30 July 2016

1QFY17 Results Update | Sector: Capital Goods

Larsen & Toubro

Buy

BSE SENSEX

28,052

S&P CNX

8,639

CMP: INR1,558

TP: INR1,660(+7%)

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

LT IN

935.5

1457.5 / 21.8

1844/1017

0/29/-15

3125

100

Financials & Valuations (INR b)

Y/E Mar

2016 2017E

Sales

1,026 1,094

EBITDA

123.3 124.2

Adj PAT *

47.3

52.4

EPS (INR)*

50.6

56.0

EPS Gr. (%)

7.1

10.7

BV/Sh (INR)

470.2 511.4

RoE (%)

11.1

11.4

RoCE (%)

6.9

8.1

P/E (x)*

31.6

28.6

P/BV (x)

3.7

3.4

EV/EBITDA (x)

19.9

18.7

2018E

1,244

151.7

64.9

69.4

24.0

562.9

12.9

9.4

23.0

3.1

15.5

*Consolidated

Estimate change

TP change

Rating change

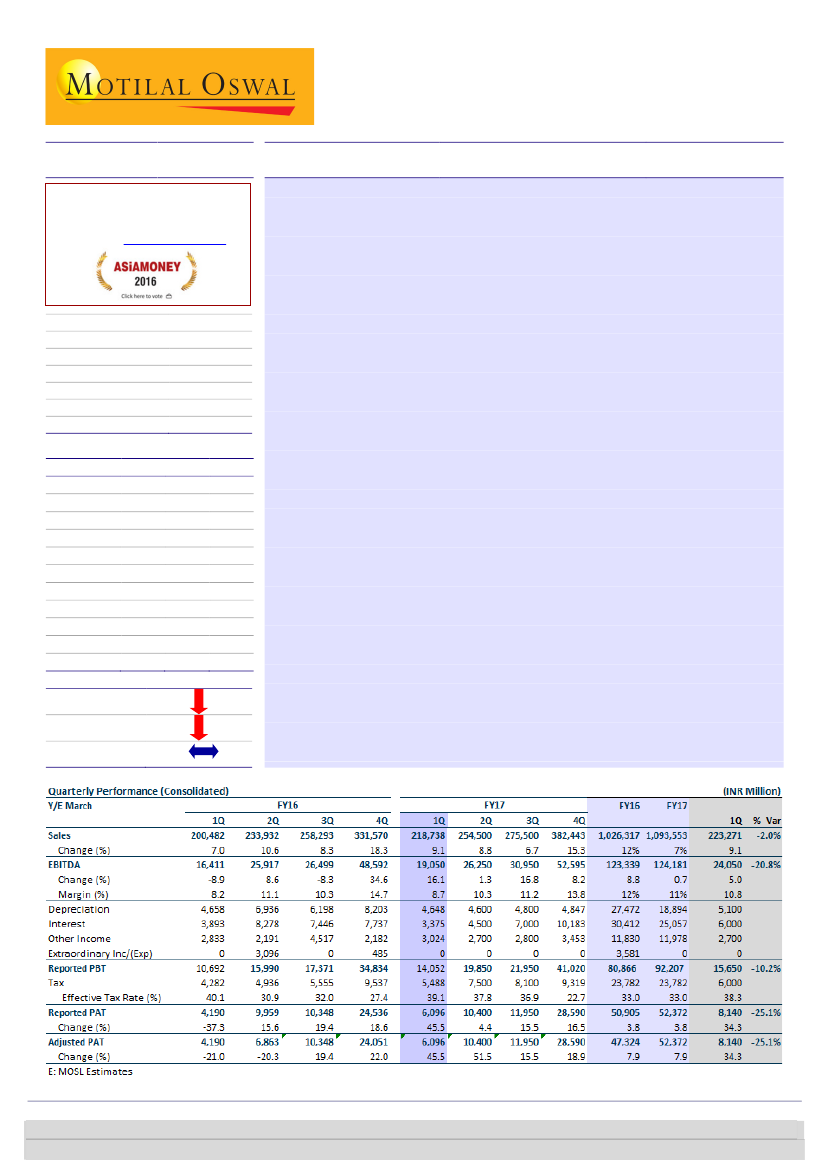

1QFY17 performance below expectations:

Larsen & Toubro’s (L&T) 1QFY17

consolidated performance was substantially below expectations. Revenues of

INR219b (+9% YoY) were in line with our estimates of INR223b. EBITDA at

INR19b (+16.1% YoY) was meaningfully below our estimate of INR24b, driven

by provisions under Ind-AS, write-down in the shipbuilding division and close

out costs incurred in the hydrocarbon segment. However, adjusted for the

same, reported EBITDA was in line with our estimates. Reported PAT at

INR6.1b was below our estimate of INR8.1b.

Margin disappointment led by provisioning and one-time write-downs:

As

discussed earlier, EBIDTA missed our estimate significantly, primarily due to a)

incremental provisioning of INR2.5b during the quarter under the newly

implemented Ind-AS for expected credit loss (INR1.5b) and employee

performance-linked incentives (INR1b); b) Inventory write-down in shipbuilding

(INR1b); and c) close out cost for the hydrocarbon project in the Middle East.

Adjusted for the same, reported EBITDA was in line with our estimates (see

Exhibit 1 on Page 2). Reported margins at 8.7% were 210bp below our estimate

of 10.8%.

Order intake below our estimate:

In 1QFY17, consolidated intake stood at

INR297b (+14% YoY), below our estimates of INR350b. Unannounced orders

were at INR48b (16% of total order intake), excluding the services business and

IDPL. Order inflow was primarily driven by finalization of large orders in the

Heavy Civil Infra, Water (Telangana barrage order) and Hydrocarbons (Hasbah

project from Saudi Aramco) segments.

Maintains guidance for FY17:

L&T has maintained guidance on orders revenue

and margins for FY17: order intake is guided to be up 15% YoY and EBIDTA

margins are being guided to improve 50bp YoY to 10.0% (Ind-AS). Revenue

growth is guided at 12-15%.

Maintaining Buy; cutting estimates and target price.

We cut our estimates for

consolidated earnings for FY17/FY18 by 6%/7% to factor in ECL-related

provisions. We maintain

Buy

and cut our SOTP-based target price to INR1,660.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ankur Sharma

(Ankur.VSharma@MotilalOswal.com); +91 22 6129 1556

Amit Shah

(Amit.Shah@MotilalOswal.com); +91 22 6129 1543