

136

9

-4

7.9

42

980 1,296

325

655

222

433

9

-2

7.9

43

2.4

2.0

15.8

427

869

302

567

24

21

8.7

39

3.5

2.3

16.7

Gross NPAs (%) - 4mNA

ROA (%)

ROE (%)

2.0

17.6

Valuation and view

Chola's branch network (534) has gone up over 3x since FY10 and is up 53% since FY12 whereas, peers have increased

their branches by 18% over the same period. This is reflected in Chola's higher cost/income ratio at 39% vs peer group

average of 32%. However, with the recovery in the CV cycle (especially LCVs), Chola shall enjoy higher operating leverage

which would enable it to grow its profits at a higher rate of 32% CAGR over FY16-18E as against its peer group.

The management expects home loans business to grow aggressively in coming years and reach the size of its Home

Equity business (LAP) over a five year period, thereby lowering Chola's dependence on vehicle finance business.

Diversification of loan book towards home loans, normalization of credit costs and reduction of GNPAs / provisioning from

the current cyclical peaks should transform the business to 3.0% ROA from current ROA of 2.3% in coming years.

Improvement in ROA should translate into a rerating opportunity for the business. We raise our earnings estimates for

FY17/18 by 9% and also raise our target P/B multiple to 3.0x (in line with Sundaram Finance; earlier 2.3x) and arrive at a

target of INR 1,000 (earlier INR 700).

Jehan Bhadha

(jehan.bhadha@MotilalOswal.com); Tel: +91 22 33124915

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.