22 July 2016

1QFY17 Results Update | Sector:

Financials

BSE SENSEX

27,711

S&P CNX

8,510

CMP: INR764

Bharat Financial Inclusion

TP: INR945 (+24%)

Buy

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

BHAFIN IN

126.3

96.5/1.4

800 / 369

7/45/46

1010

97.4

Financials & Valuation (INR Billion)

Y/E March

NII

PPP

PAT

EPS (INR)

BV/Sh. (INR)

RoE (%)

Valuations

P/E (x)

P/BV (x)

32.1

7.0

15.7

4.9

14.6

3.6

2016 2017E 2018E

5,796 8,116 12,665

4,325 6,056 9,660

3,030 6,214 6,684

23.8

48.8

52.5

108.6 157.4 209.9

6.3

4.5

RoA on AUM (%)

5.1

24.9

36.7

28.6

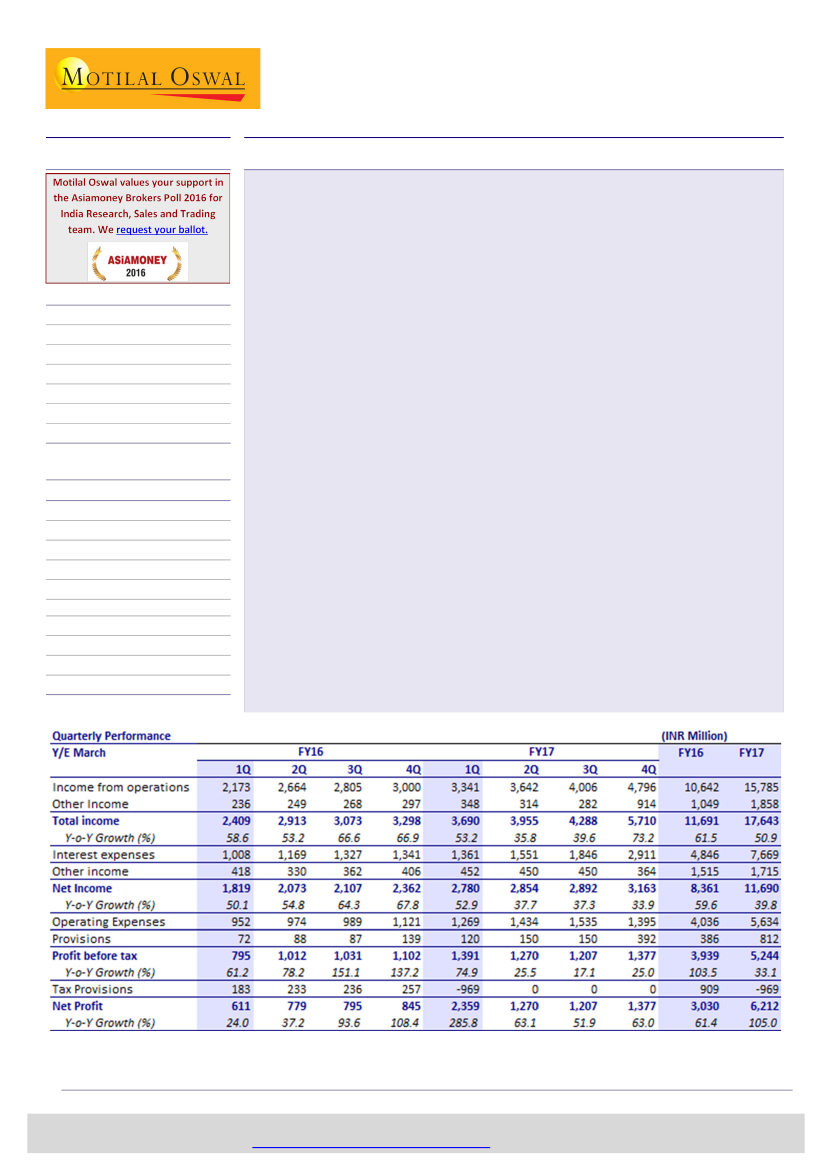

Bharat Financial’s (BHAFIN) 1QFY17 PAT grew 286% YoY and 180% QoQ to INR2.4b

(v/s est. of INR2.0b). Strong AUM growth (76%YoY), improving funding cost

(marginal CoF of 9.7%), lower cost-to-income ratio (down 670p YoY at 45.7%) and

MAT credit entitlement (INR1.3b) were the key highlights for the quarter.

AUM during the quarter grew at a notable pace of 76% YoY and 10% QoQ, driven

by 38% YoY growth in customer additions, coupled with a 25% increase in ticket

size (INR17k) to income generating loans (IGL). Notably, the RBI revised the

regulation allowing for higher ticket sizes, which led to BHAFIN focusing on short-

term loans. Long-term loans constituted 11% of disbursement in the quarter

compared to 24% in 1QFY16. Disbursements continued to grow at a robust pace of

59% YoY to INR37b.

Reported NIM increased 20bp QoQ, but was down 60bp YoY to 10.8% due to a cut

in interest rates last fiscal. However, marginal cost of borrowings now stands at

9.9% v/s 11.5% for 1QFY16. Asset quality improved as absolute GNPA declined

from INR41m to INR35m sequentially. % GNPA stood at 10bp (stable YoY) and

NNPA at 3bp. Strong PAT performance was also driven by operating leverage—

evident from the C/I ratio, which reduced 670bp YoY to 45.7%.

Valuation and view:

Large unmet demand, low competitive intensity, supportive

regulations, a strong balance sheet and best-in-class operating metrics have put

BHAFIN on a high-growth path. BHAFIN trades at 4.8x FY17E and 3.5x FY18E BV.

While valuations appear high, we believe they are justified, given its high medium-

term growth visibility, superior profitability and robust asset quality. Current

valuations should sustain and even improve, given its strong profitability (49% PAT

CAGR over FY16-18), healthy asset quality and capitalization. We increase our

FY17/FY18 estimates by 6.5%/10.5% to account for higher growth. Maintain

Buy

with a target price of INR945 (4.5x FY18E BV).

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521

Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.