26 October 2016

2QFY17

Results Update | Sector: Consumer

ITC

Buy

BSE SENSEX

27,836

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,615

ITC IN

12070.8

2883.7 / 44.1

266 / 178

-3/2/-1

2634

100.0

CMP: INR239

TP: INR285 (+19%)

Cig volumes surprise on the upside

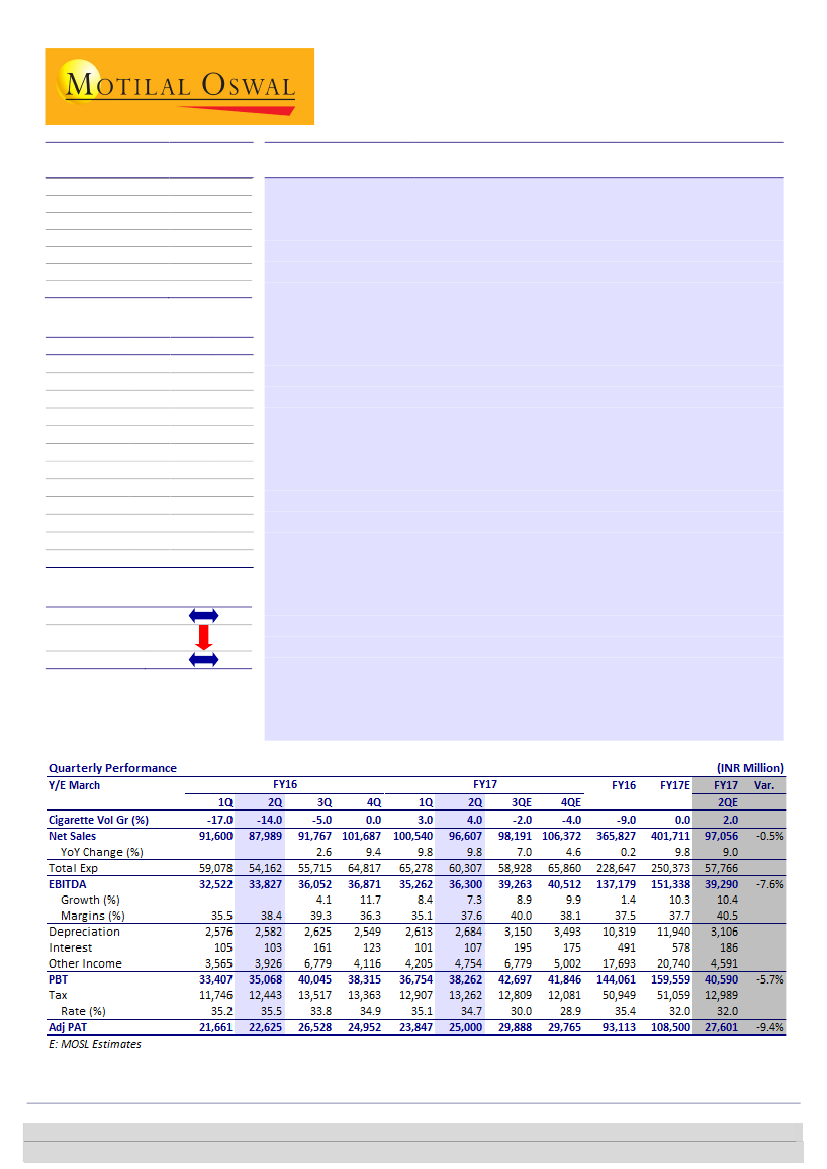

2QFY17 revenues better than estimate:

Net revenues (Ind-AS) increased 9.8%

YoY (est. of +9% YoY) to INR96.6b. EBITDA and PAT were below estimates due

to lower-than-expected EBITDA margin (-80bp YoY v/s est. of +50bp) and PAT

before other comprehensive income (+10.5% YoY to INR25b v/s est. of

+13.5%). Absolute sales, EBITDA and PAT numbers differ from our estimates

due to Ind-AS adjustments in the base quarter.

We reckon cig volumes were up 4% YoY

(best numbers since 4QFY13 and

better than our expectation of +2%), aided by higher growth in the sub-65mm

segment (now well over 20% share in overall volumes, in our view), benign

base (2QFY16: 14% volume decline) and lower price increases of late. Cig

revenues and EBIT grew 7.1% and 8.4% YoY, respectively (like-to-like), with

40bp expansion of cig EBIT margin (despite mix impact YoY). While

performance on cig volumes has been creditable, base is less favorable going

forward (3QFY16 and 4QFY16 base of -5% and 0%, respectively).

Non-cig FMCG business posted robust 13.3% YoY sales growth,

which is highly

creditable in a weak operating environment. The segment reported EBIT loss of

INR33m, worse than our expectations of marginal profit, but better than

INR45m EBIT loss in 1QFY17. Agri business revenue increased only 2% as

currency depreciation in Brazil, Russia and Australia has made their agri

products more competitive. Margins were flat YoY.

Maintain Buy:

Near-term challenges remain due to weaker cig volume base

going forward and potential cess on cigarettes (to be decided by GST Council in

November). However, cig volume growth in FY17 is likely to be better than

preceding years, and other FMCG is showing resilience in a weak market. At

22.7x FY18E, ITC trades at significant discount to peers. Maintain

Buy

with

target multiple of 25x September 2018E EPS (target price of INR285).

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

Net Sales

362.2 397.7

EBITDA

137.2 151.3

NP

93.1 108.5

EPS (INR)

7.7

9.0

EPS Gr. (%)

-3.5

16.5

BV/Sh. (INR)

27.3

31.8

RoE (%)

29.3

30.4

RoCE (%)

27.8

29.2

P/E (x)

31.0

26.6

P/BV (x)

8.8

7.5

EV/EBITDA (x)

19.6

17.6

Div. Yield

2.9

2.4

2018E

448.5

176.7

126.8

10.5

16.9

36.6

30.7

30.0

22.7

6.5

14.9

2.8

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +91 22 6129 1545

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 22 6129 1547