Amara Raja Batteries

BSE SENSEX

25,881

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INR m

Free float (%)

S&P CNX

7,935

AMRJ IN

170.8

145.3 / 2.2

1,132/773

-8/-2/3

275.3 / 0.3

47.9

25 May 2016

4QFY16 Results Update | Sector: Automobiles

CMP: INR851

TP: INR975(+15%)

Buy

Below est; Sales growth moderates, higher RM and other expenses leads

to 8 quarter low EBITDA margins; Downgrade EPS

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Net Sales

46.9

54.5

63.7

EBITDA

8.2

9.7

11.4

PAT

4.9

6.1

7.4

EPS (INR)

28.7

35.7

43.3

Gr. (%)

17.7

24.6

21.4

BV/Sh (INR)

123.0 152.8 189.1

RoE (%)

25.8

25.9

25.4

RoCE (%)

24.2

24.5

24.3

P/E (x)

29.7

23.8

19.6

P/BV (x)

6.9

5.6

4.5

Estimate change

TP change

Rating change

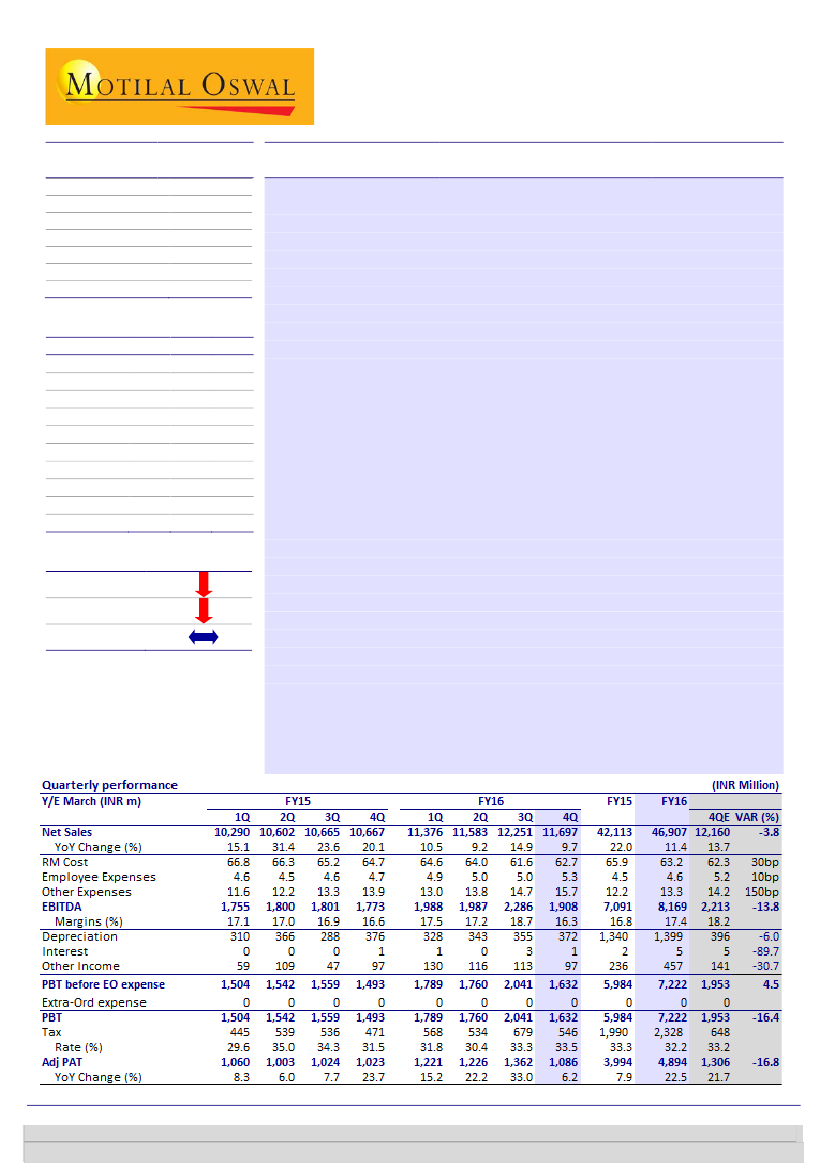

Net sales grew by 10% YoY (-4.5% QoQ) to INR11.7b (in line with our est.), with

the YoY growth being driven by a broad-based performance across segments.

EBITDA margin declined by 30bp YoY (-240bp QoQ) to 16.3%, translating into

EBITDA growth of ~7.6% YoY (-17% QoQ).

Raw material costs increased by 110bp QoQ (-200bp YoY) to 62.7%, as lead

costs hardened on a QoQ basis, but declined by ~12% YoY (spot prices with a

lag of one quarter). Other expenses were also higher by ~100bp QoQ (+180bp

YoY), which was most likely due to overheads incurred for recently

commissioned capacities and higher marketing spend.

Adjusted PAT grew by 6.2% YoY to INR~1.1b (vs. our estimate of ~INR1.3b).

At the end of 4QFY16, working capital rose by ~5 days, driven by an increase of

11 days in inventory to 47 days.

Free

cash flow came in at a negative ~INR0.5b due to higher capex of ~INR5.5b,

resulting in net cash declining to ~INR939m (as against ~INR1.64b in FY15).

Capacity expansion plan for 2W batteries:

The company is expanding its 2W

battery capacity in four phases, staggered over a period of four years, from the

current 11m units per annum to 25m units per annum, with the first phase

comprising of three lines adding a capacity of 4m units per annum. The

company had earlier also announced expansion of its 4W battery capacity from

8.25m units per annum to 11m units per annum.

Takeaways from press release:

a) The aftermarket segment continued to

witness high growth, driven by new products, network expansion and

marketing support b) The auto OEM business also recorded growth due to

supply to new platforms and recovery in PV volume c) Auto exports growth was

driven by higher penetration in focused markets d) The auto segment’s market

share improved across segments e) The company has strengthened its core

management team, with a focus on making its management systems and

processes more robust.

Valuation and view:

We have lowered our EPS estimate for by 7-8% in order to

factor in the weaker sales growth and higher other expenses. The stock trades at

23.8x/19.6x FY17/18 EPS. Maintain

Buy

with a TP of ~INR975 (~22.5x FY18E EPS).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Aditya Vora

(Aditya.Vora@MotilalOswal.com); +91 22 3078 4701