27 July 2016

Results Update | Sector: Consumer

Asian Paints

Neutral

BSE SENSEX

28,024

S&P CNX

8,615

CMP: INR1,062 TP: INR970(-9%)

Healthy growth, stellar margin performance

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

APNT IN

959.2

1018.5 / 15.6

1080 / 779

1/9/23

1040

47.2

Financials & Valuations (INR b)

2016 2018E

Y/E Mar

153.3 160.5

Net Sales

26.1

31.2

EBITDA

17.8

21.4

NP

18.5

22.3

EPS (INR)

25.0

20.1

EPS Gr. (%)

58.4

68.3

BV/Sh. (INR)

34.4

35.1

RoE (%)

30.8

32.1

RoCE (%)

57.3

47.7

P/E (x)

18.2

15.6

P/BV (x)

2018E

187.8

36.1

24.8

25.9

16.3

80.7

34.8

31.8

41.0

13.2

Estimate change

TP change

Rating change

+8%

+13%

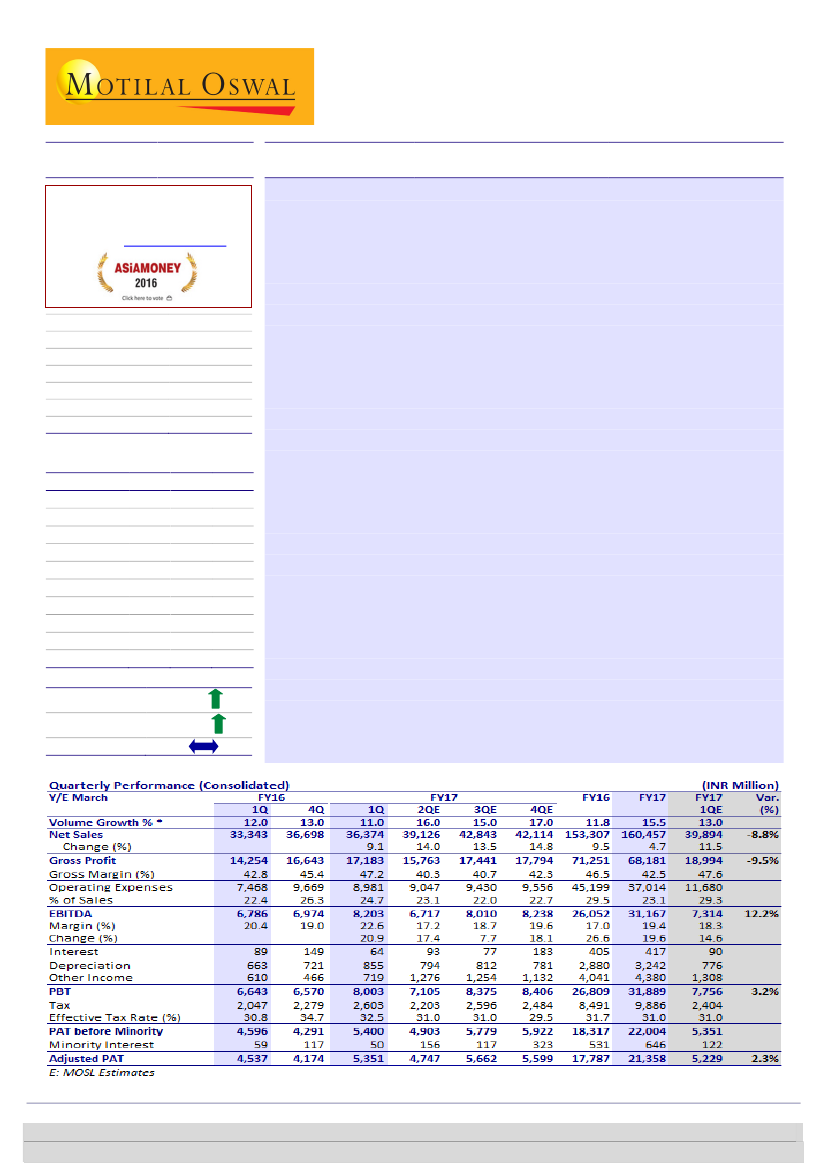

Asian Paints (APNT)

posted 1Q17 consol. sales growth of 9.1% YoY (est.11.5%)

to INR36.4b (IndAS) with estimated 11% volume growth (management

mentioned lower double digit growth) in the domestic decorative paints

business despite base of 12% volume growth in 1Q16. Consol. EBITDA/Adj. PAT

grew 20.9% (est.14.6%)/ 17.9% YoY (est.14.9%) to INR8.2b and INR5.3b resp.

Domestic Decorative paints business posted est. 11% volume growth

aided by

recovery in demand, reducing repainting cycles and continued strong rural

growth ahead of urban growth led by increase in permanent dwellings, low

base and expanding distribution reach.

Gross margin expanded 450bp YoY

(est. 200bp YoY) to 47.2% led by benign

input costs. Despite higher other expenses (up 180bp YoY) and employee

expenses (up 50bp YoY) EBITDA margin expanded 220 bp YoY (est. 50 bp YoY

improvement) to 22.6%. Thus EBITDA posted growth of 20.9% YoY (est. 14.6%)

to INR8.2b. High depreciation (up 29% YoY) and higher tax rate (up 170 bp YoY

to 32.5) led to PAT growth of 17.9% YoY (est. 14.9%) to INR5.3b. Imputed sub.

Sales, EBITDA and Adj. PAT grew 10.5%, 29.1% and 29.4% resp.

Concall takeaways:

(a) Demand uniformly good all across the country. There

has been no major shift from unorganized to organized recently which makes

the double digit domestic decorative volume growth highly creditable; (b)

Healthy demand is also being witnessed in kitchen and batch fittings as well as

industrial and auto paints.

Valuation and view:

We upgrade estimates by 8% due to possible pick-up in

demand in 2HFY17 and sustained gross margin improvements. APNT enjoys

strong position in the Deco Paints industry, backed by unparalleled supply

chain leadership. However, steep stock price increase of 19% in last 3 months

and fair valuations prevents us from being more constructive. Maintain Neutral

with a revised target price of INR970 (36x June’2018).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +91 22 6129 1545

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 22 6129 1547