22 August 2016

1QFY17 Results Update | Sector: Real Estate

Oberoi Realty

Buy

BSE SENSEX

28,077

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,667

OBER IN

339.3

98.9 / 1.6

316 / 209

-2/13/15

66.0

27.5

CMP: INR298

TP: INR352(+18%)

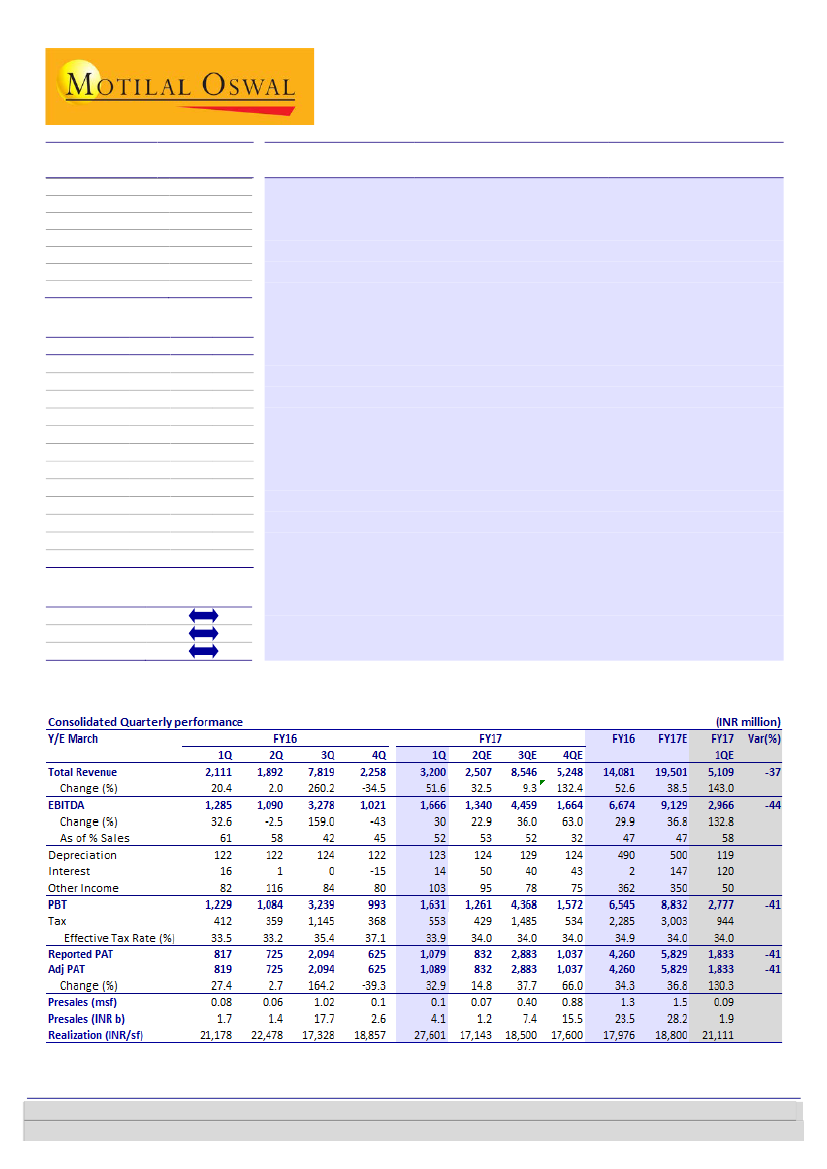

Operationally strong quarter, led by bookings in Three Sixty West

Strong P&L:

Revenue grew 52% YoY to INR3.2b, EBITDA grew 30% YoY to

INR1.7b, and PAT grew 30% YoY to INR1.1b. EBITDA margin shrank 9pp YoY but

expanded 6pp QoQ to 52%. The P&L strength is attributable to strong revenue

recognition from

Esquire

in 1QFY17. Rental income was down 1.3% QoQ/YoY to

INR0.7b, led by decline in rentals from

Westin.

Average monthly rental per

square foot from

Commerz II

Phase-I increased from INR117 in 4QFY16 to

INR122.

Three Sixty West boosts presales:

Presales were strong at 0.15msf (INR4.1b)

on bookings in

Three Sixty West

(58%), Borivli project (11%),

Exquisite

(10%),

Prisma

(9%), and

Esquire

(4%).

Collections down; gearing near zero:

Collections declined 26% YoY (and 36%

QoQ) to INR2.4b. Net debt went up by INR0.6b QoQ to INR2.7b (0.05x).

Financials & Valuations (INR b)

2016 2017E 2018E

Y/E Mar

Net Sales

14.1

19.5

33.9

EBITDA

6.7

9.1

20.1

Adj PAT

4.3

5.8

13.1

Adj EPS (INR)

13.0

17.8

39.9

EPS Growth (%)

34.3

36.8 124.7

BV/Share (INR) 156.3 170.0 203.9

RoE (%)

8.6

10.5

20.6

RoCE (%)

7.4

9.4

18.4

Payout (%)

18.6

20.4

12.1

P/E (x)

22.5

16.4

7.3

P/BV (x)

1.9

1.7

1.4

EV/EBITDA (x)

14.8

9.2

4.1

Preferred Mumbai play, Buy:

Despite a sluggish market, OBER’s new operating

cycle has been strong, with the success of

Three Sixty West

and its Borivli project.

This speaks volumes about the company’s brand equity, product attractiveness,

and cash flow strength. We maintain our positive bias on the stock. It trades at

16.8x FY17E EPS, 1.8x FY17E BV, and at an 18% discount to NAV of INR352.

Maintain

Buy;

OBER is our preferred Mumbai play.

Estimate change

TP change

Rating change

Aashumi Mehta

(Aashumi.Mehta@MotilalOswal.com); +91 22 6129 1537

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.