Pidilite Industries

BSE SENSEX

27,982

S&P CNX

8,623

2 August 2016

1QFY17 Results Update | Sector: Consumer

CMP: INR740

TP: INR850 (+15%)

Buy

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Long-term growth drivers in place

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

PIDI IN

512.7

379.5 / 5.7

770 / 508

0/15/33

355

30.4

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Net Sales

53.7

60.7

73.8

EBITDA

11.8

14.0

16.5

PAT

7.6

9.4

11.1

EPS (INR)

14.8

18.3

21.6

Gr. (%)

46.6

23.0

18.2

BV/Sh (INR)

53.4

68.0

82.9

RoE (%)

30.4

30.1

28.6

RoCE (%)

29.1

28.7

27.6

P/E (x)

49.9

40.6

34.3

P/BV (x)

13.9

10.9

8.9

Estimate change

TP change

Rating change

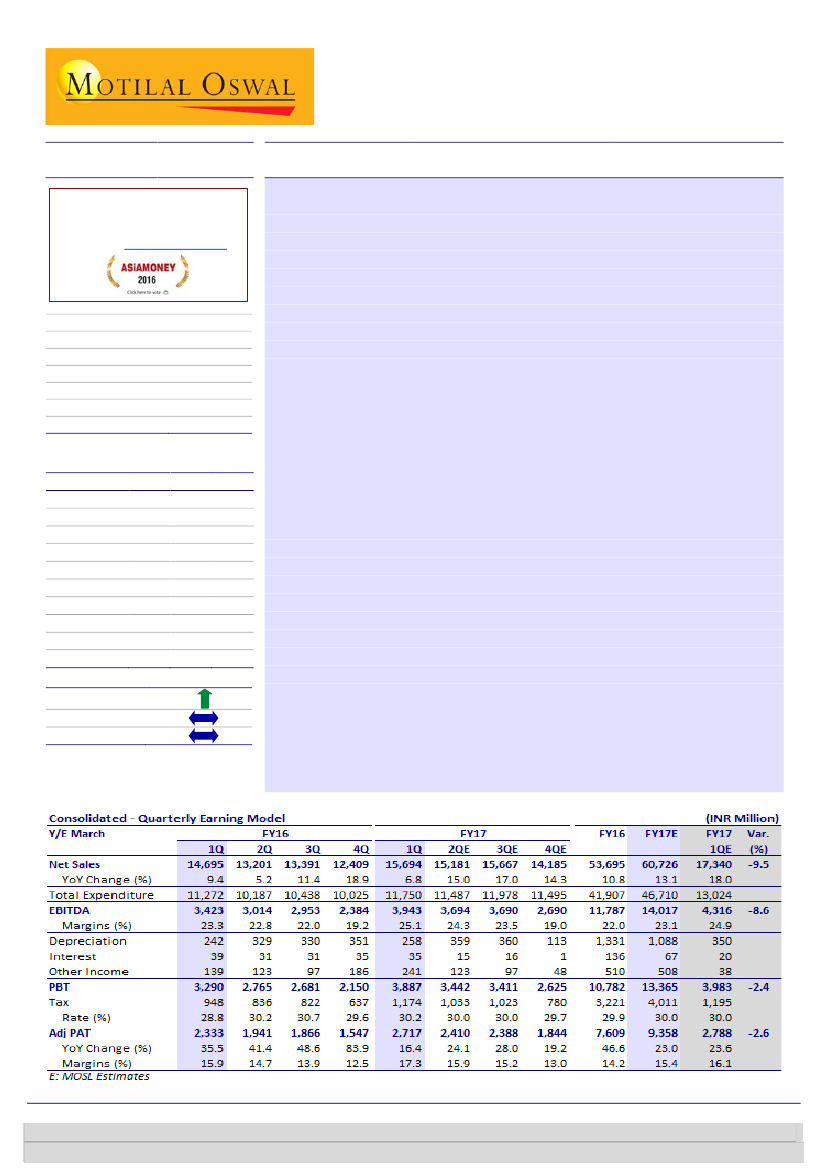

Pidilite Industries’ (PIDI) 1QFY17

performance was below our expectations.

Consolidated sales grew 6.8% YoY (est. of +18% YoY) to INR15.7b (Ind-AS).

Volume growth was reportedly ~9% YoY in the Consumer Bazaar segment.

EBITDA grew 15.2% YoY (est. of +25.6%) to INR3.94b. Adjusted PAT was up

16.4% YoY (est. of +23.6%) at INR2.72b.

Sharp gross margin expansion:

Gross margin expanded sharply by 330bp YoY

to 52.3% aided by benign input costs, but the impact was partly offset by

higher staff costs (+70bp YoY) and other expenses (+80bp YoY). EBITDA margins

expanded 180bp YoY (est. of +150bp) to 25.1%.

Segmental performance:

Consumer Bazaar posted 9.4% YoY revenue growth,

with underlying EBIT margin expansion of 130bp YoY to 27.1%. Industrial

segment’s revenues grew 4.2% YoY, while EBIT margin expanded 270bp YoY to

18.3%.

Standalone highlights:

Sales, EBITDA and adj. PAT grew 4.9%, 8.6% and 20.9%,

respectively, on a YoY basis. Gross and EBITDA margins rose 420bp YoY and

320bp YoY, respectively. Subsidiary revenues exhibited a sharp improvement

YoY to 21.6%, but EBITDA declined to INR76m vs. INR161m in 1QFY16.

Key concall highlights:

(1) VAM costs remain benign around USD900, and at

these levels, the company is unlikely to increase prices. (2) According to

management, its distribution reach, brand, first-to-market status, innovation

and generation of trust give an edge over competition.

Valuation and view:

We believe PIDI offers a high-quality discretionary play

with its strong competitive positioning, proven in-market excellence and

impeccable track record of generating long-term shareholder value over

multiple periods. We continue to like the franchise, despite near-term rich

valuations. While we have reduced our sales forecasts for FY17, we still get an

8.8% EPS upgrade for FY18 as (a) we are assuming faster sales growth in FY18,

led by good monsoon and implementation of 7

th

Pay Commission

recommendations, (b) we are no longer assuming a steep operating margin

decline given the favorable material cost outlook, and (c) due to the absence of

amortization expenses (~25% of D&A) going forward as per Ind-AS. We

maintain our

Buy

rating, with a revised target price of INR850 (37x June 2018

EPS).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +91 22 3982 5428

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 22 3980 4261