Detailed Report | Sector: Financials

12 Annual Global Investor Conference

BSE Sensex

28,797

S&P CNX

8,867

th

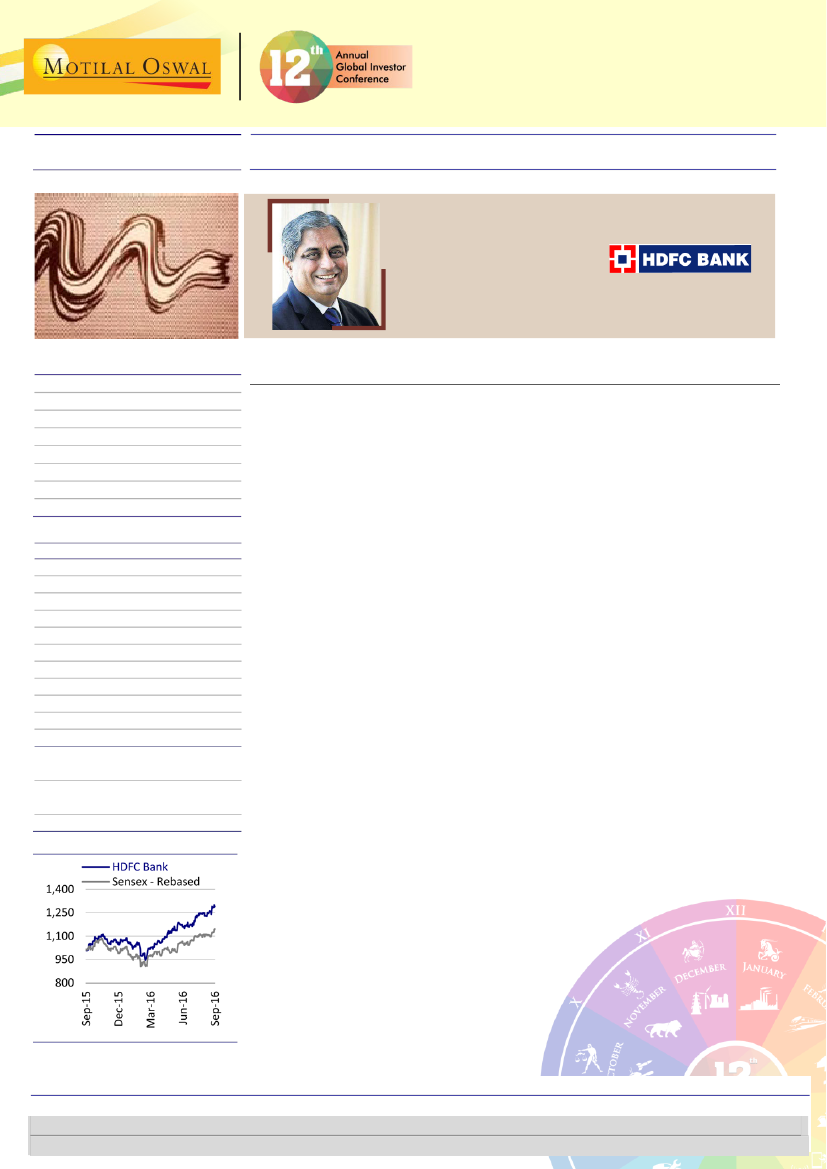

HDFC Bank

TP: INR1,450 (+12%)

Mr Aditya Puri

MD and CEO

HDFC Bank

CMP: INR1,291

Buy

CEO TRACK

Stock Info

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

M.Cap. (INR b)

M.Cap. (USD b)

12M Avg Val (INR M)

Free float (%)

HDFCB IN

2528.2

1,305/929

1/9/15

3,264

48.9

1,637

78.6

2019E

484.4

375.0

213.8

4.6

84.6

20.4

450.9

438.7

20.2

1.9

23.4

15.3

2.9

2.9

1.3

It’s all about being digital

Key takeaways from CEO Track

Financial Snapshot (INR Billion)

2017E 2018E

Y/E Mar

NII

335.5 399.2

OP

256.8 306.3

NP

147.8 177.6

NIM (%)

4.8

4.7

EPS (INR)

58.4

70.2

EPS Gr. (%)

20.2

20.2

BV/Sh. (INR) 332.2 386.1

ABV/Sh. (INR) 326.5 379.0

RoE (%)

18.9

19.6

RoA (%)

1.9

1.9

Payout (%)

23.4

23.4

Valuations

P/E(X)

22.1

18.4

P/BV (X)

3.9

3.3

P/ABV (X)

4.0

3.4

Div. Yield (%)

0.9

1.1

Relative to Index

Significant investment in digital initiatives has begun paying off: (a) ~20% of

incremental unsecured personal loans sourced through 10-second personal loan

product, (b) 8-10% of auto loans sourced through digital channel, (c) volumes on

SmartBuy, HDFCB’s online market place almost 1/10th of Amazon’s volumes.

HDFCB’s digital journey will continue through collaborations/partnerships. It is

committed to platform-agnostic services. Lot of technology initiatives are in store –

expect rollout by March 2017 (robots in branches, artificial intelligence).

Significant investments in branches and technology would provide operating leverage

and efficiency in ensuing quarters. Expect cost-to-income ratio to decline, led by

higher business volumes.

HDFCB remains a picture-perfect story, with (a) continued market share gain (12.5%

incremental share (9.2% for FY15)), (b) adequate capitalization (CET1 of 13.3%, best in

class), (c) CASA ratio of 40%+, (d) best in class profitability, with 1.9% RoA and 18.3%

RoE. Subsidiaries have become sizeable – based on multiple of 15x for securities

business and 3x BV for NBFC business, per share value for HDFCB works out to INR58

(post HoldCo).

Digital journey – customer focus and ease of business key effort areas

HDFCB’s digital strategy is centered around (a) increasing efficiency, (b) accelerating

geographic expansion, (c) raising customer convenience and ease, and (d)

competing against disruptive technology. It is already seeing strong success in 10-

second personal loans (20% of incremental sourcing through this channel), pre-

approved auto loans (8-10% of disbursements), and SmartBuy (10% of Amazon’s

volumes). It plans to use artificial intelligence for routine work and most initiatives

are likely to be launched by December 2016. With these initiatives gaining traction

and incremental business coming from these channels, the management is

confident of reducing the cost-to-income ratio.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com)

Krishnan ASV

(A.Krishnan@MotilalOswal.com);+91 22 6129 1571 /

Rahul Gupta

(rahul.pgupta@MotilalOswal.com); +91 22 6129

1544

September 2016

advised to refer through important disclosures made at the last page of the Research Report.

1

Investors are

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.