25 July 2016

1QFY17 Results Update | Sector:

Financials

BSE SENSEX

28,095

S&P CNX

8,636

CMP: INR742

Indiabulls Housing Finance

TP: INR866 (+17%)

Buy

Bloomberg

IHFL IN

Equity Shares (m)

426.2

M.Cap. (INR b) / (USD b) 312.6/4.6

52-Week Range (INR)

820 / 551

1, 6, 12 Rel. Per (%)

7/-10/2

12M Avg Val (INR M)

1462

Free float (%)

75.8

Financials & Valuation (INR Billion)

Y/E March

2016 2017E 2018E

Net Fin inc

28.7 36.5 45.7

PPP

36.3 44.3 54.6

EPS (INR)

55.7 68.2 84.0

EPS Gr. (%)

4.1 22.6 23.0

BV/Sh. (INR)

254 280 315

3.3

3.3

RoA on AUM (%)

3.4

RoE (%)

27.1 25.6 28.2

Payout (%)

64.7 52.5 50.0

Valuations

P/E (x)

13.3 10.9 8.8

P/BV (x)

2.9

2.6

2.4

P/ABV (x)

2.9

2.6

2.4

Div. Yield (%)

4.9

4.8

5.7

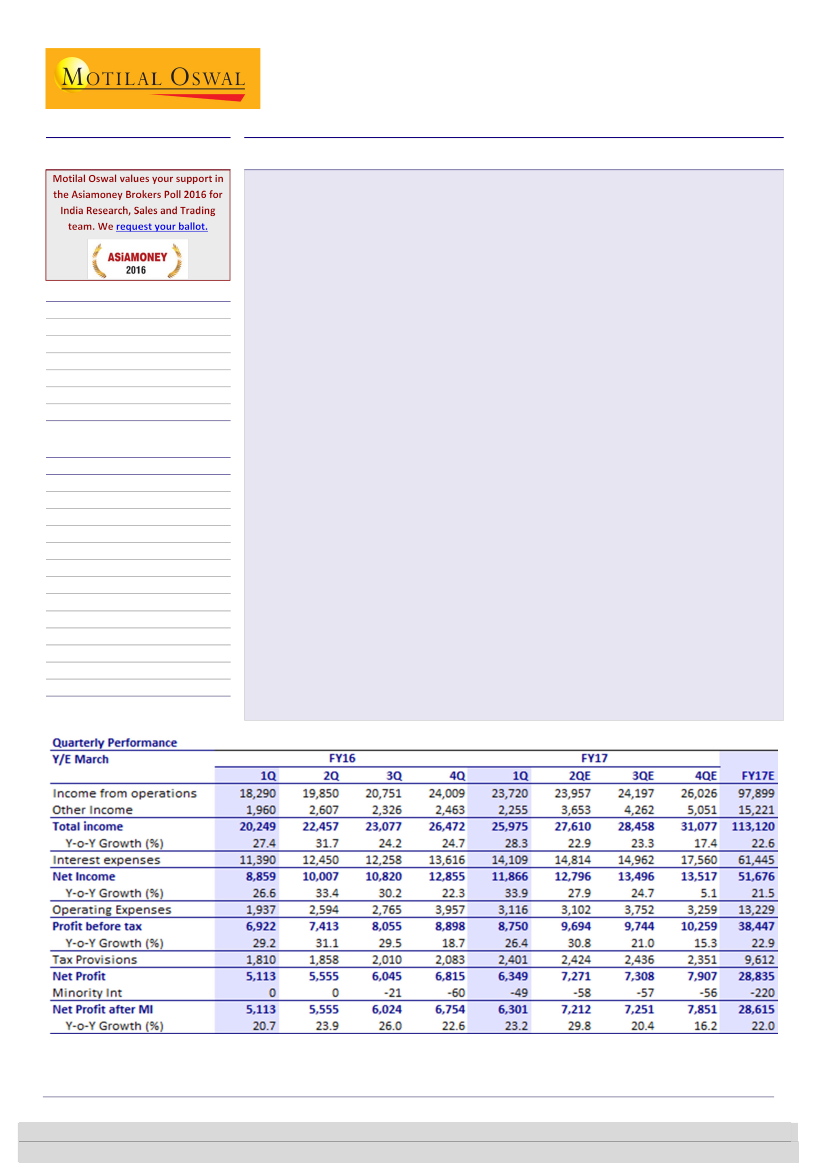

Indiabulls Housing Finance’s (IHFL) PAT grew 23% YoY but declined 7% QoQ to

INR6.3b (In-line with our est. of INR6.2b). Strong AUM growth of 30.9% YoY, stable

asset quality and book spreads of 318bp were the key highlights of the quarter.

AUM growth remained healthy at 31% YoY to INR 710b; Loan mix continues to

shift in favor of housing loans—will increase from the existing 53% to 60% by FY18

and 65% by FY20. Home loan disbursements to the salaried segment is 70% and to

the self-employed segment is 30% - would continue to maintain the proportion.

NII growth was robust at 39% YoY on the back of 318bp of book spreads and

300bp incremental spreads. Overall cost of funds stood at 9.25%, down 35bp YoY

driven by decrease in bank borrowings as well as increased sell-downs, whereas

incremental borrowing cost stood 8.9%.

GNPAs remained stable sequentially at 0.84%; however provisions at INR1.26b

almost doubled as compared to INR0.65b in 1QFY16on a lower base as IHFL had

standard asset provisions buffer during last quarter.

Other highlights

a) O/S ZCBs stand at INR10.6b v/s INR19.6b in 1Q16- wont issue

further ZCBs. b) Sold loans of INR11.14b in 1QFY17 v/s 5.22b in 1QFY16 c)

Launched e-Home loans during the quarter d) Subordinate debt was upgraded to

AAA in the quarter.

Valuation and view:

IHFL’s transformation from a diversified lender to a focused

mortgage player has yielded returns, with RoE/RoA improving from 3%/0.8% in

FY09 to +26%/3.5% in FY16. Focus on mortgage and market share gains will drive

AUM growth of 26% over the next two years. IHFL is among the lowest-levered

HFCs (4.6x) to support growth. Asset quality trend is likely to remain stable.

Improved borrowing profile, better credit rating and liquidity buffer will aid the

company maintain healthy spreads. De-risked business model, superior

profitability and +5% dividend yield warrant premium. The stock is trading at PBV

of 2.4x FY18E. Maintain

Buy

with a target price of INR866 (2.75x FY18E PB).

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com)/Piran

Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.