27 August 2016

1QFY17 Results Update | Sector: Automobiles

Tata Motors

Buy

BSE SENSEX

27,782

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

8,573

TTMT IN

3,395.9

1,710.3 / 25.5

522/266

1/47/41

4,037

67.0

CMP: INR504

TP: INR562 (+12%)

Below estimates; JLR Margins impacted by lower China incentive & MTM

Fx impact; Expect recovery from 2QFY17

Financials & Valuations (INR b)

Y/E Mar

2016 2017E

Net Sales

2,755.6 2,879.2

EBITDA

402.4

410.2

NP

125.2

134.5

Adj.EPS(INR)

36.9

39.6

EPS Gr. (%)

-15.5

7.5

BV/Sh. (INR)

237.9

276.5

RoE (%)

18.3

15.4

RoCE (%)

14.3

11.2

P/E (x)

13.7

12.7

P/BV (x)

2.1

1.8

Estimate change

TP change

Rating change

Consol

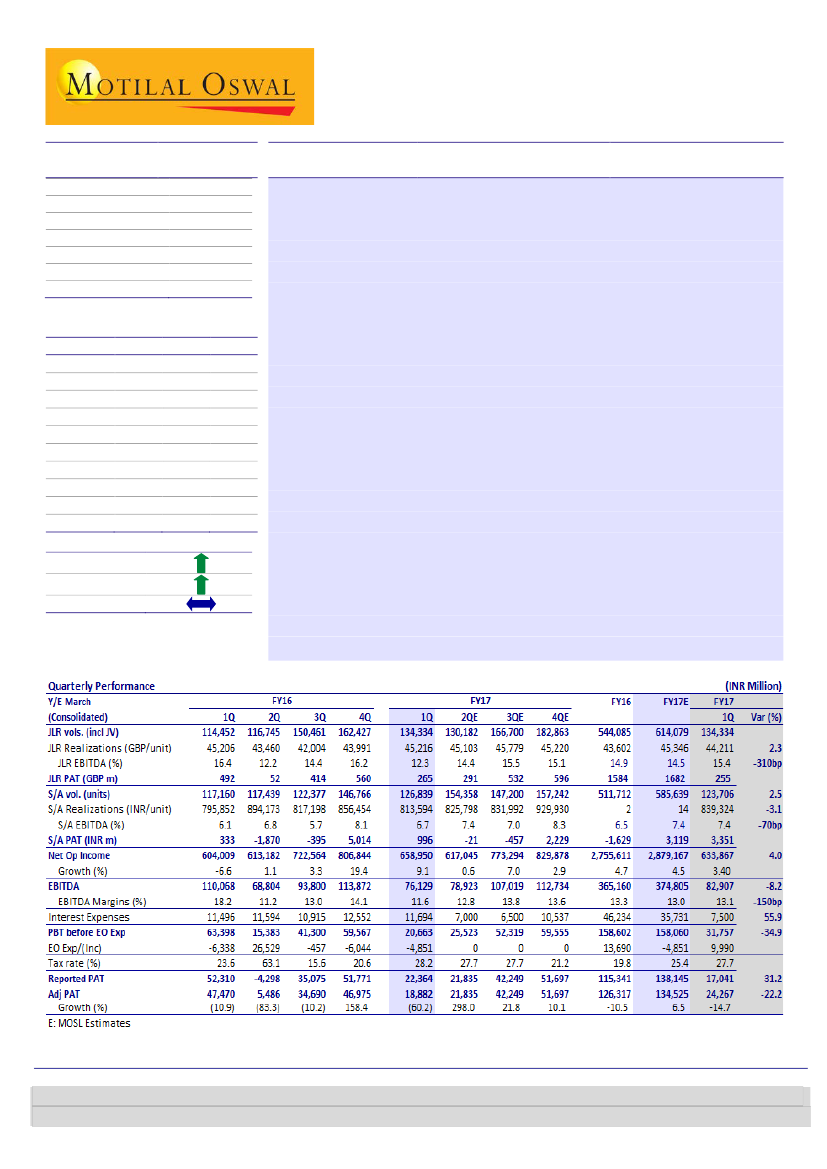

sales at INR659b (v/s est INR633b; +9% YoY). EBITDA at INR76.2b (v/s

est INR82.9b; +12% YoY). Adj. PAT at INR18.8b (v/s est INR24.3b; -60% YoY).

JLR

realization at GBP45k (v/s est GBP44k) grew 2.8% QoQ (flat YoY) driven by

favorable Fx. EBITDA margins at 12.3% (v/s est ~15.4%) were impacted due to

MTM impact on payables (~150bp impact), lower incentives in China (~100bp

impact) and partly due to launch expenses. However, adj PAT came in at

2018E

GBP265m (v/s est ~GBP255m) boosted by higher share of Cherry JV profits

3,242.4

and lower depreciation and Fx gains.

487.6

182.6

S/A

EBITDA margins (ex JV) were at 5.7% (v/s est 7.4%), decline of 240bp QoQ

53.8

(-40bp YoY) due to higher staff cost. Adj PAT was at INR996m (v/s est ~INR

35.7

3.35b) declined by 80% QoQ.

327.0

Earnings call highlights:

a) Other expenses had Fx loss on realized hedges of

17.8

GBP123m, there was commensurate benefit reflecting in sales. b)

China JV:

13.0

Margins are strong, but will moderate due to additional cost as full capacity

9.4

1.5

commissions. c) F-Pace has average waiting period of 3-4 months.

Valuation & view:

While we raise our EPS for FY17 by 8%, we cut FY18 by 5%. The

stock trades at 9.2x/7.3x FY17/18E consol EPS. We expect JLR’s operating

performance to start improving from 2QFY17, driven by continued volume

momentum and gradual benefit of weaker GBP. S/A business should benefit from

CV cycle recovery and favorable product lifecycle for PV business. Maintain

Buy.

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Venil Shah

(Venil.Shah@MotilalOswal.com); +91 22 3982 5445

/Aditya Vora

(Aditya.Vora@MotilalOswal.com); +91 22 3078 4701

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.