25 May 2016

Q4FY16 Results Update | Sector: Automobiles

Bosch Ltd

Buy

BSE SENSEX

25,881

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol m

Free float (%)

S&P CNX

7,935

BOS IN

31.4

688.1 / 10.2

26,701/15,753

10/19/0

568.9 / 0.0

28.8

CMP: INR21,914

TP: INR24,659(+13%)

Above Estimates; Lower cost drives EBITDA margins to decadal high

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Net Sales

106.1

130.2

145.6

EBITDA

18.8

24.4

28.4

PAT

12.5

16.4

22.0

EPS (INR)

396.8

522.9

699.5

Gr. (%)

-8.2

31.8

33.8

BV/Sh (INR) 2,639.8 3,031.9 3,556.6

RoE (%)

15.9

18.4

21.2

RoCE (%)

23.6

26.3

28.3

P/E (x)

55.2

41.9

31.3

P/BV (x)

8.3

7.2

6.2

Estimate change

TP change

Rating change

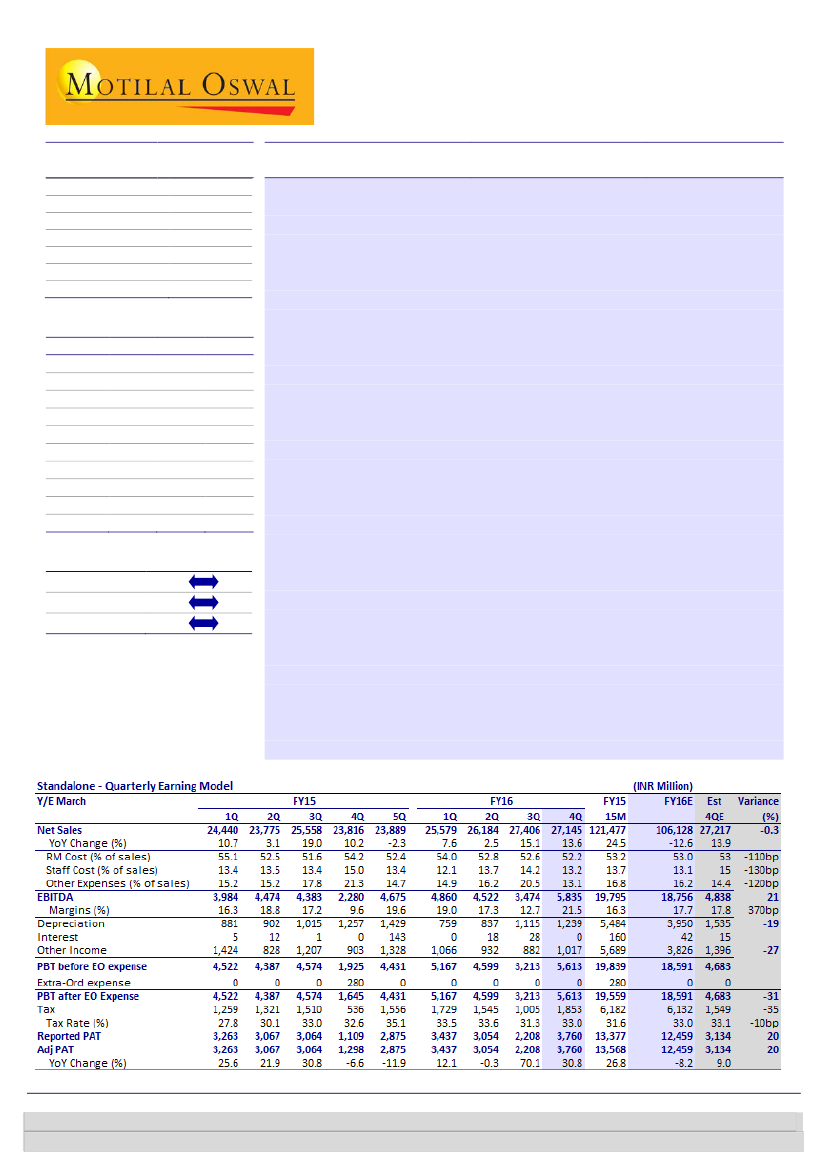

In-line revenue driven by strong growth in auto:

Bosch Ltd.’s (BOS) net sales

for 4QFY16 at INR27.1b were in line with our estimate of INR27.2b and were up

14% YoY (-1% QoQ), driven by a growth of ~14.7% YoY in auto and ~9.6% YoY in

non-auto. Domestic revenue grew by ~15.5% YoY, but exports declined by

~9.1% YoY due to a decline of 17.4% YoY in auto exports.

Lower overall costs drive highest margin in decade:

BOS’ EBITDA margin

surged higher by ~880bp QoQ (+190bp YoY) to ~21.5% (vs. our estimate of

~17.8%), driven by lower than estimated overall costs. Raw material costs were

down ~40bp QoQ, staff cost declined by ~100bp QoQ and other expenses fell

by 740bp QoQ. Adjusted PAT stood at ~INR3.8b (vs. our estimate of ~INR3.1b),

marking a growth of ~31% YoY (+70% QoQ).

Earnings call highlights:

a) BOS’ Gasoline and Diesel business grew in the

double-digits. A decline in the share of diesel PV was more than offset by a

robust growth in the CV and tractor segments b) In the non-auto business,

security systems witnessed a double-digit growth, while revenue from starters

& generators remained flat. The growth in Thermo technology was primarily

due to one-time export orders c) Management provided a capex guidance of

INR7.7b for FY17 towards a new office building in Bangalore and capacity

expansion at the Nashik and Bidadi plants d) The implementation of BS VI for 2

wheelers presents a long-term opportunity for BOS e) The localization for BSIV

CRDi is relatively higher.

Demerger of Starter Motor and Generator business expected by Aug-16:

BOS

has received approval from the board and shareholders for selling off its SMG

division for INR4.86b to a 100% subsidiary of the parent. The SMG division

recorded revenue of ~INR8.9b and PBT of ~INR262m in FY16, implying a deal

valuation of ~0.55x FY16 sales (as compared to BOS’ EV/Sales of ~5x CY14).

Valuation and view:

We are largely maintaining our EPS estimates for FY17/18,

despite factoring in the divestment of SMG from FY18 onwards. The stock

trades at 41.9x/31.3x FY17E/18E EPS. Maintain

Buy

with a target price of

INR24,659 (~35x FY18E).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Aditya Vora

(Aditya.Vora@MotilalOswal.com); +91 22 3078 4701