24 October 2016

2QFY17 Results Update | Sector:

Consumer

BSE SENSEX

28,179

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INR m)

Free float (%)

S&P CNX

8,709

VGRD IN

300.9

58.4/0.9

199/79

6/89/109

62

34.5

CMP: INR194

TP: INR215 (+11%)

V-Guard Industries

Neutral

All-round performance, but valuations rich

Financials & Valuation (INR b)

Y/E MAR

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh (INR)

RoE (%)

RoCE (%)

Payout %

Valuations

P/E (x)

P/BV (x)

EV/EBITDA(x)

Div. yield (%)

EV/Sales (x)

Estimate change

TP change

Rating change

52.3

12.4

32.8

0.4

3.1

34.5

9.6

23.5

0.5

2.7

27.1

7.5

18.2

0.6

2.3

2016 2017E 2018E

18.6

1.8

1.1

3.7

57.4

15.6

26.3

25.4

21.9

21.4

2.4

1.7

5.6

51.5

20.1

31.5

31.4

20.6

24.8

3.1

2.2

7.2

27.4

25.9

31.2

31.2

19.4

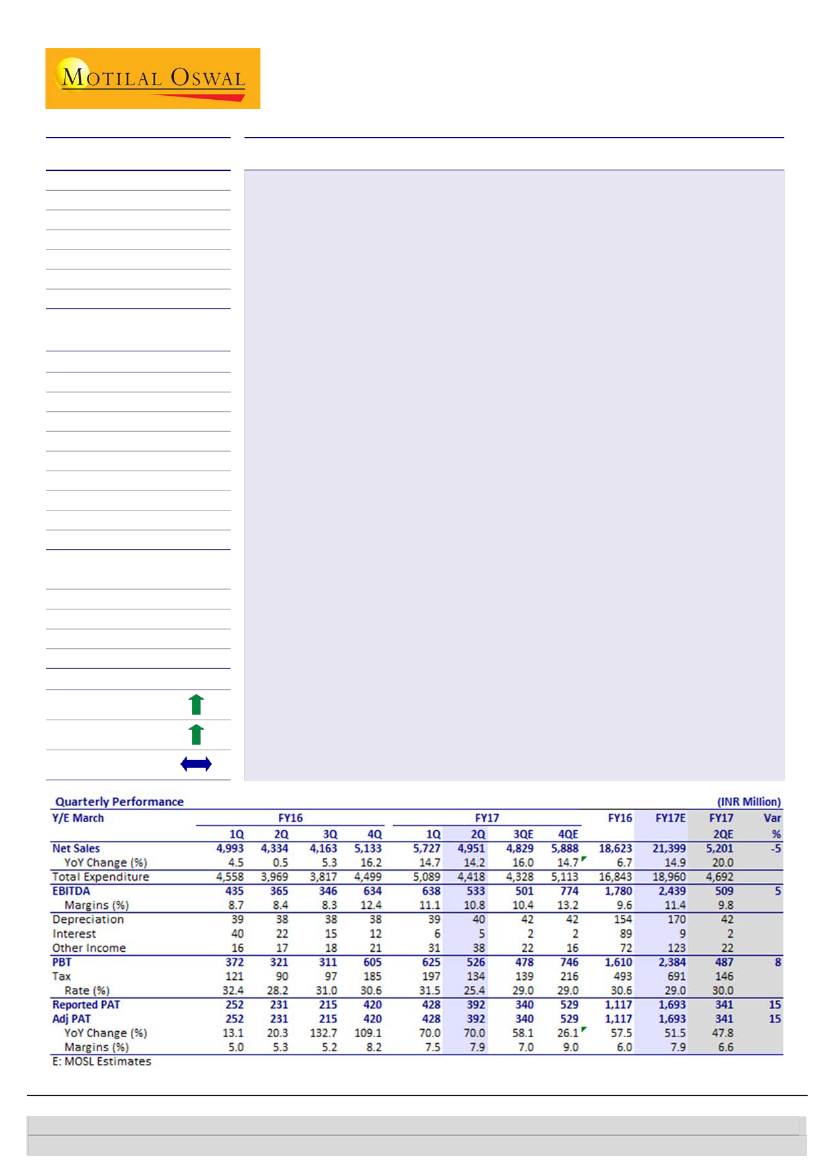

Broad-based revenue growth across segments:

V-Guard Industries’ (VGRD)

revenue increased 14.2% to INR4.95b (our estimate: INR5.2b) in 2QFY17 from

INR4.33b in the year-ago period, led by strong growth in Stabilizers (+15%), UPS

(+13%), Pumps (+20%), Water Heaters (+25%), Fans (+18%) and new product

categories (Kitchen Appliances and Switchgears +40%). However, Cables and Wires

– the largest segment – grew marginally by 3% YoY due to lower realizations

(+3%). Non-south markets grew 16% YoY, while south markets rose 13.4%. Onam

season offered some support with festive demand-related categories doing well.

Healthy margin expansion:

Gross margin improved 400bp YoY to 32.7%. EBITDA

grew 46% YoY to INR533m (our estimate: INR509m) in 2QFY17, with margins

expanding 240bp YoY to 10.8% (our estimate: 9.8%). Management highlighted that

improvement in gross margin was led by lower input costs (~200bp) and supply

chain initiatives (~200bp) undertaken last year. Management believes that

margins have scope to improve, but will largely be maintained at around 11% due

to reinvestments in A&P and people. Non-south region profitability further

improved, and management intends to further increase its thrust on advertising

and brand building in this market to boost its share.

Outlook encouraging:

Led by improved consumer sentiment in the Onam season,

management believes the upcoming festive season will drive healthy revenue

growth (guided for +15% in FY17). Also, it believes gross margin expansion is

sustainable due to benefits of supply chain initiatives undertaken last year.

Management expects ramp-up in advertisement spends in 2HFY17 and guided for

EBITDA margin of 11% in FY17.

Valuation and view:

Management highlighted favorable 2HFY17 outlook on the

back of 7th Pay Commission payout, increased rural spending due to better

monsoon, softer inflation, RBI rate cut and stable GDP growth. We increase our

EBITDA estimates by 10%/20% for FY17/FY18, given higher gross margins and

operating leverage benefits; expect revenue CAGR of 15% and PAT CAGR of 39%

over FY16-18. Due to rich valuations, we maintain our

Neutral

rating with a target

price of INR215 (30x FY18E EPS).

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +912239825422/Chitvan

Oza

(Chitvan.Oza@MotilalOswal.com); +912230102415

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.