1 August 2016

1QFY17 Results Update | Sector: Technology

Tata Elxsi

Buy

BSE SENSEX

28,003

S&P CNX

8,637

CMP: INR1,645

TP: INR1,965 (+19%)

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

In-line results; focused on futuristic business

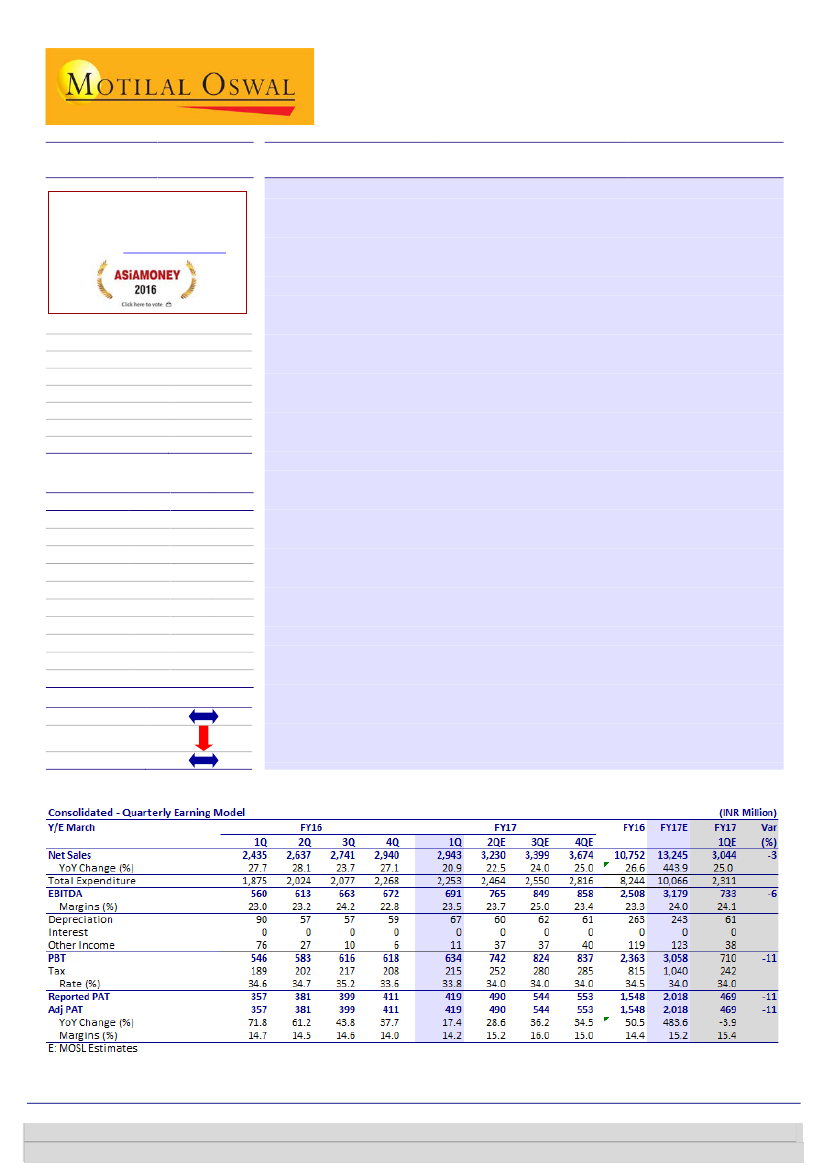

Results in line:

Revenue grew 21% YoY to INR2,943m (est. of INR3,044m), with

Embedded Product Development (EPD) division contributing 80.1% to

revenue, Industrial design and VLC (14.4%) and System integration at 5.5%.

EBITDA grew 23% YoY to INR691m (est. of INR733m) as margins expanded

50bp YoY to 23.5% (est. of 24.1%). PAT grew 17.4% YoY to INR419m (est. of

INR469m).

We met the management of the company in its Investor Meet

2016 where it had also showcased some of its products (details inside).

Focused on futuristic opportunities:

Management highlighted that Over The

Top content (OTT) business is gaining momentum with trend changing

globally. The Broadcasters are incrementally focusing on moving directly to

the customers. TELX key customers in OTT business includes Hotstar, Ditto TV,

Voot, Eros Now, Hungama and Zee living. Additionally, the company believes

that automation in car is on the rise will continue to increase with high

intensity. In this direction the company has taken many initiatives like e-

Cockpit, Driver behavior monitoring and is also working on Driverless Car. The

company intends to refocus on VCL business but will be selective to take

projects where outcome is predictable.

Growth momentum to continue:

Company is confident of continuing the

steady pace of growth. In the automotive segment the company is engaged

with 10OEM’s and 29 suppliers. Within automotive, TELX is focusing on Safety

and Security, Body and Chassis electrical, Powertrain and Hybrids,

Infotainment and Telematics. Employees as at end of 1QFY17 numbered 4,700

and plans to recruit ~1,000 every year (~15% attrition). The management

highlighted that TELX enjoys ~9-12% market share in each business segment.

Valuation and view:

We expect TELX to post 24% revenue CAGR and 28% PAT

CAGR over FY16-18, led by EPD. Given its strong set of capabilities built over

last 25 years in the areas of Technology, Engineering and Design and its

standing as a strong play on IoT, we recommend

Buy

with a price target of

INR1,965—24x FY18E EPS.

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

TELX IN

31.1

51.3/ 0.8

2,396/1,591

-8/-33/-1

1,506

55.4

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Sales

10.8

13.2

16.4

EBITDA

2.5

3.2

4.0

PAT

1.5

2.0

2.6

EPS (INR)

49.7

64.8

81.9

EPS Gr. (%)

50.5

30.4

26.3

BV/Sh. (INR)

123.9 162.3 208.2

RoE (%)

46.3

45.3

44.2

RoCE (%)

46.3

45.3

44.2

P/E (x)

33.2

25.5

20.1

P/BV (x)

13.3

10.2

7.9

Estimate change

TP change

Rating change

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 39825000

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +91 22 3982 5422

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.