21 July 2016

1QFY17 Results Update | Sector:

Financials

BSE SENSEX

27,711

S&P CNX

8,510

CMP: INR218

TP: INR331 (+52%)

Dewan Housing

Buy

Lower operating expenses sustains robust performance

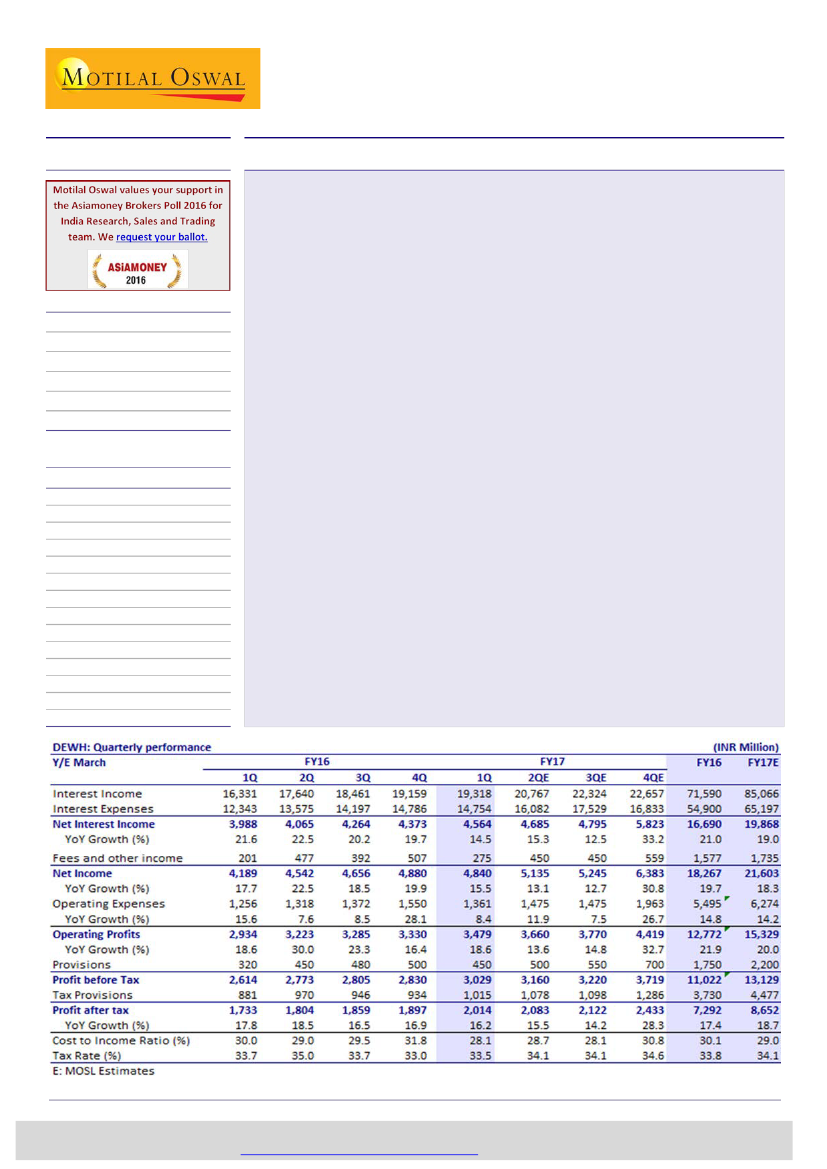

Dewan Housing Finance’s (DEWH) 1QFY17 PAT grew 16.2% YoY to INR2b (inline).

Reduction in cost to income ratio by 190bp YoY to 28.1% - a 33 quarter low. AUM

and disbursements growth remains healthy at +20/26% YoY.

Reduction in cost of funds coupled with shift in the portfolio towards high yielding

segment helped DEWH to maintain margins at 2.9% despite high competitive

intensity in core home loan segment. Cost of funds declined 40bp+ YoY to ~9.5%

Asset quality remained broadly stable, with GNPLs of 98bp v/s 93bp in 1QFY16.

Coverage ratio remains healthy at ~100%.

Annualized repayments rate of 24% v/s run-rate of 18% were due to higher pre-

payments and the changing loan mix toward the non-housing portfolio (which

formed 28% of AUM v/s 25% a year ago).

Other highlights:

(1) There was a negative impact on net worth of INR200m due to

treatment of DTL, and of another INR200m due to amortization of discount of zero

coupon bonds. (2) Average ticket size stood at INR1.29m.

Valuation and view:

DEWH continues to capitalize on its mortgage lending

expertise in an underpenetrated market. We expect AUM growth to remain higher

than industry average at 20%+. In an environment where most of the financials

facing asset quality pressure, mortgage financiers (including DEWH) asset quality

remains impeccable. Margins can improve further with a rating upgrade, reduction

in base/wholesale rates and change in mix towards high yielding loans. Moreover,

management’s commitment to lower cost can provide delta to earnings and

further reduction in C/I ratio will lead to re-rating (key concern for investors). The

stock trades at 1x FY18E P/B and 6.0x P/E, a steep discount compared with other

HFCs. Maintain

Buy

with a TP of INR331 (1.5x FY18E ABV).

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INR m)

DEWH IN

291.4

63.5/0.9

268/141

3/3/-2

341

Financials & Valuation (INR Billion)

Y/E MAR

NII

PPP

Adj. PAT

EPS (INR)

EPS Gr. (%)

BV (INR)

RoAA (%)

RoE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

P/ABV (x)

Div. Yld (%)

2016 2017E 2018E

16.6

12.8

7.3

25.0

17.2

171.9

1.2

15.1

37.1

8.7

1.3

1.3

3.7

19.9

15.3

8.7

29.7

18.7

194.1

1.2

16.2

23.2

7.4

1.1

1.1

2.7

24.1

18.8

10.6

36.4

22.7

220.9

1.2

17.5

23.2

6.0

1.0

1.0

3.3

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521

Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.