The Ramco Cements

BSE SENSEX

27,698

S&P CNX

8,545

3 August 2016

1QFY17 Results Update | Sector: Cement

CMP: INR536

TP: INR625 (+17%)

Buy

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Robust volume growth amid weak realizations

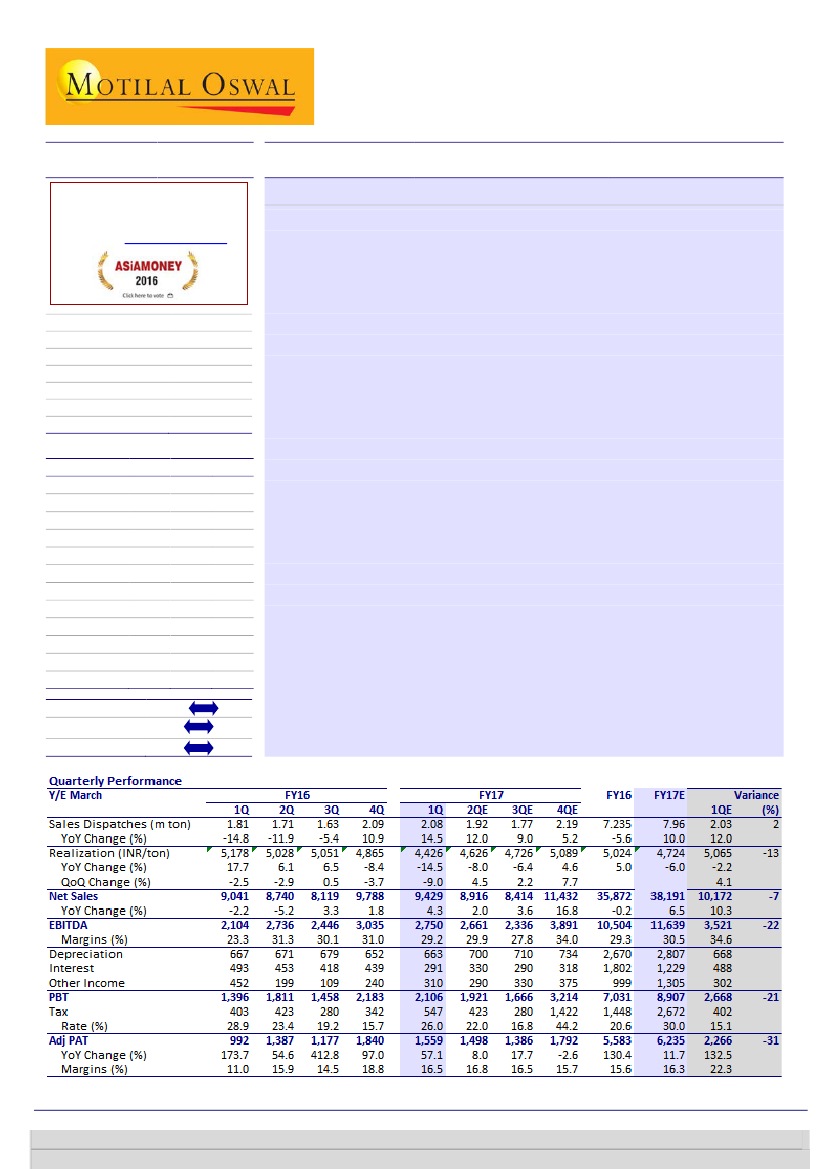

Robust volume growth:

TRCL’s volumes grew 12% YoY to 2.08m tons in

1QFY17, driven by spurt in southern demand. Blended realization declined 3%

QoQ (below expectation), as prices failed to recover in the South. Revenue

grew 4% YoY to INR9.4b, a 7% miss. PAT grew 57% YoY to INR1.6b.

Realization drop offset by cost moderation:

Blended EBITDA/ton was

INR1,325 (+14% YoY, -9% QoQ). Realization dip was partially offset by 1% QoQ

(and 16% YoY) drop in unitary cost to INR3,217/ton, aided by (a)

lower

fuel

prices (pet coke mix near ~40%; cheaper imports), and (b) positive operating

leverage. Margins expanded 5.9pp YoY to 29.2%.

Further deleveraging:

TRCL reduced its debt by INR3.1b out of internal

accruals and reduction in working capital, which led to lower interest cost in

1QFY17. With no immediate expansion plans, it is poised for further

deleveraging.

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

TRCL IN

238.1

127.6 / 1.9

595 / 300

-8/28/51

71.2

57.7

2018E

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

Sales

35.9

38.2

EBITDA

10.5

11.6

NP

5.6

6.2

Adj EPS (INR)

23.4

26.2

EPS Gr. (%)

130.3

11.7

BV/Sh. (INR)

129.9 152.6

RoE (%)

19.5

18.5

RoCE (%)

13.2

13.1

Payout (%)

14.9

13.3

P/E (x)

22.9

20.5

EV/EBITDA (x)

14.1

12.2

EV/Ton (USD)

142

132

43.1

13.6

7.6

31.7

21.2

179.7

19.1

14.6

14.6

16.9

9.9

125

Best southern play, but valuations rich

TRCL offers strong play on southern recovery, given its (a) superior brand, (b) cost

efficiencies, aiding industry-leading profitability, and (c) visibility of de-leveraging.

Our assumption of 6% volume CAGR (early sign of southern recovery) and 3%

price CAGR (already disciplined base) over FY16-18 would drive 7-8% EBITDA/PAT

CAGR. The stock trades at 9.9x FY18E EV/EBITDA and EV/ton of USD125. We

maintain

Buy

with a TP of INR625, an upside of 17% (valuing cement business at

EV/ton of USD146, 11.5x FY18E EBITDA).

Estimate change

TP change

Rating change

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 6129 1524

Aashumi Mehta

(Aashumi.Mehta@MotilalOswal.com); +91 22 6129 1537

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.