27 July 2016

1QFY17 Results Update | Sector:

Financials

BSE SENSEX

25,437

S&P CNX

7,806

CMP: INR1,388

TP: INR1,563 (+13%)

HDFC

Buy

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Strong pick-up in disbursements drives AUM growth to 16.4% YoY; Retail

continues to gain share

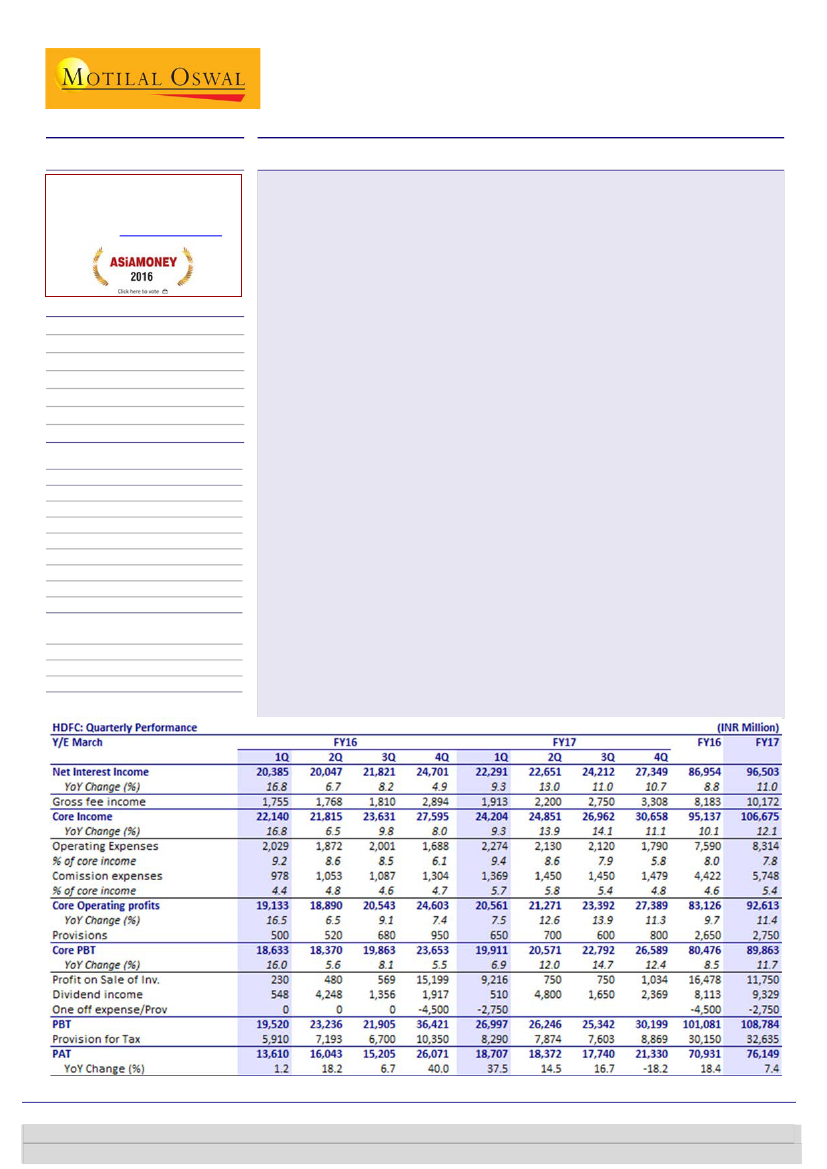

HDFC’s 1QFY17 headline PBT growth of 38% YoY (to INR27.0b) was driven by

one-off income due to gains on stake sale of its insurance venture (INR9.2b),

partially offset by INR2.75b addition to contingency provisions. Retail loan

growth (on AUM) picked up to 18% YoY, driving overall AUM growth of 16.4%

YoY. Individual disbursement grew 26% YoY (the highest in 13 quarters).

NII of INR24.7b was in line with our estimate. The gradual mix shift toward

residential loans resulted in spread compression of 5bp YoY and 3bp QoQ to

2.26%. This was driven by spread compression in the retail book by 5bp YoY and

2bp QoQ to 1.92%, given intense competition from not only HFCs but also large

banks.

Asset quality witnessed marginal deterioration with GNPA ticking up 6bp YoY to

75bp. This was driven by a 5bp YoY increase in retail segment GNPL to 59bp and

a 7bp rise in corporate segment GNPL to 1.11%.

Other highlights

a) Reported NIMs were flat YoY at 3.8%. b) Share of retail loans

in overall AUM increased 50bp QoQ to 73.3%. c) ATS in retail segment increased

8% YoY to INR2.53m. d) Share of off-balance sheet AUM in overall AUM

remained largely stable at ~12%. e) Sold loans worth INR33b to HDFC Bank and

INR 18.1b to other banks during the quarter. f) INR 3.6b deducted from net

worth due to MTM on derivative transaction.

Valuation and view:

HDFC’s retail loan growth is impressive, despite

heightened competitive pressures. Core PBT growth moderated to 9% in FY16

v/s 13-16% over FY12-15, led by a change in the AUM mix and higher buyback

by HDFC Bank. For FY17-19E, we expect largely stable spreads (pressure on

retail spreads to be compensated by lower cost of funds). We expect NII/core

PBT CAGR of ~14% on the back of ~15% CAGR in loans. The stock is trading at

FY17E/18E AP/E of 26x/22x and AP/BV of 4.6x/3.8x. Maintain

Buy

with SOTP of

INR1,563/share.

Bloomberg

HDFC IN

Equity Shares (m)

1,574.7

M.Cap. (INR b) / (USD b) 2176.2/32.6

52-Week Range (INR)

1398 / 1012

1, 6, 12 Rel. Per (%)

7/6/2

12M Avg Val (INR M)

3476

Free float (%)

100.0

Financials & Valuation (INR Billion)

Y/E MAR

2016 2017E 2018E

NII

87.0

96.5 110.1

PAT

70.9

76.1

87.1

EPS (INR)

30.8

34.6

37.9

EPS Gr. (%)

6.1

12.4

9.6

BV/Sh. (INR) 221.7 245.8 273.7

ABV/Sh. INR 169.5 193.6 217.1

RoAA (%)

2.6

2.5

2.5

Core RoE (%) 21.5

19.5

19.0

Payout (%)

43.9

43.5

43.5

Valuation

AP/E (x)

31.3

25.8

21.6

P/BV (x)

6.2

5.6

5.0

AP/ABV (x)

5.7

4.6

3.8

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com)/Piran

Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.