Market Overview

Turmeric traded lower on expectation of higher

production at the growing regions. Though,

anticipation of good domestic as well as upcountry

demand ahead of festival season capped some losses.

Crude palm oil prices fell as speculators booked profits

at prevailing higher levels amid fall in demand in spot

market. Ample stocks following higher supplies from

producing belts too weighed on crude palm oil futures.

Mentha oil prices were in futures market as

participants widened their holdings on the back of

rising demand from consuming industries at the spot

market. Tight stocks position following restricted

arrivals from major producing belts of Chandausi in

Uttar Pradesh also extended support to mentha oil

prices uptrend. Fresh positions built up by speculators,

driven by rising demand from consuming industries in

the spot markets against restricted supplies from

Chandausi led to the rise in prices.

Jeera futures edged lower on expectation of good

sowing for jeera in Gujarat and Rajasthan as the sowing

season commenced next month. Though, some losses

were capped due to strong domestic as well as export

demand at the spot market.

Malaysian palm oil futures reversed gains from the

more than two-year high reached the previous day, as

the market reacted to revised industry data and a

strengthening ringgit.

U.S. wheat were narrowly higher as traders covered

short positions after prices for each crop fell to the

lowest levels in more than a week. Soybeans eased for

a second session as supplies from a freshly-harvested

record U.S. crop hit the market, although losses were

limited by strong Chinese demand.

Commodity

Turmeric

Jeera

Soybean

Soy Oil

R M Seed

CPO

Sugar

Wheat

Mentha Oil

Cotton

Exchange

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

MCX

NCDEX

NCDEX

MCX

MCX

Expiry

Nov

Nov

Nov

Nov

Nov

Oct

Dec

Nov

Oct

Oct

Price

7198.0

17315.0

3102.0

671.1

4517.0

535.5

3485.0

1900.0

893.3

19040.0

%

Change

-0.4%

-0.5%

-0.6%

-0.3%

-0.5%

-0.7%

0.2%

1.6%

0.2%

0.4%

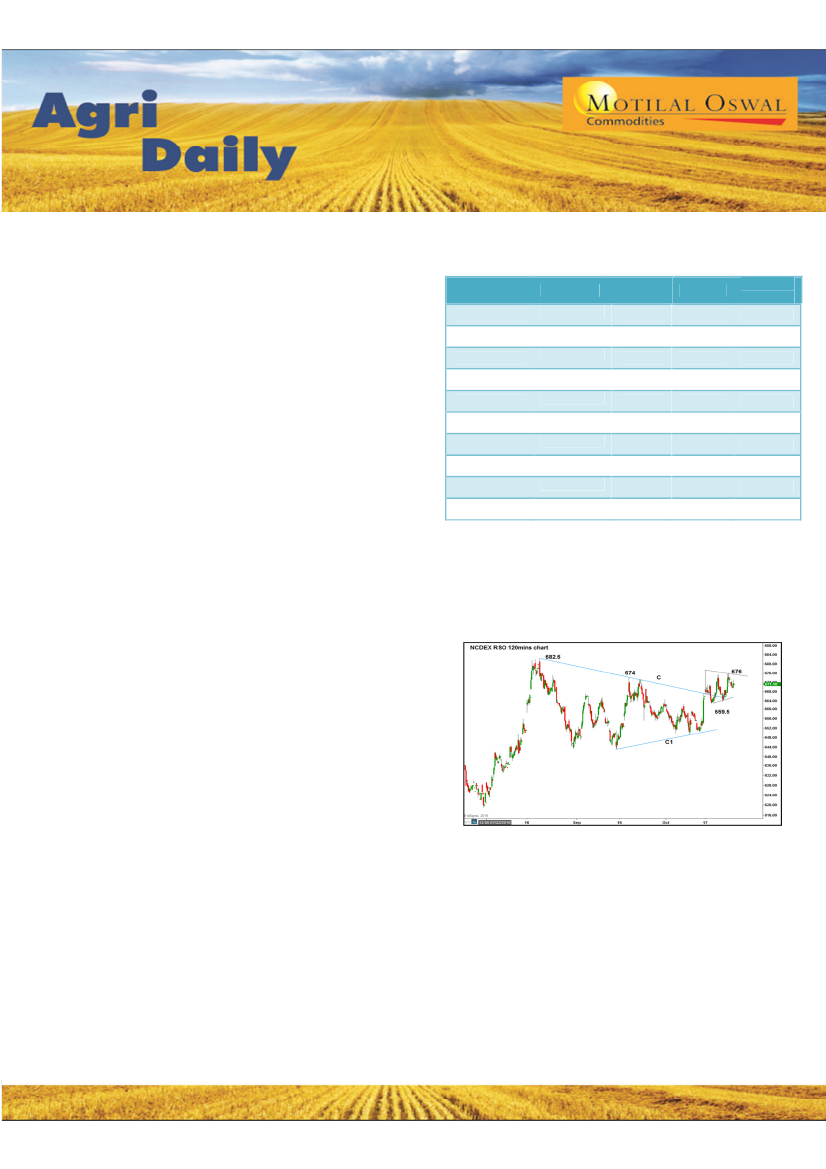

Chart of the Day: NCDEX RSO

As shown, NCDEX RSO has recently breached consolidation

range marked by C –C1 and is sustaining well above the

same indicating bullish move ahead. As long as immediate

support near Rs.664-659.50 zone is held, dip buying is

advised targeting Rs.682 on the higher side.

1

Please refer to disclaimer at the end of the report.