13 October 2016

Q2FY17 Results Update | Sector: Financials

IndusInd Bank

Buy

BSE SENSEX

28,082

Bloomberg

Equity Shares (m)

M.Cap.(INRb) / (USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,709

IIB IN

595.8

726/10.8

1,255 / 799

3/14/26

1,360

85.1

CMP: INR1,222

TP: INR1,400(+15%)

Financials & Valuations (INR b)

2016 2017E 2018E

Y/E Mar

NII

45.2

60.3

74.6

OP

41.4

53.6

65.7

NP

22.9

28.8

36.3

NIM (%)

4.0

4.3

4.3

EPS (INR)

38.4

48.4

60.9

EPS Gr. (%)

13.4

25.8

26.0

BV/Sh. (INR)

291

333

385

ABV/Sh. (INR)

288

330

383

RoE (%)

16.6

15.5

17.0

RoA (%)

1.8

1.8

1.9

Payout (%)

18.5

14.0

14.0

Valuations

P/E (X)

31.8

25.3

20.0

P/BV (X)

4.2

3.7

3.2

P/ABV (X)

4.2

3.7

3.2

Div. Yield (%)

0.4

0.5

0.6

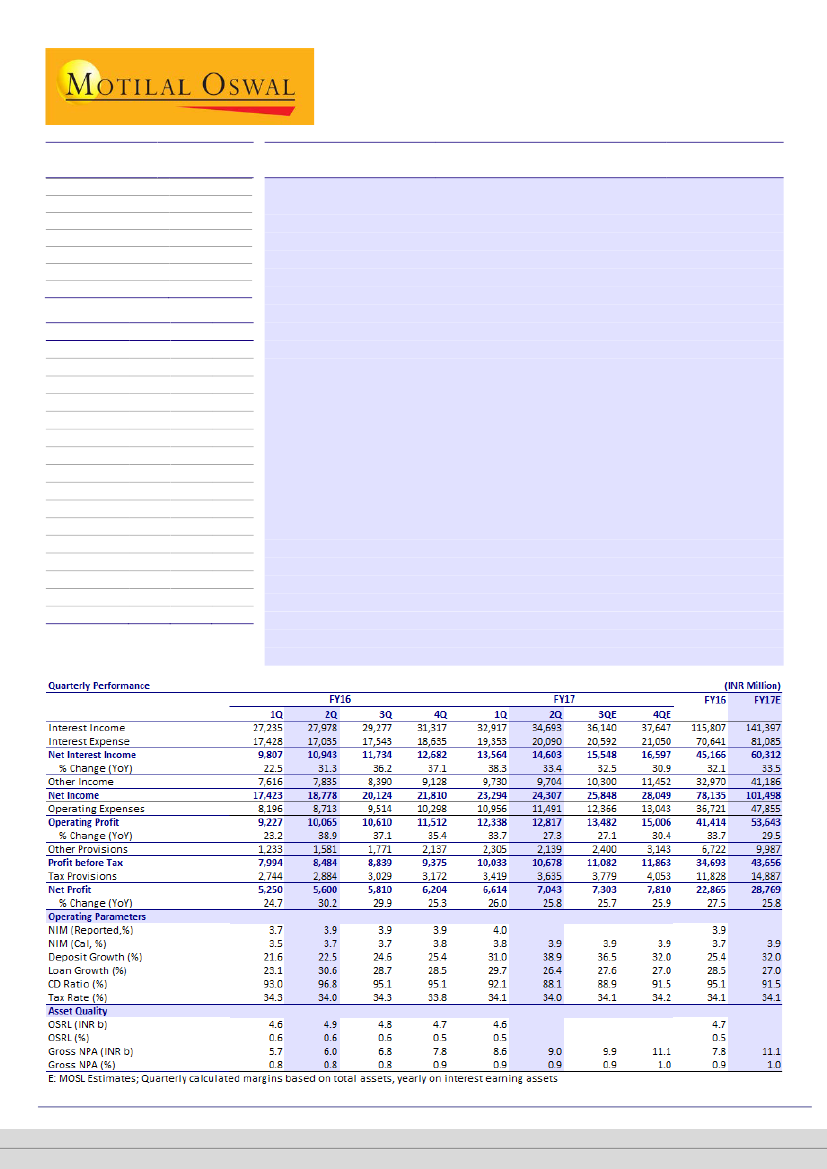

In-line: Strong core operating performance, stable asset quality

IndusInd Bank’s (IIB) 1QFY17 PAT grew 26% YoY (in line with expectations) to

INR7b, led by strong core PPoP growth of 27% YoY and 9% QoQ. Asset quality

remained stable QoQ, with GNPA at 90bp and stable PCR of 59%.

NII growth (33% YoY, 8% QoQ) was driven by 27% YoY loan growth and uptick

in NIM to 4% (v/s 3.97% in 1QFY17 and 3.88% in 2QFY16). Core fee income

growth, which came in marginally below loan growth at 23% YoY, was broad-

based, with all segments barring FX income contributing to growth. Investment

banking fees remained strong at 15% of PBT.

Corporate/consumer loans exhibited robust 26/27% YoY growth, resulting in a

60:40 loan mix at the end of the quarter. However, adjusting for the gems and

jewelry and the microfinance portfolio, which are included in corporate loans,

the mix would be close to 50:50.

Deposit growth witnessed a sequential uptick to 39% from 31% in 1QFY17. This

was driven by strong CASA deposit growth. There were one-off items that

contributed to strong CA growth. As at the end of the quarter, CASA ratio stood

at 36.5% compared to 34.4% in 1QFY17.

Other highlights:

(a) Restructured loans declined to 0.44% of loan book, as one

account slipped into NPA, and (b) CET1 was strong at 14.68% (-13bp QoQ).

Maintaining estimates; FY16-19E EPS CAGR of 26%:

In the planning cycle-3, which

concludes in FY17, IIB’s key focus is to scale up its operations using a 3D strategy:

Dominate (to be among the top three banks in home markets), Differentiate

(extensive use of technology and cross-sell), and Diversify (new products). Strong

core profitability (3% of average assets v/s private banks’ average of 2.5% and

HDFCB’s 2.7%), improving CASA ratio (best among mid-sized private banks), and

healthy return ratios (1.9%+ RoA and 16-18% RoE) are key positives.

Buy;

our

target price is INR1,400 (3.4x September 2018E BV).

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.