6 September 2016

1QFY17 Results Update | Sector: Oil & Gas

MRPL

Buy

BSE SENSEX

28,978

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

8,943

MRPL IN

1,752.6

146.9 / 2.2

93/49

2/26/46

72

11.4

CMP: INR84

TP: INR98 (+17%)

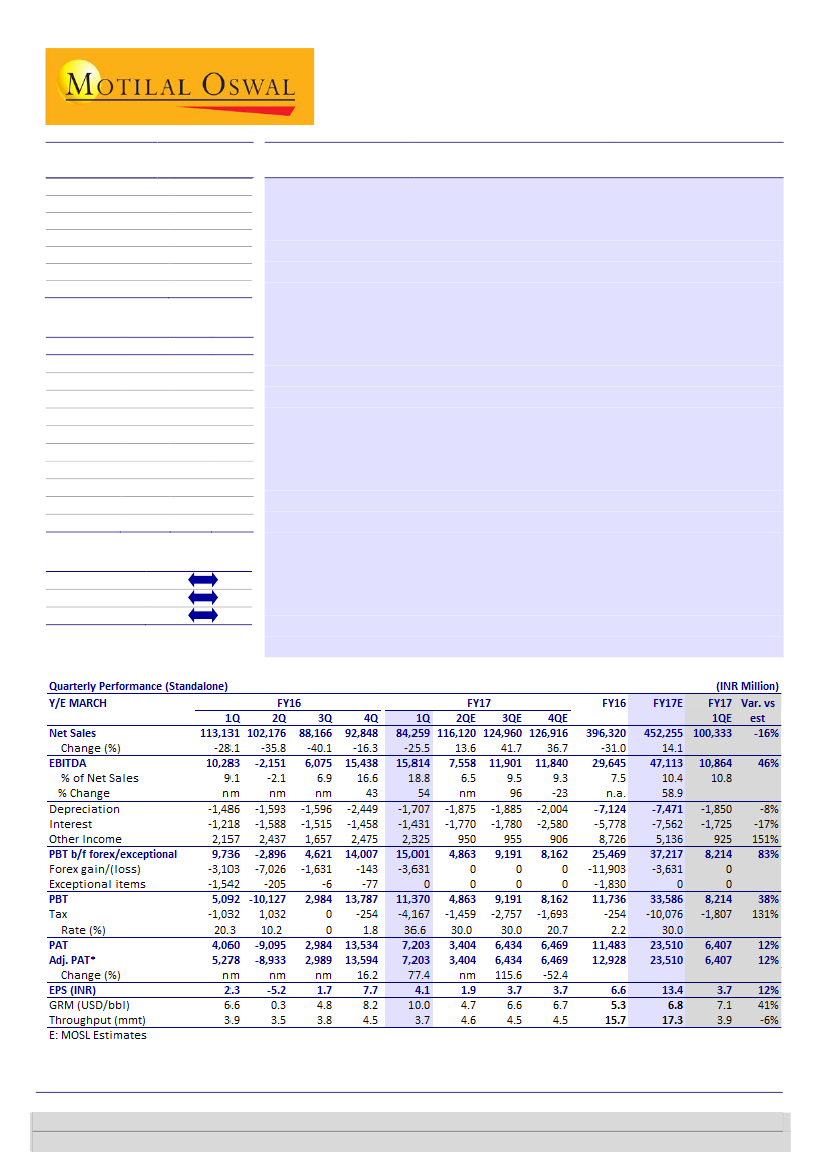

Above est. led by inventory gains; core GRM tracking benchmark

MRPL posted EBITDA of INR15.8b (+54% YoY), higher than our estimate of INR11b.

Reported GRM of USD10/bbl was higher than our estimate of USD7.1/bbl, boosted

by inventory gain of USD4.7/bbl. PAT grew 77% YoY (but declined 47% QoQ) to

INR7.2b (v/s our estimate of INR6.4b).

EBITDA above estimate:

EBITDA grew 54% YoY (and 2.4% QoQ) to INR15.8b,

led by reported GRM of USD10/bbl (v/s USD6.6/bbl in 1QFY16) and lower opex

at USD1.3/bbl (v/s our estimate of INR1.5/bbl).

Forex loss, higher tax rate lowers PAT:

Differential at PAT level was lower

despite higher income at INR2.3b (v/s our estimate of INR925m) due to forex

loss at INR3.6b and higher tax rate at 37%.

Operating GRM at USD10/bbl in 1QFY17:

Reported GRM grew 51% YoY to

USD10/bbl (v/s our estimate of USD7.1/bbl), boosted by inventory gain of

USD4.7/bbl. Core GRM was USD5.3/bbl (v/s regional benchmark Reuters

Singapore GRM of USD5/bbl).

Crude throughput declined 6% YoY (and 19% QoQ) to 3.66mmt, impacted by

shutdowns on account of water unavailability during the summer.

Valuation and view:

MRPL being a standalone refiner is highly sensitive to GRM.

For every USD1/bbl change in GRM, FY17/FY18E EPS changes ~25%. We expect Iran

crude payments to be made in the next few months. The stock trades at 6.1x FY18E

EPS, and at an EV of 4.5x FY18E EBITDA. We roll over our target price to FY18 and

value the stock at an EV of 5.5x FY18E EBITDA to arrive at a fair value of

INR98/share, implying 17% upside.

Buy.

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Sales

396.3 452.3 516.3

EBITDA

29.6

38.3

48.6

Adj. PAT

12.9

23.5

24.0

Adj. EPS (INR)

7.4

13.4

13.7

EPS Gr. (%)

-174.5

81.8

2.2

BV/Sh.(INR)

36.6

46.9

57.4

RoE (%)

19.6

32.1

26.3

RoCE (%)

23.1

19.9

15.5

P/E (x)

11.4

6.2

6.1

P/BV (x)

2.3

1.8

1.5

Estimate change

TP change

Rating change

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 6129 1529

Abhinil Dahiwale

(Abhinil.Dahiwale@motilaloswal.com); +91 22 3980 4309

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.