KPIT Technologies

BSE SENSEX

27,916

S&P CNX

8,566

20 July 2016

1QFY17 Results Update | Sector: Technology

CMP: INR133

TP: INR160(+20%)

Neutral

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Multiple pressure points impact revenue growth…

…and consequently profitability

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

KPIT IN

197.5

26.6 / 0.4

197 / 98

-33/-21/21

153

83.2

2018E

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

32.2

33.4

Net Sales

4.4

4.5

EBITDA

3.0

2.7

NP

14.1

13.7

EPS (INR)

19.0

-2.4

EPS Gr. (%)

69.0

83.4

BV/Sh. (INR)

21.0

18.0

RoE (%)

24.3

21.4

RoCE (%)

9.3

9.5

Payout (%)

1.9

1.6

Div. Yield

37.4

5.2

3.2

16.0

16.4

99.4

17.5

21.7

8.2

1.3

Estimate change

TP change

Rating change

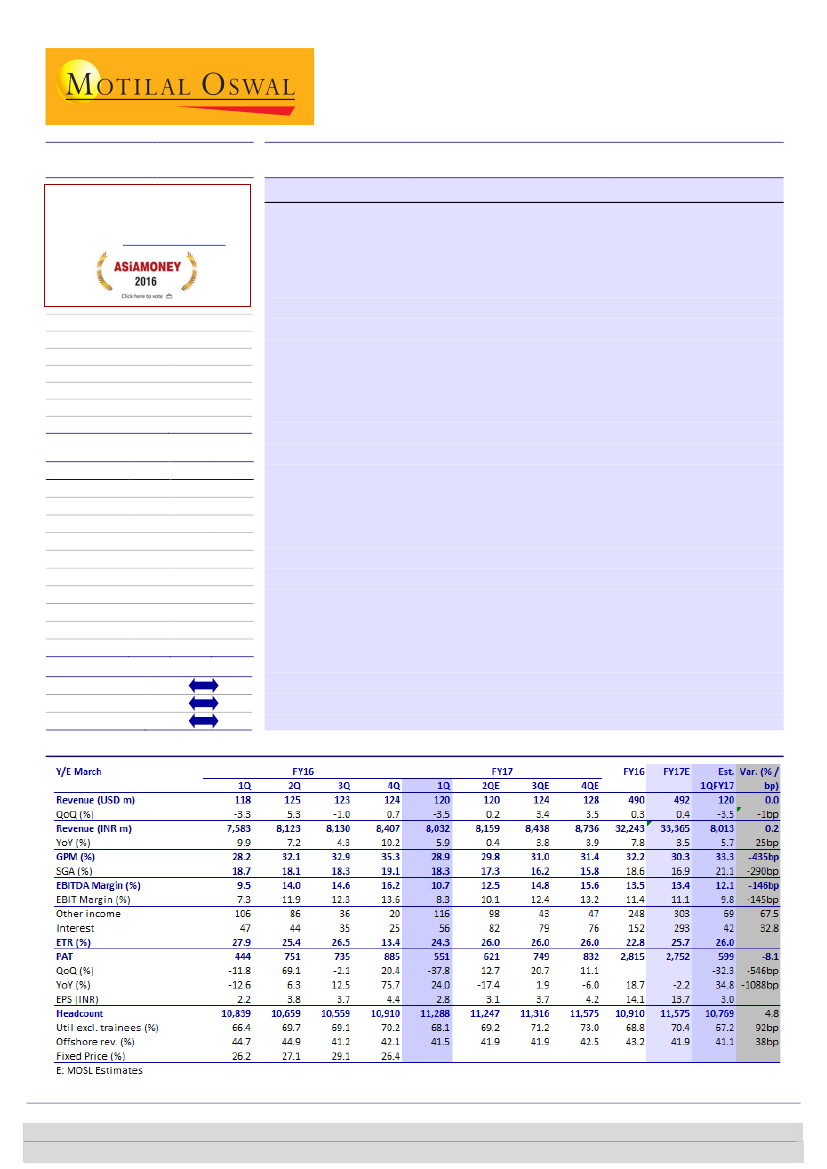

Quarterly Performance (Consolidated)

Revenue decline led by multiple factors:

KPIT’s 1QFY17 revenue of USD120m

(-3.5% QoQ) came in line with our estimate, post management’s guidance of a

weak quarter. The revenue decline was led by aggravated weakness at its top

client (-12% QoQ), pressure in Product Engineering and Energy verticals, and

ERP implementation. The revenue decline, along with wage hikes and

investments, resulted in a margin decline of 550bp QoQ to 10.7%.

Growth recovery not imminent:

Revenue growth recovery in FY17 appears

difficult, especially with the Product Engineering business under pressure.

Moreover, volatility in SAP, ERP pressure in IES and severe weakness at its top

client add to uncertainty around revenue growth revival. Margin resurrection

seen through FY16 fell apart in the absence of revenue growth, which we

believe challenges margin turnaround in FY17.

Cash generation weak as well:

Cash generation too faltered in 1QFY17, with

negative cash flow from operations of INR532m. FCF was at negative INR930m

in the quarter, offsetting FCF improvement seen through FY16. DSO at the end

of the quarter was higher by 7 days at 82.

Revenue revival key to re-rating:

Amid sluggish revenue growth momentum,

upcoming investments and multiple pressure points, we are conservative on

the margins front. We expect margins to decline 30bp in FY17 and expand 50bp

in FY18. Inconsistent revenue performance and consequent volatility in profits

are key drags on KPIT’s valuation multiples. Consequently, we maintain our

Neutral

rating, with a one-year price target of INR160—discounting forward

EPS by 10x.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531