Friday, August 05, 2016

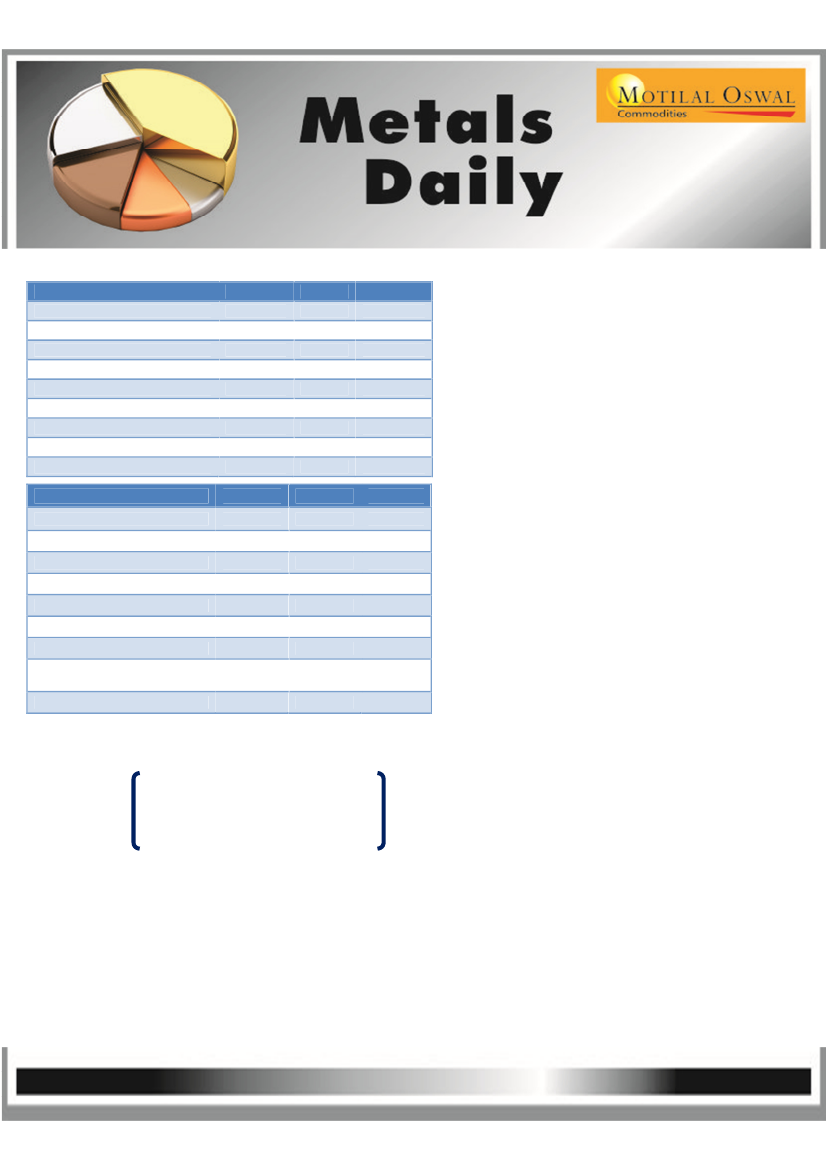

Commodity

Gold / US Dollar FX Spot

Silver / US Dollar FX Spot

Crude oil $ Spot

COMEX Copper $

LME Copper (3M)

LME Aluminum (3M)

LME Nickel (3M)

LME Lead (3M)

LME Zinc (3M)

Last

1360.8

20.28

41.92

343.5

4834.5

1631

10565

1798.5

2260

Chg.

3.3

-0.08

1.12

-1.9

2.5

8

5

2.5

5

% Chg.

0.24%

-0.39%

2.75%

-0.55%

0.05%

0.49%

0.05%

0.14%

0.22%

Market Overview (Economy)

Asian markets are largely positive as oil

prices recovered and as the BOE

announced an unexpected stimulus.

The Bank of England cut interest rates

for the first time since 2009, taking

rates from 0.50% to a record low

0.25%. The BOE also announced that it

would buy 60 billion pounds of

government debt and 10 billion pounds

of high-grade corporate bonds.

The dollar index remains flat ahead of

the all-important payrolls data today

while the pound is likely to slump

further.

Equity

BSE Sensex Index

S&P CNX NIFTY

Hang Seng Index

Shanghai SE Composite Index

Nikkei 225 Index

DAX Index

CAC 40 Index

Dow Jones Industrial Average

Index

NASDAQ 100 Index

Last

27714.4

8551.1

21832.2

2982.4

16254.9

10227.9

4345.6

18352.1

4743.8

Chg.

16.9

6.3

93.1

4.0

171.8

57.7

24.6

-3.0

9.5

% Chg.

0.06%

0.07%

0.43%

0.13%

1.07%

0.57%

0.57%

-0.02%

0.20%

Precious Metals

Gold prices are flattish ahead of the

non-farm payrolls data even as they

recovered post the BOE decision

yesterday.

The Bank of England cut interest rates

for the first time since 2009.

Nonfarm payrolls are expected to

increase by 175k in July after surging

287k in June.

Initial jobless claims also supported gold

as they jumped to 269,000, higher than

the 265,000 projected.

Holdings of SPDR Gold

0.37% to 973.21 tonnes.

Trust,

rose

Nonfarm payrolls are expected to

increase by 175k in July after surging

287k in June.

1

Please refer to disclaimer at the end of the report.