23 July 2016

Results Update | Sector: Technology

Mphasis

Neutral

BSE SENSEX

27,803

S&P CNX

8,541

CMP: INR540

TP: INR570 (+6%)

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Sanguine deal signings…

…lend confidence to continued traction in Direct International channel

Delivering in the focus areas:

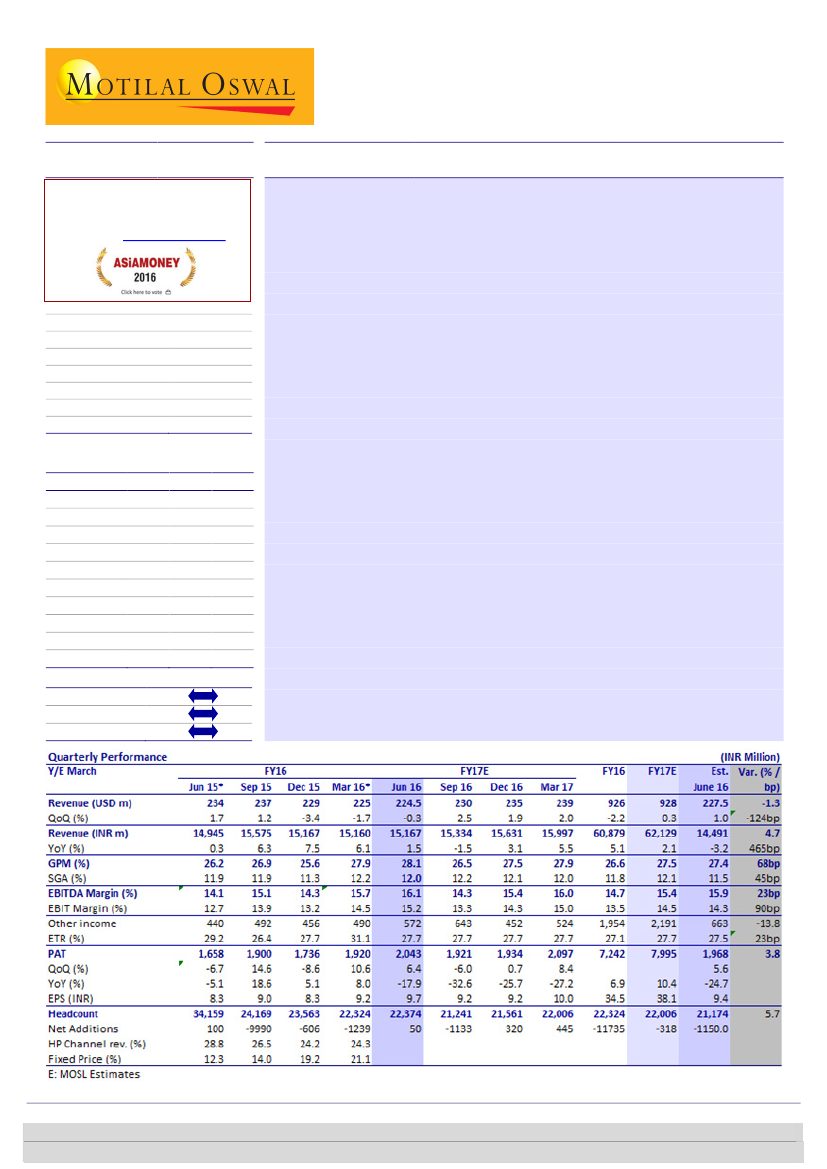

MPHL reported revenue decline of 0.3% QoQ to

USD225m in 1QFY17 (compared to our estimate of USD227.5m). Direct International

(ex. Digital Risk) segment grew 2.1% QoQ, continuing the momentum in its focus area.

Overall performance was weighed upon by decline in the HP channel (-4.2% QoQ),

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

MPHL IN

210.2

113.9 / 1.7

622 / 382

-4/6/28

129

39.5

decline in the Direct emerging business (-8.5% QoQ) and flat revenue in Digital Risk.

Deal signings of USD90m during the quarter, higher than the run-rate seen in FY16

(total of USD303m TCV in FY16), lend confidence and visibility of growth.

HP Channel to stabilize in 2QFY17:

The management has been indicating stabilization

of the HP Channel 2Q onwards. In 1QFY17, revenue from the HP channel declined by

4.2% QoQ to USD52m. The MSA provides visibility for USD990m in revenue over a five

year period, which would imply stability at ~USD50m. MPHL does not expect HPE’s

merger with CSC to impact the MSA with HP.

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

60.9

62.1

Net Sales

9.0

9.6

EBITDA

7.2

8.0

NP

34.5

38.1

EPS (INR)

6.8

10.6

EPS Gr. (%)

299.4 294.3

BV/Sh. (INR)

12.3

12.8

RoE (%)

11.2

12.0

RoCE (%)

15.7

14.2

Payout (%)

1.8

1.8

Div. Yield

2018E

71.9

11.4

8.9

42.4

11.3

310.3

14.0

13.5

12.8

1.7

Margin beat amid improving mix:

EBIT margin expanded by 70bp QoQ to 15.2%, above

our estimate of 14.3%; reaching mid-point of the guided range of 14-16%. While the

bettering revenue mix is aiding margin expansion, this quarter also benefited from a

24% reduction in depreciation expense to the tune of 30bp. Although 2Q will be

negatively impacted by wage hikes, the overall revenue mix change is on track to keep

the direction right through the course of the year.

Valuation and view:

Direct International (ex. Digital Risk) has been growing above

industry average, and drag on overall performance from HP is easing. At the same time,

the reduction in Direct Emerging business and volatility in Digital Risk have been

keeping overall revenue growth under check. We expect revenue CAGR of 6.1% and

EPS CAGR of 11.0% over FY16-18E. Our target price of INR570 discounts forward

operating PAT by 12x added to net cash of INR130/share.

Neutral.

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531