Parag Milk Foods

BSE SENSEX

27,860

S&P CNX

8,592

11 August 2016

Q1FY17 Results Update | Sector: Consumer

CMP: INR326

TP: INR340(+4%)

Neutral

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Long term growth drivers in place

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

PARAG IN

84.4

27.5 / 0.4

357 / 202

-2/-/-

257

52.5

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Net Sales

16.5

18.4

22.8

EBITDA

1.5

1.8

2.3

PAT

0.5

0.8

1.1

EPS (INR)

6.7

9.3

12.8

Gr. (%)

-66.7 38.2

37.9

BV/Sh (INR)

51.4

89.4 102.2

RoE (%)

19.5

14.1

13.4

RoCE (%)

12.4

11.1

11.7

P/E (x)

48.5

35.1

25.4

P/BV (x)

6.3

3.6

3.2

Estimate change

TP change

Rating change

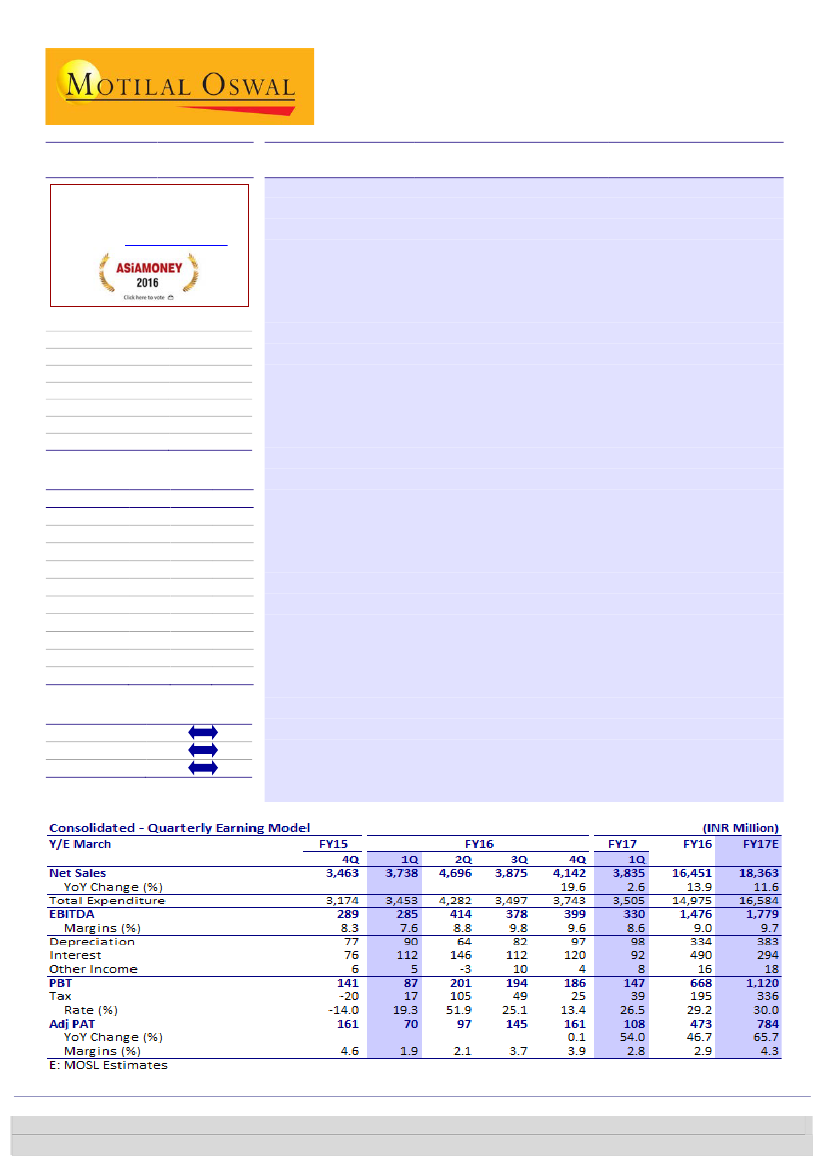

PARAG’s 1QFY17

consolidated sales grew 3% YoY to INR3.8b led by Fresh milk

growth of 25% and Milk products sales growth of 5% (with around 4% volume

growth). SMP sales declined 14% YoY and others segment sales declined by

79%. EBITDA grew 16% YoY to INR330m while PAT grew 54% YoY to INR108m.

Sharp gross margin expansion:

Gross margins expanded sharply by 420bp YoY

to 29.9% aided by improving product mix and utilization of lower cost raw

materials of the previous quarter. Increase in employee costs (up 90bp YoY to

4.6%) and higher other expenses (up 230bp YoY to 16.7%) led to EBITDA

margin expansion of 100bp YoY to 8.6%. EBITDA thus grew 16% YoY to

INR330m.

Debt reduction:

Interest costs declined 17% YoY as debt levels reduced to INR

3b after repayment of loans worth INR1b. Tax rate increased 720bp YoY off a

low base. Full year tax rate is likely to be around 30%, same as last year.

Key concall highlights:

(1) 1st quarter sales and margins are the lowest in

terms of full year performance; summers are also low in terms of sale of milk

and milk products. (2) Price increases were taken at the back end of quarter so

the entire growth for 1QFY17 is mostly due to volume growth. (3) Management

is aiming for 5% PAT margin in FY19 led by price increase, product mix,

economies of scale, cost efficiencies and lower interest cost.

Valuation and view:

Opportunity size in Dairy is huge and in-turn offers strong

growth visibility for branded players. Parag with its strengths on procurement,

distribution, innovation and management bandwidth is best placed among

peers. While rest of the listed Dairy players are either regional in nature or

have dominant B2B positioning, Parag offers a pan-national branded dairy play

with B2C focus. While we are positive on the long term investment story, the

stock has appreciated by 51% since its IPO three months ago, capping the near

term upside at 4%. Maintain Neutral rating and target price of INR 340 (25x

June 2015 EPS). From a medium term perspective, Parag offers a compelling

three year play with potential 23% CAGR returns.

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 2239804261

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +912239825428/Gautam

Duggad

(Gautam.Duggad@motilaloswal.com); +912261291522

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.