TVS Motor Company

BSE SENSEX

27,916

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INR m

Free float (%)

S&P CNX

8,615

TVSL IN

475.1

195.5 / 2.9

341/201

-8/-14/16

548

42.6

27 October 2016

2QFY17 Results Update | Sector: Automobiles

CMP: INR411

TP: INR492 (+20%)

Buy

In-line; Margin improvement continues; Strong EPS growth to continue

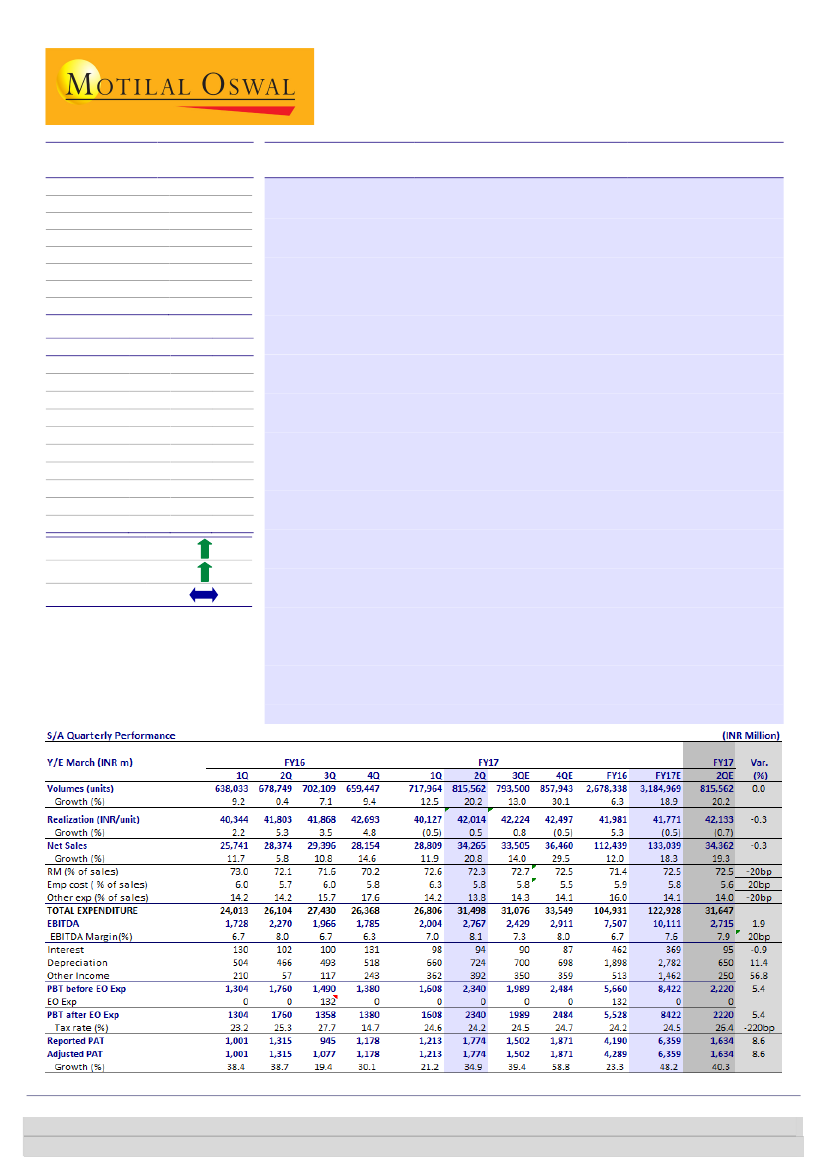

Strong volume growth drives sales…:

Total volumes grew 20% YoY (+14% QoQ)

to 816k units, driven by ~30% YoY growth (+17% QoQ) in motorcycles and

moped segment growth of ~35% YoY (+5% QoQ). This is despite muted growth

in scooters at ~6% YoY (+17% QoQ) and decline in exports of ~12% YoY.

Realizations grew 4.7% QoQ to ~INR42k driven by better mix. Net sales grew

21% YoY (+19% QoQ) to INR34.3b.

EBITDA margins continue to rise as operating leverage benefits kick-in:

EBITDA margin expanded by 110bp QoQ (+10bp YoY) to 8.1% (v/s est 7.9%),

driven by operating leverage benefits despite decline in higher margins export

business. Higher than expected other income boosted PAT to INR1.8b (v/s est

INR1.6b), a growth of ~35% YoY (+46% QoQ).

Earnings call highlights:

a) Management re-iterated its two year target of

market share (of 18%) and EBITDA margins (double digit), b) It is taking

initiatives to recovery back lost scooter market share, c) Product from BMW

alliance to be launched during early 2017, and d) Invested ~INR500m in equity

of captive finance company TVS Credit Services (as against earlier investment

routed through preference shares of SPV).

Valuation and view:

We have upgraded our estimates for FY17/18 by 6%/3%

respectively to factor in for stronger than estimated moped volumes and

better margins. We expect strong earnings momentum for TVSL over next 2-3

years led by a) ramp-up of Victor volumes and recovery in scooter market

share, b) benefit of monsoons and 7

th

Pay commission to aid sustained volume

growth in H2FY17, c) launch of BMW Alliance product in early 2017, d) recovery

in export markets as crude oil prices recover and e) resultant margin

improvement. The stock trades at 22.2x/17.5x FY18E/19E EPS. Maintain

Buy

with a target price of INR492 (~18x FY19E EPS + ~INR68/share for BMW

alliance).

Financials & Valuations (INR b)

Y/E Mar

2017E 2018E 2019E

Net Sales

133.0 158.5 185.8

EBITDA

10.1

13.4

16.6

PAT

6.4

8.8

11.2

EPS (INR)

13.4

18.5

23.6

Gr. (%)

47.1

38.6

27.1

BV/Sh (INR)

50.8

65.8

84.5

RoE (%)

29.2

31.8

31.4

RoCE (%)

30.2

34.8

35.9

P/E (x)

30.7

22.2

17.5

P/BV (x)

8.1

6.3

4.9

Estimate change

TP change

Rating change

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Venil Shah

(Venil.Shah@MotilalOswal.com); +91 22 3982 5445

/Aditya Vora

(Aditya.Vora@MotilalOswal.com); +91 22 3078 4701

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.