13 August 2016

1QFY17 Results Update | Sector: Healthcare

Granules India

BSE SENSEX

28,152

S&P CNX

8,672

CMP: INR135

TP: INR160 (+19%)

Buy

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2016 for

India Research, Sales and Trading

team. We

request your ballot.

Results largely in line; margins remained robust

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

GRAN IN

216.7

29.3 / 0.4

164 / 101

-10/4/27

218

48.9

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Sales

14.3

15.6

19.0

EBITDA

2.8

3.2

4.0

NP

1.2

1.6

2.2

EPS (INR)

5.5

6.8

9.8

EPS Gr. (%)

22.8

25.1

42.6

BV/Sh. (INR)

30.7

39.6

47.5

RoE (%)

21.6

19.9

22.4

RoCE (%)

14.0

14.1

16.4

P/E (x)

24.6

19.7

13.8

P/BV (x)

4.4

3.4

2.8

Estimate change

TP change

Rating change

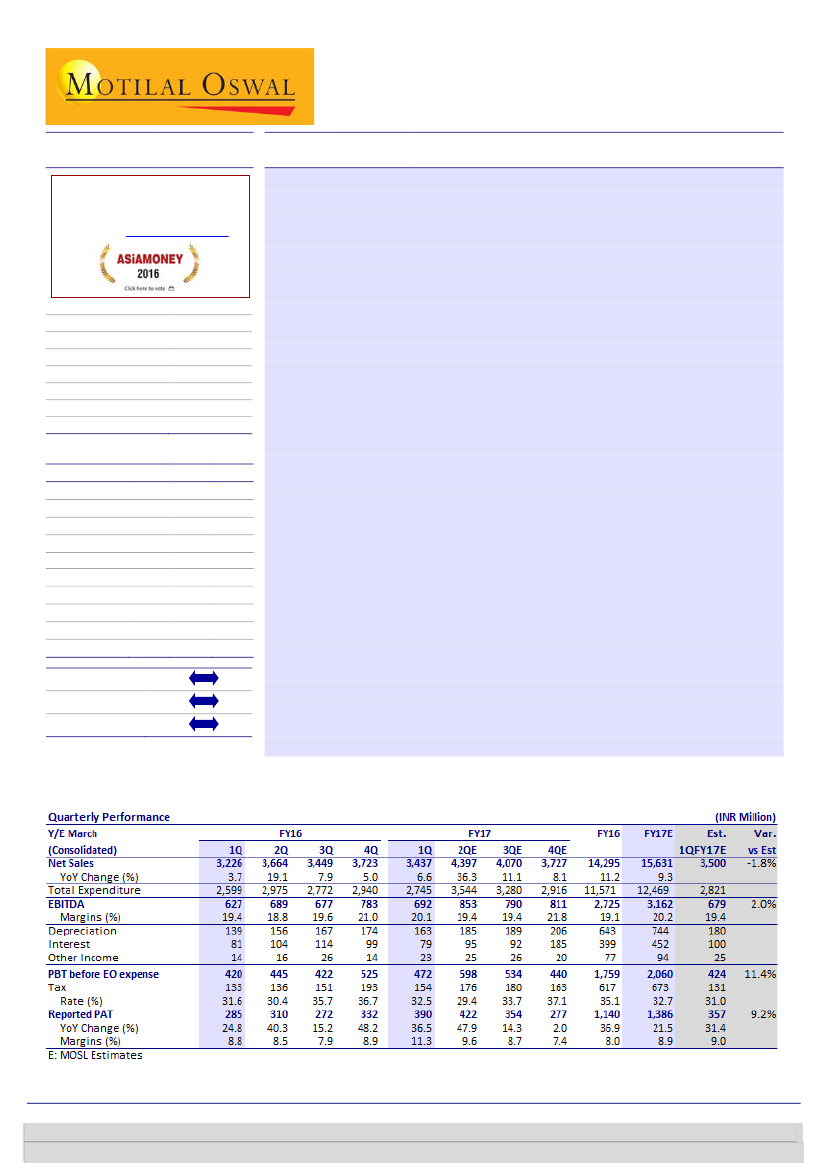

As per Ind-AS, revenues grew 7%YoY to INR3.4b (largely in line) led by sustained

traction in CMO and Rx business. However, EBITDA increased 11% YoY to INR692m

on the back of improved business mix in 1QFY17. EBITDA margins expanded 72bps

YoY, to 20.1% primarily owing to higher gross margins (up 280 bps YoY). PAT grew

37% YoY to INR390m (+9% beat). JV business (Biocause and Omnichem delivered

robust profits of INR71m in 1QFY17.

Finished dosage continues to shine:

Finished dosage segment grew 31%YoY

to ~INR1.2b, driven by scale up in Rx business. PFI segment declined by 13%

YoY and API segment grew at a modest pace of 4.4% YoY to INR1.4b. The

company has been witnessing pricing pressure within the Paracetamol

molecule that has resulted in muted API sales. The company maintained its

consolidated top-line growth of ~15-16% YoY in FY17. Company expects to

launch 1

st

ANDA product from US Pharma acquisition (gLatuda) in 4Q FY18.

Over FY16-18E, we expect GRAN’s revenues to grow at 18% CAGR (adjusted for

JV sales), driven by strong growth in Finished dosages segment.

Margins remained robust on the back of favorable business mix:

EBITDA

margin at 20.1% (up 72bp YoY) was boosted by higher contribution from

finished dosages segment during this quarter (~36% of sales vs 29% in 1Q

FY16). Moreover, The company is also working on improving manufacturing

efficiency that resulted in better yield for some of the key products. We expect

EBITDA margins to expand by 240bp over FY16-18E led by improving business

mix and better operating leverage. Hence, EBITDA is likely to outpace revenue

growth at 21% CAGR over FY16-18E.

Earnings acceleration to drive valuation upside:

We expect GRAN to

report 34% PAT CAGR over FY16-18E, driven by improving traction in finished

dosages formulations. However, the story beyond FY18 is much rosier, as we

see more approvals in the US for the OTC and Rx business and ramp-up is

expected in Omnichem JV, which will drive both revenue and profitability. At

CMP stock trades at 20x FY17E and 14x FY18E EPS. We re-iterate

Buy

with

target price of INR160 (@16x FY18E EPS).

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Gaurav Tinani

(Gaurav.Tinani@motilaloswal.com); +91 22 6129 1552

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.