28 October 2016

Q3CY16 Results Update | Sector: Consumer

Nestle India

Neutral

BSE SENSEX

27,942

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,638

NEST IN

96.4

671.1 / 10.0

7390/4990

8/12/7

270

37.2

CMP: INR6,961 TP: INR7,410 (+6%)

Sales better than anticipated; expect gradual recovery ahead

Financials & Valuations (INR b)

Y/E Dec

2015 2016E 2017E

Net Sales

81.2

92.6 110.0

EBITDA

15.9

18.8

23.4

PAT

11.6

11.8

14.8

EPS (INR)

119.9 122.3 153.9

Gr. (%)

-7.3

2.0

25.8

BV/Sh (INR)

292.3 340.0 406.7

RoE (%)

40.9

38.7

41.2

RoCE (%)

40.7

38.7

41.2

P/E (x)

58.1

56.9

45.2

P/BV (x)

23.8

20.5

17.1

Estimate change

TP change

Rating change

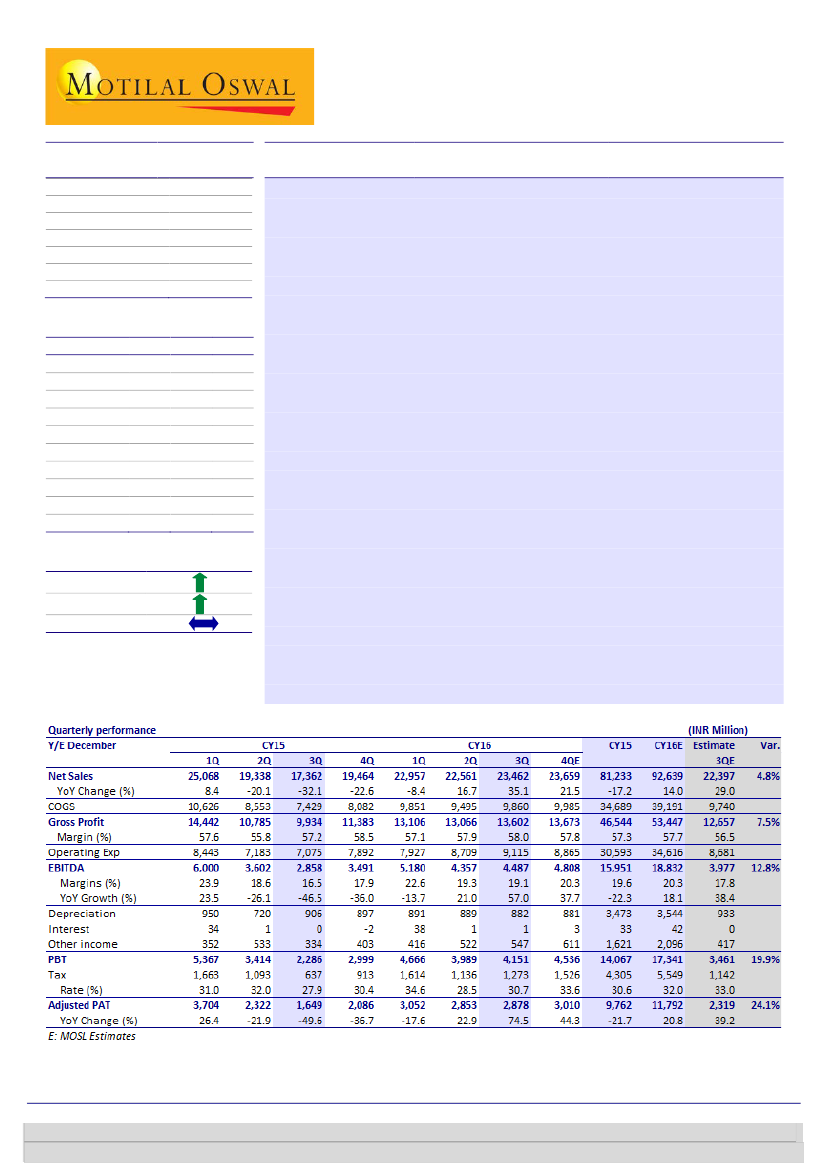

Nestle India’s (NEST) 3QCY16 operating performance better than

expectations:

Net sales were up 35.1% YoY (+4% QoQ) to INR23.5b (est. of

INR22.4b), primarily as the base quarter had sales write-backs and no Maggi

sales. The 25 new products and variants launched over past few months will

gradually help the company to gain some traction. Adj. PAT before

contingencies grew 74.5% YoY to INR2.88b (est. of INR2.32b) over a very weak

base quarter. Sequential EBITDA/PAT growth was 3%/1%.

EBITDA margin expanded 260bp YoY

(est. of +120bp), led by 80bp YoY

improvement in gross margin and 190bp savings on staff costs. EBITDA rose

57% YoY to INR4.49b (est. of INR4b).

9MCY16 results:

9MCY16 sales, EBITDA and PAT growth was muted at 11.7%,

12.6% and 14.4% YoY, respectively, despite absence of Maggi sales for nearly

half of the corresponding period last year, sales write-offs, and logistics and

incineration-related costs on Maggi in the base period.

Valuation and view:

We are encouraged by the much-needed strategic

changes made by the new CEO over the past year. The 25 new launches

(variants of existing products, some premium products and some interesting

new categories) too offer comfort. However, it is still early to gauge the

response to these new products. Based on sequential sales growth and data

presented in the analyst meet two months ago, there is no sign that the

absence of volume growth across categories for the past few years is

undergoing a change for the better. There is also no discernable hint of any

significant change in the overt premiumization strategy that had held back

volume growth for many years. While we raise our EPS forecast by ~8% on

good results, valuations are fair at 39.4x September 2018 EPS. Maintain

Neutral

with a target price of 7,410 (42x September 2018 EPS).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +91 22 3982 5428

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 22 3980 4261