Persistent Systems

BSE SENSEX

27,803

S&P CNX

8,541

24 July 2016

1QFY17 Results Update | Sector: Technology

CMP: INR658

TP: INR710 (+8%)

Neutral

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

IBM-Watson IoT deal drives revenue growth

…But likely to weigh on profitability in the current year

In-line performance…:

Revenue growth of 4.3% QoQ to USD105m was in-line with our

estimate. Profitability too was in-line as EBITDA margins declined by 80bp QoQ to

15.1% - led by visa expenses and additional costs associated with the IBM-Watson IoT

deal. However, the decline in EBIT margins was more severe (-190bp QoQ to 10.2%) as

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

PSYS IN

80

50.7 / 0.8

797 / 563

-9/-2/5

70

61.9

amortization expense increased by 34% QoQ and 51% YoY because of the change to

IND-AS and subsequent increase in the value of intangible assets.

…but varying composition of revenue:

During the quarter, the IBM-Watson IoT deal

had revenue of USD11.5m and Citrix reported USD2m. Excluding the incremental

addition from these two, revenue was flat during the quarter. Growth in ISVs was

strong at 3.4% QoQ (versus 0.1% CQGR over FY16) and Enterprise saw a rebound (5.9%

QoQ versus 1.8% in the previous quarter). The sharp decline in IP revenue (ex. IBM and

Citrix) of ~13% QoQ weighed on growth.

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

23.1

29.9

Net Sales

4.2

4.7

EBITDA

3.0

3.0

NP

37.2

37.7

EPS (INR)

2.3

1.5

EPS Gr. (%)

211.0 238.3

BV/Sh. (INR)

19.5

17.3

RoE (%)

18.9

16.9

RoCE (%)

17.8

17.5

Payout (%)

3.1

2.8

Div. Yield

2018E

35.1

5.8

3.8

47.4

25.7

250.3

20.0

15.8

13.9

2.6

FY17 margins to remain a pain-point:

The costs associated with the IBM deal are front-

ended and are expected to weigh upon margins to the tune of 200bp in FY17. Margins

would face the headwind of wage hikes in 2Q; although a lot of it can be offset by

traditional levers. The structural recovery to margins would only begin once revenue

from the IBM deal reached a point where it exceeds the cost associated with it, which

is likely to be back-ended; resulting in a full-impact in FY18E.

…which keeps rerating in check:

The IBM deal and traction in the Enterprise segment

has waned some of the revenue growth pressures on PSYS, leading to visibility of

strong revenue growth over FY16-18E (20% revenue CAGR). While the deal provides

potential of earnings accretion in the year beyond, at 18/14x FY17/18E, valuation

upside at PSYS would be constrained by near-term pressures. Moreover, ISVs (ex. IBM)

continue to weigh on overall performance. Our revised target price of INR710 (post

~4% earnings cut in FY17/18E) discounts FY18E earnings by 15x.

Neutral.

Estimate change

TP change

Rating change

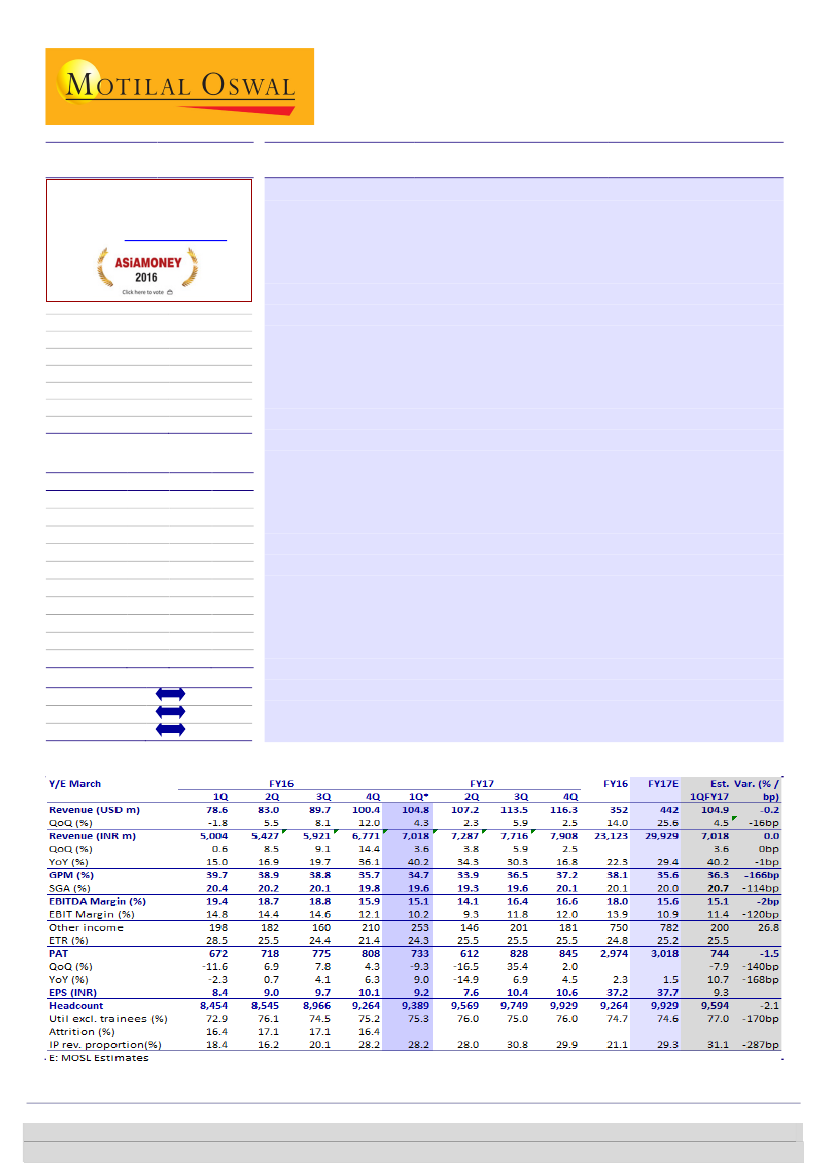

Quarterly Performance (Consolidated)

; *IND-AS

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531