1 August 2016

1QFY17 Results Update | Sector: Technology

Tech Mahindra

Neutral

BSE SENSEX

28,003

S&P CNX

8,636

CMP: INR490

TP: INR550(+12%)

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Much-needed reprieve in top clients’ performance

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

TECHM IN

970.1

475.4 / 7.1

575 / 403

-6/-10/-6

952

63.7

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

264.9 295.4

Net Sales

43.4

47.1

EBITDA

31.2

30.0

NP

35.1

33.8

EPS (INR)

19.7

-3.6

EPS Gr. (%)

165.6 193.8

BV/Sh. (INR)

23.4

19.8

RoE (%)

20.1

17.3

RoCE (%)

14.0

14.5

Payout (%)

3.0

2.5

Div. Yield

2018E

339.5

55.9

36.7

41.3

22.1

219.9

17.6

18.0

11.9

2.2

Estimate change

TP change

Rating change

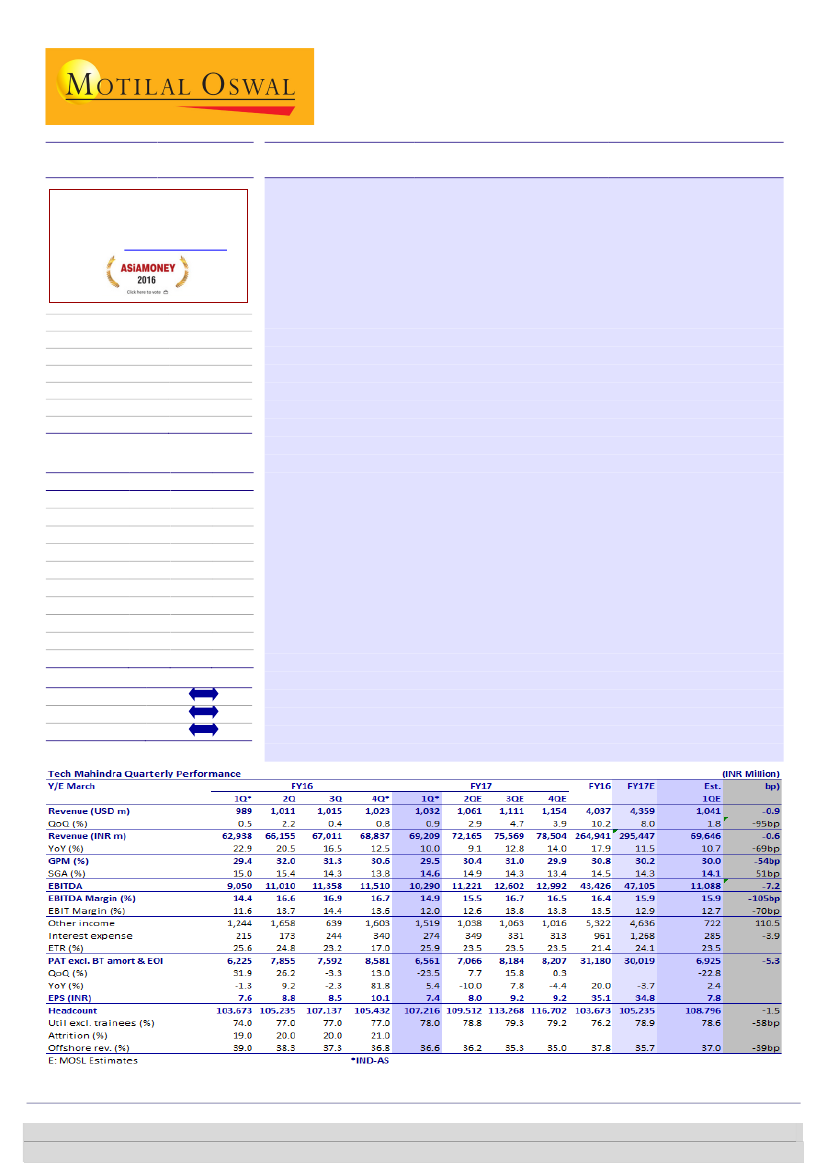

Top clients’ performance turning the corner:

Tech Mahindra’s (TECHM)

1QFY17 CC revenue growth of 0.4% QoQ was marginally below our estimate of

+1.2% (and reported USD revenue grew to USD1,031.5m, up 0.8% QoQ v/s our

estimate of +1.8%). Revenues from its top 5 accounts turned the corner,

growing 4.1% QoQ compared to last six quarters’ sequential growth between -

12% and +0.5%. TECHM cited expectations of continued traction in the top

client bucket, a key positive.

Profitability disappoints:

EBITDA margin declined 180bp QoQ to 14.9%, higher

than our estimate of a 100bp fall QoQ, led by more pronounced seasonality in

Comviva than anticipated. Compared to the earlier target of margin expansion

YoY, TECHM now expects to maintain margins at FY16 levels (~16% EBITDA).

Higher other income (INR2.5b v/s estimate of INR0.7b) led to PAT of INR7.5b

(down 12.6% QoQ, up 20.5% YoY) higher than our estimate of INR6.9b.

Telecom could add to Enterprise momentum:

Enterprise business’ strong

execution continued with 4.2% QoQ growth. Comviva seasonality and LCC

dragged Telecom’s performance; however, excluding the same, core business

grew ~3% QoQ. With Comviva seasonality behind and LCC likely to stabilize

after one quarter, we expect sequential growth rates at TECHM to improve

(excluding acquisitions).

Expect some valuation catch-up in near term:

We have cut our EBITDA margin

estimates for FY17E/FY18E by 80bp/40bp to factor in the miss in the current

quarter and the impact from Ind-AS. While 1Q margin of 14.9% should be hurt

by ~50bp in 2Q due to GBP depreciation, discontinued visa costs and

operational efficiencies should aid gradual expansion in EBITDA margin. That

said, TECHM’s valuation of 11.9x FY18E EPS has fallen below peers like WPRO

(13.7x FY18E) and HCLT (12.8x FY18E). This quarter’s performance and

commentary demonstrated the gradual improvement in Telecom which begun

only last quarter. This gains further weight with likewise positive commentary

by peers on the vertical. We expect to see some catch up on valuations by

TECHM v/s peers, driving near-term outperformance. Our target price of

INR550 discounts FY18E earnings by 13x, implying 12% upside.

Neutral.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531