21 July 2016

1QFY17 Results Update | Sector:

Financials

BSE SENSEX

S&P CNX

27,711

8,510

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Kotak Mahindra Bank

CMP: INR761

TP: INR866 (+14%)

Buy

In-line, healthy lending business performance; stable asset quality

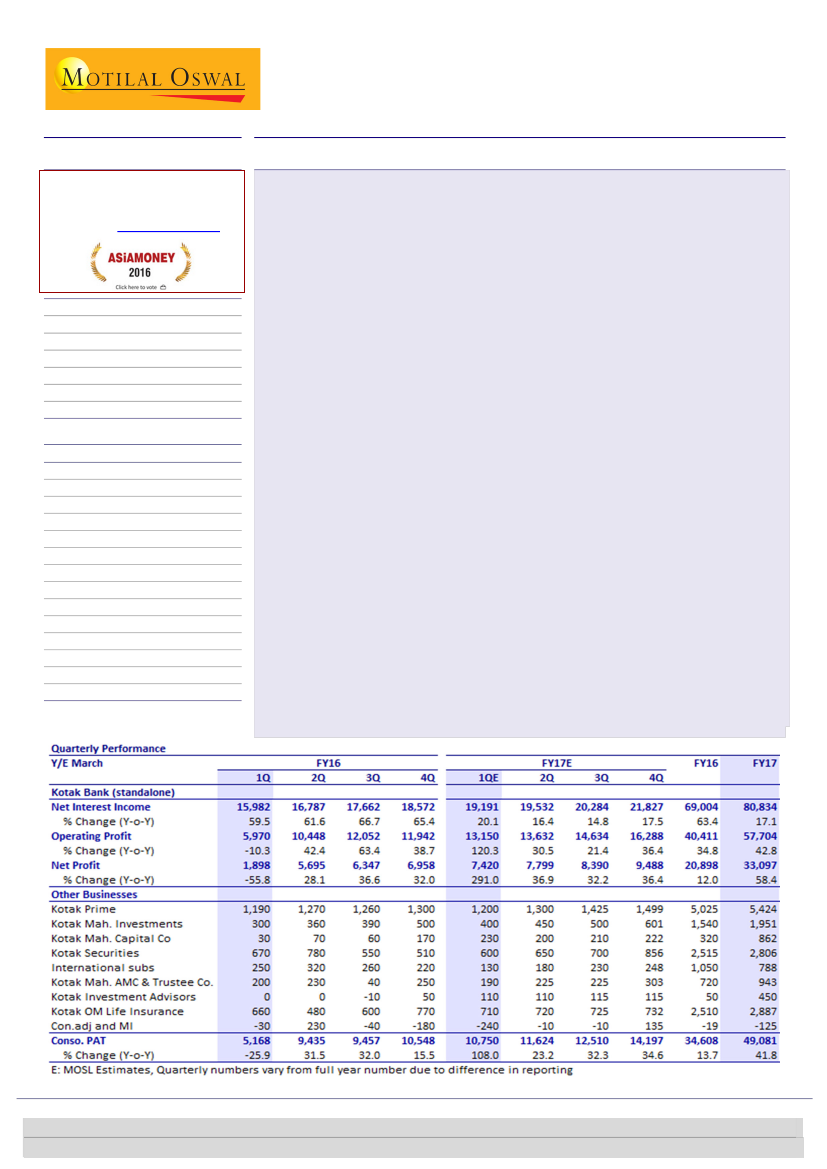

KMB’s standalone results:

PAT grew 3x YoY to INR7.4b (in line with estimates).

Strong core operating performance (+26% YoY), healthy NII growth (20% YoY) on

the back of margin improvement (4.4%), controlled opex growth (adjusted +12%

YoY), and stable asset quality (NSL at 1.3%) were the key highlights. Moderate

wealth management fee was the key drag on fee income (+12% YoY) in the

quarter.

Loans grew 17% YoY (+2% QoQ) led by robust growth in the corporate banking

(+9% QoQ, 22% YoY) and CV (+7% QoQ, 42% YoY) segments. Management

expects 20% growth for FY17.

Other highlights:

a) SMA2 at 39bp; b) SA growth of 34% YoY; c) continued

traction in CV loans (+14% QoQ) and business/personal loans (+9% QoQ).

Other businesses:

a) Profitability at its capital market businesses improved to

INR830m v/s INR680m a quarter ago, led by KMCC (INR230m v/s INR170m); b)

K-Sec market share improved 10bp QoQ to 2.4%; c) overall average AUM

increased 8% QoQ (+18% YoY) – average domestic AUM increased 7% QoQ and

31% YoY, of which equity AUM increased 7% QoQ (34% YoY).

Valuation and view:

Merger with eIVBL places KMB in a sweet spot, with strong

presence across geographies and products, and continued healthy capitalization (T1

of ~16%). The merged entity is India’s fourth largest private sector bank, with a loan

book of INR1.2t and loan market share of 1.7%+. KMB’s premium multiples are likely

to sustain, considering strong growth and operating leverage available across

businesses, and a clean loan portfolio. Comfort on asset quality remains the highest,

with no SDR/5:25, negligible SMA2 and OSRL (13bp). We cut

standalone/consolidated earnings by 3-4% over FY17/18, led by lower revenue

growth, and roll forward the target price. At our SOTP of INR866 (v/s INR863

previously), KMB will trade at 3.6x consolidated BV with cons. ROE of ~15%.

Buy.

Bloomberg

KMB IN

Equity Shares (m)

911.6

M.Cap. (INR b) / (USD b) 1,298.1/20.5

52-Week Range (INR)

790 / 587

1, 6, 12 Rel. Per (%)

-2/-2/7

12M Avg Val (INR M)

1035

Free float (%)

66.3

Financials & Valuation (INR b)

Y/E Mar

2016E 2017E 2018E

NII

69.0 80.8 97.2

OP

40.4 57.7 74.4

NP

20.9 33.1 43.5

34.6 49.1 62.3

Cons.

NP

NIM

(%)

4.1

4.4

4.5

Cons. EPS

18.9 26.8 34.0

EPSG

r. (%)

41.9 26.9

Cons. BV. (INR) 182

207

240

Cons. RoE (%) 10.9 13.8 15.2

RoA (%)

1.1

1.6

1.8

Valuations

P/E(X) (Cons.) 40.3 28.4 22.4

P/BV (X)

4.2

3.7

3.2

Div. Yield (%)

0.0

0.1

0.1

* Proforma merged (KMB+EIVBL )

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Krishnan ASV

(A.Krishnan@MotilalOswal.com);+91 22 6129 1571 /

Dhaval Gada

(Dhaval.Gada@MotilalOswal.com); +91 22 6129 1544

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.