Zee Entertainment

BSE SENSEX

28,091

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,691

Z IN

960.5

494.8 / 7.3

589 / 350

0/19/17

927.3

56.93

25 October 2016

2QFY17 Results Update | Sector: Media

CMP: INR475

TP: INR610 (+28%)

Buy

Financials & Valuations (INR b)

Y/E MARCH

2016 2017E 2018E

Net Sales

58.3

68.0

76.7

EBITDA

15.0

19.5

25.5

NP

10.2

14.2

18.8

EPS (INR)

10.6

14.8

19.5

EPS Gr. (%)

3.9

39.6

32.2

EPS ex-&TV, INR 11.8

15.5

19.3

RoE (%)

27.3

31.1

32.9

RoCE (%)

17.8

21.9

25.2

Div. Payout (%) 21.3

15.2

12.8

Valuations

P/E (x)

48.7

34.9

26.4

P/E ex-&TV (x)

43.5

33.2

26.7

EV/EBITDA (x)

33.2

24.1

18.0

Div. Yield (%)

0.4

0.4

0.5

Estimate change

TP change

Rating change

Strong operational performance continues; EBITDA exceeds estimates

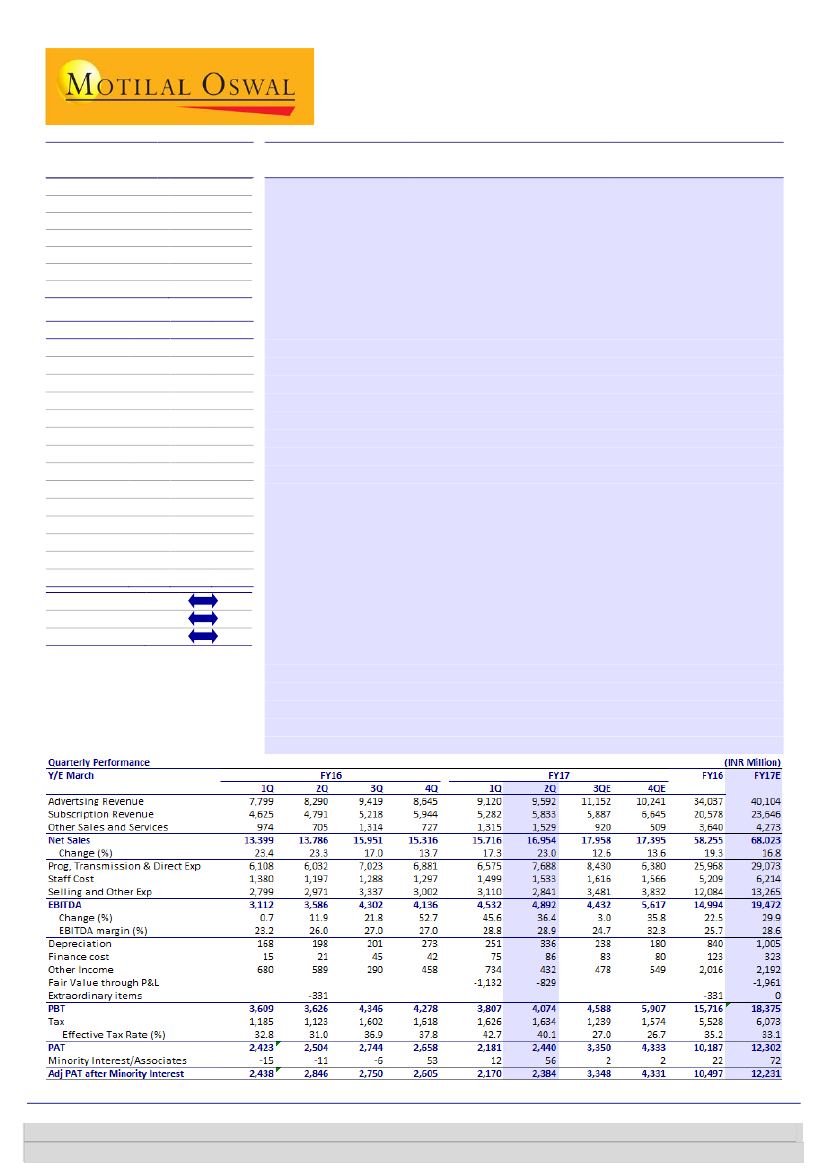

2QFY17 operational performance above expectations:

Zee Entertainment’s

(ZEE) 2QFY17 EBITDA grew 36% YoY to INR4.89b (6% above est.), led by higher-

than-expected subscription and other sales & services revenues; sports losses

too were contained. Reported PAT declined 16% YoY to INR2.38b (est. of

INR3.32b), primarily led by losses booked in P&L on account of fair value

accounting of ZEE’s preference shares and lower-than-expected other income.

Adj. PAT grew 13% YoY to INR3.21b (3% below est.).

Strong ad growth, albeit lower-than-expected; subscription surprises

positively:

Revenue grew 23% YoY to INR16.95b (2.6% above our estimate of

INR16.52b). Ad growth remained strong at 16% (INR9.59b), albeit 2% lower than

our estimate of INR9.78b. Subscription revenue surprised positively with 22%

YoY increase to INR5.83b (7.5% above est.), more than offsetting ad miss.

Domestic subscription grew 25% YoY to INR4.67b (8% higher than our estimate

of INR4.32b), which was largely a function of early closure of content deals this

fiscal v/s previous years, further aided by catch-up revenues for 1Q. International

subscription grew 11% YoY to INR1.16b.

Movie biz and sports syndication revenues offer further boost:

Other sales &

services (includes movie biz and sports syndication) revenues more than doubled

YoY to INR1.53b (est. of INR1.31b), largely led by strong box-office performance

of ZEE co-produced movie

Rustom

and cricket-related syndication revenues.

Sports losses contained; ex-sports EBITDA up 300bp QoQ:

Sports losses stood at

INR168m (v/s est. EBITDA losses of INR199m). We cut our sports loss estimates

for FY17 to ~INR120m (v/s INR180m earlier), given that 3Q is not cricket-heavy.

Non-sports revenue grew 19% YoY to INR14.83b (v/s est. of INR14.4b), while

margins expanded 300bp QoQ/563bp YoY to 34.1% (est. of 33.5%)

Valuation and view:

Ad growth is expected to remain healthy, despite the

expected moderation in FMCG as viewership share gains in regional portfolio and

new channels could aid in cushioning the impact. Telecom ad spend too is expected

to pick up in 2H. We largely maintain our FY17/FY18 earnings estimates. We

maintain

Buy

with a TP of INR610 based on 31.6x FY18E EPS (ex-&TV) plus

INR18/sh toward &TV DCF value less INR18/sh toward pref. share liability.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Jay Gandhi

(Jay.Gandhi@MotilalOswal.com); +91 22 6129 1546

Aliasgar Shakir

(Aliasgar.Shakir@MotilalOswal.com); +91 22 30102415