Grasim Industries

BSE SENSEX

27,860

S&P CNX

8,592

11 August 2016

1QFY17 Results Update | Sector: Cement

CMP: INR4,539

Under Review

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Strong realizations and cost moderation boost 1QFY17 results

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

GRASIM IN

93.3

423.7 / 6.3

5,349 / 3,242

-1/13/22

290

68.7

Financials & Valuations (INR b)

2016

2017E

2018E

Y/E Mar

365.9

408.2

459.6

Net Sales

60.2

79.8

101.5

EBITDA

22.6

35.5

44.1

NP

241.7

380.2

472.4

EPS (INR)

26.8

57.3

24.3

EPS Gr. (%)

BV/Sh. (INR) 2,766.8 3,120.6 3,568.1

9.2

12.9

14.1

RoE (%)

10.0

13.2

15.6

RoCE (%)

18.8

11.9

9.6

Payout (%)

132.3

115.4

113.7

Div. Yield

Estimate change

TP change

Rating change

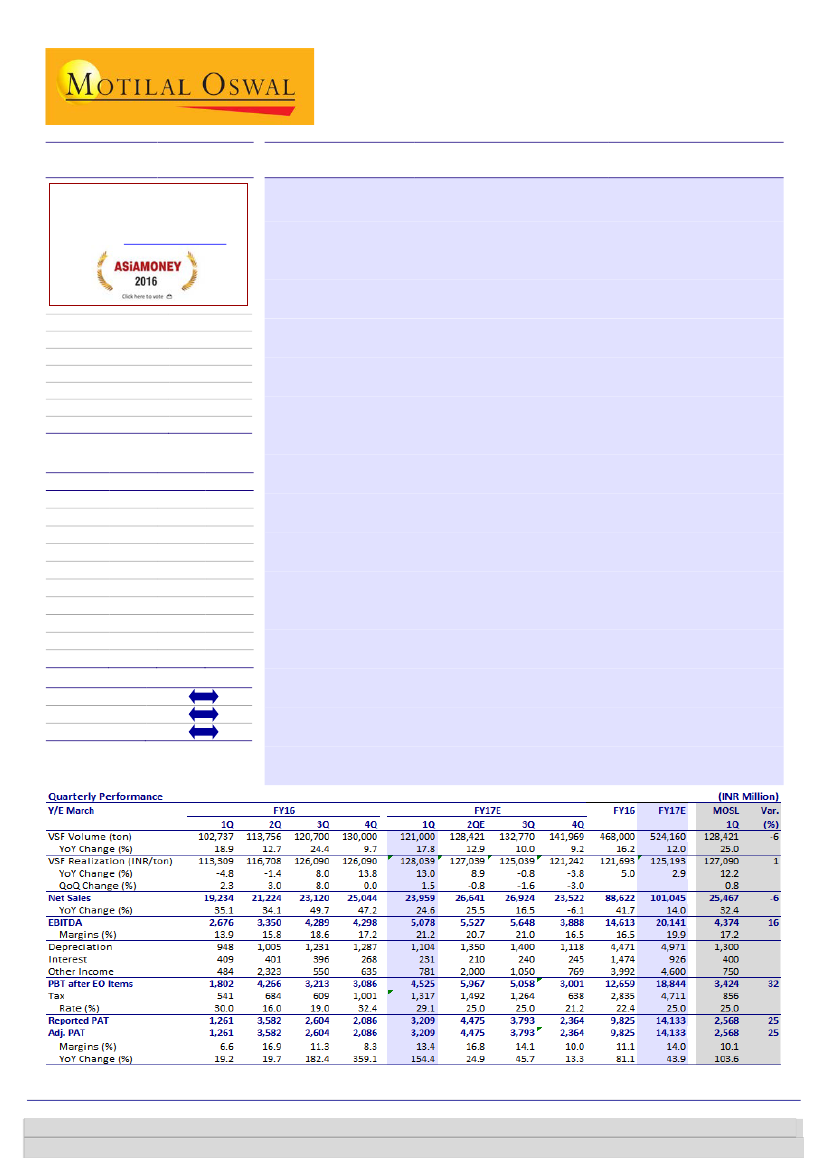

Strong margins led by cost control:

Grasim Industries’ (GRASIM) standalone

1QFY17 EBITDA rose 90% YoY (+18% QoQ) to INR5.1b, translating into margins

of 21.2% (+4pp QoQ, +7.3pp YoY), driven by near-peak utilizations, high pricing

and lower energy costs. Revenues grew 25% YoY to INR24b, while PAT stood at

INR3.2b (2.5x YoY) led by better margins.

VSF – encouraging utilization ramp-up and pricing boost:

VFS revenues grew

32% YoY to INR16.5b (est. of INR17.6b), led by volume growth of 17% YoY (est.

of +25% YoY) and realizations boost of 13% YoY, which translated into (a)

margins of 19% (v/s 11% in 1QFY16) and (b) RoCE of high-teens. Realizations

boost was attributable to uptrend in prices and depreciation of INR. With

commendable ramp-up at the Vilayat plant, overall utilizations stood at 97%.

Healthy demand aids Chemicals business:

Chemicals revenues stood at INR9b

(+18% YoY), with utilization at 100%. Margins improved to 35% from 22% in

1QFY16, led by higher volumes.

Management outlook:

Both VSF and Chemicals businesses are likely to see

improved domestic demand. De-bottlenecking of the Vilayat plant was

completed in 1QFY17, which increased capacity of Chemicals to 8,40,000 tpa

from 8,04,000 tpa. Key medium-term focus areas are: 1) more premium

product mix, (2) expanding domestic reach, (3) additional capex in organic and

inorganic route in right juncture and (4) improvement in cost efficiencies.

Aditya Birla Nuvo-GRASIM merger:

The restructuring will result in the listing of

the merged financial services business, which will be 57% owned by post-

merger GRASIM and the balance by its shareholders on a proportionate basis.

Shareholders will receive three equity shares of GRASIM for every 10 equity

shares of Aditya Birla Nuvo, and seven shares of Aditya Birla Financial Services

for every one equity share of GRASIM.

Valuation and view:

At CMP, GRASIM trades at 11.9x/9.6x FY17/18E EPS,

8.4x/6.3x FY17/18E EV/EBITDA and EV/ton of USD114 (50-55% discount to

UTCEM’s valuation). Considering this proposed merger, we put our rating on

the stock under review.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 6129 1524

Aashumi Mehta

(Aashumi.Mehta@MotilalOswal.com); +91 22 6129 1537