Manpasand Bev erages

BSE SENSEX

27,860

S&P CNX

8,592

11 August 2016

1QFY17 Results Update | Sector: Others

CMP: INR678

TP: INR850 (+25%)

Buy

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR m)

Free float (%)

MANB IN

50.1

34.0/ 0.5

743 / 369

7/41/62

40

49.6

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Sales

5.6

8.5

13.0

EBITDA

1.1

1.7

2.6

NP

0.5

0.9

1.4

EPS (INR)

10.1

17.1

28.3

EPS Gr. (%)

26.7

69.1

65.8

BV/Sh. (INR)

120.2 135.6 161.1

RoE (%)

11.4

11.9

17.0

RoCE (%)

12.2

13.4

19.1

P/E (x)

67.1

39.7

23.9

P/BV (x)

5.6

5.0

4.2

Estimate change

TP change

Rating change

Stellar growth, focus on branding through advertisements

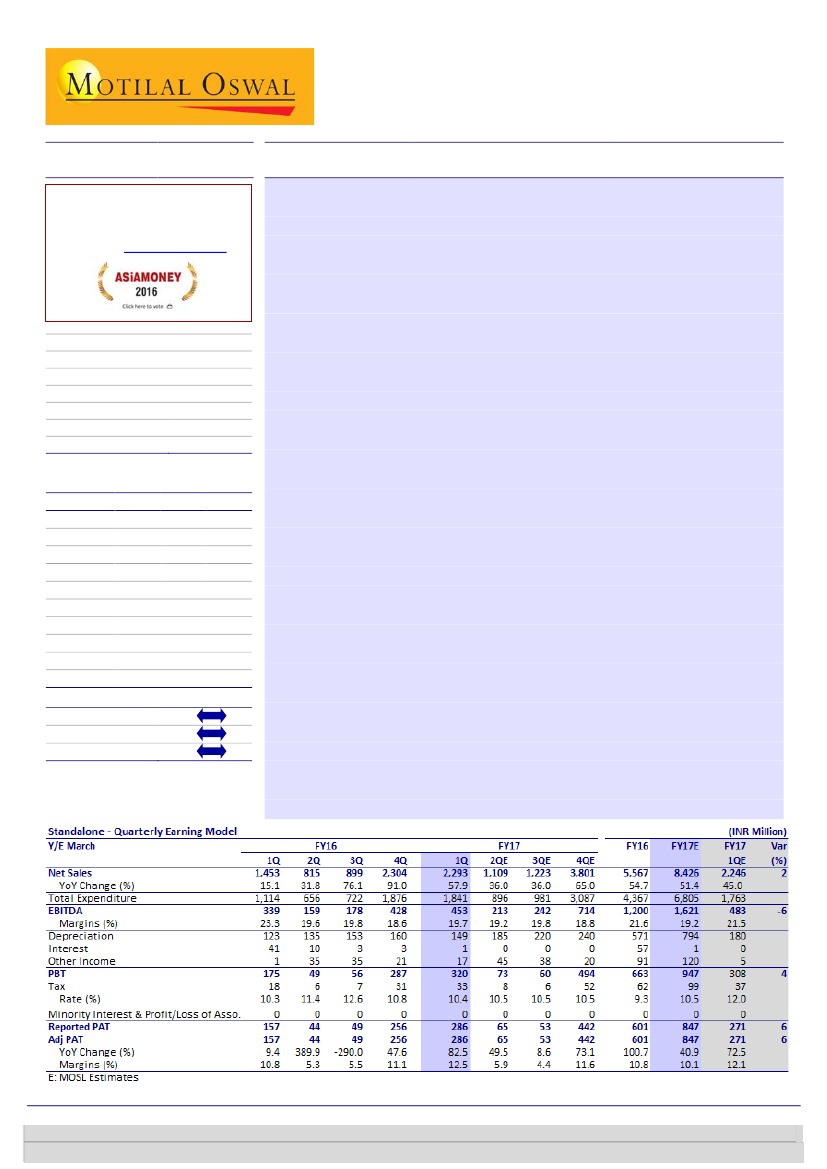

Revenue in line, but EBITDA margins below estimates:

Manpasand Beverages’

(MANB) 1QFY17 revenues grew a stellar 58% YoY to INR2,293m (est. of

INR2,246m) (revenue net of excise duty). Revenue of Mango SIP grew 47% YoY,

while that of Fruits Up grew a robust 120% YoY. Revenue mix for Mango SIP,

Fruits Up and others (incl. ORS and Coco SIP) stood at 77:22:1 v/s 84:16:0 in

1QFY16. Revenues also included contribution of ~INR120m from Modern

Trade, which was absent in the base quarter. EBITDA margin declined 360bp to

19.7% from 23.3% in 1QFY16 due to higher other expenses. EBITDA grew 33.5%

YoY to INR453m. However, due to lower interest expense (INR1m v/s INR41m

in 1QFY16) and higher other income (INR17m v/s INR1m in 1QFY16), adj. PAT

grew robustly by 82% YoY to INR286m (est. of INR271m) in 1QFY17.

Focus on branding and advertisement:

The company more than trebled

spending on advertisements (across TV commercials, radio, wall paintings and

billboards) to INR180m v/s INR50m in 1QFY16. As a result, other expenses (as

% of sales) increased 360bp to 15.1%, which led to EBITDA margin decline of

360bp to 19.7%. The company aims to follow up with another round of

aggressive adspend in 4QFY17.

Coco SIP soft launched in few markets:

MANB soft launched Coco SIP in

Mumbai and some parts of Gujarat in 1QFY17, which was well received by

consumers. However, the company has taken cognizance of some complaints

that the taste of the product differed from across batches due to the usage of

naturally processed coconut water. In this view, MANB is reworking on bringing

uniformity in taste across batches.

Valuation and view:

We believe MANB is on the cusp of a high-growth cycle

due to its capacity expansion, new product launches and increase in

distribution network, which should lead to market share gains from 5% in 2016

to 7.5% in 2018. The launch of Fruits Up and Coco SIP brands is expected to

help tackle seasonality issue and ramp up capacity utilization, thereby driving

margins. We expect sales and PAT CAGR of 53% and 67%, respectively, over

FY16-18E. The stock trades at a P/E of 40x/24x FY17/18E EPS. At a P/E of 30x

FY18 EPS, we value the stock at a target price of INR850 (25% upside) and

maintain our

Buy

rating.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 6129 1535

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +912239825422

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.