28 October 2016

2QFY17 Results Update | Sector: Automobiles

Eicher Motors

Buy

BSE SENSEX

27,941

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,638

EIM IN

27.2

652.6 / 9.7

26602/14818

-1/11/35

1158.2

49.4

CMP: INR24,026

TP: INR33,436 (+39.2%)

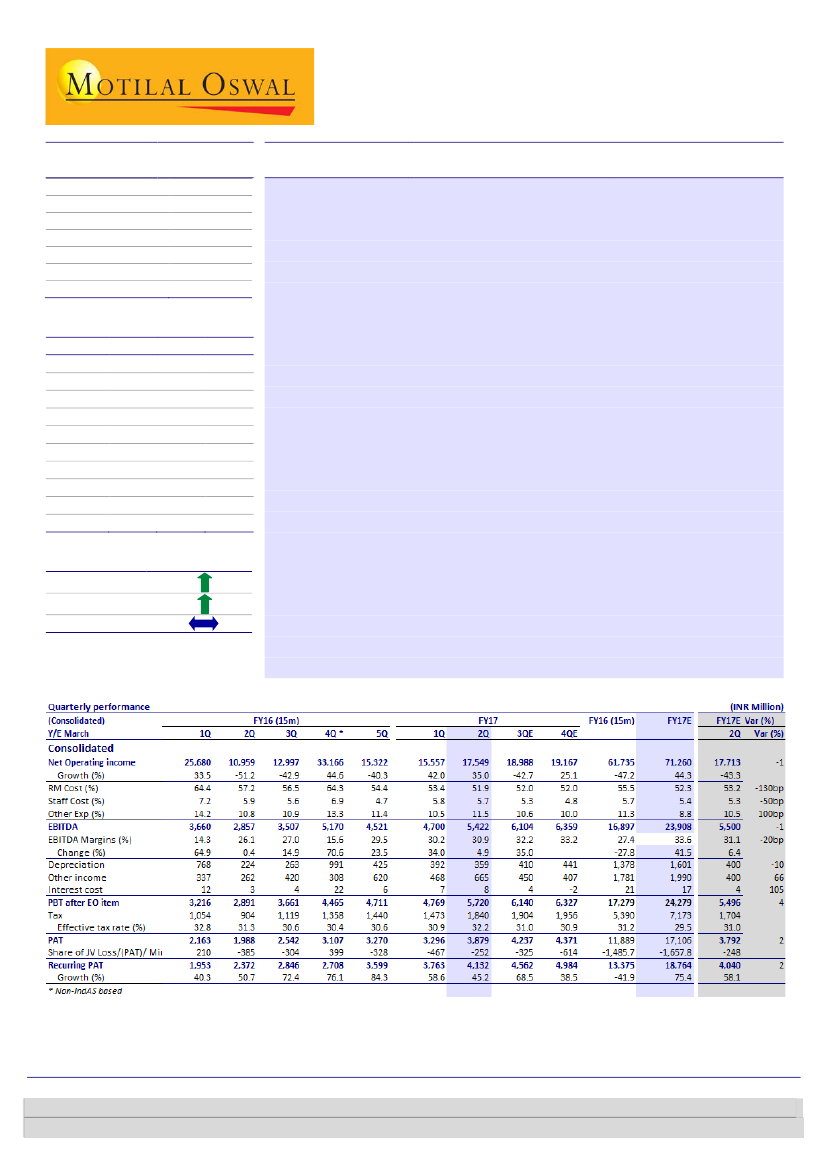

RE scales new highs, but VECV disappoints

Royal Enfield (RE) records best-ever EBITDA margin:

RE volumes grew 31% YoY

(+13% QoQ). Net realization grew 4% YoY (flat QoQ) to ~INR106k (in-line).

EBITDA margin expanded ~410bp YoY (+50bp QoQ) to 31.3% (v/s est. of

~30.6%), driven by efficiency-led reduction in RM costs (-450bp YoY; -140bp

QoQ). Adj. PAT rose 54% YoY to INR3.9b (v/s est. of ~INR3.8b), primarily driven

by higher other income (+58% YoY).

VECV margins decline due to unfavorable product mix:

VECV realizations

increased ~11% QoQ (-4% YoY) to ~INR1.47m (est. of ~INR1.46m) due to a

lower base of 1QFY17. EBITDA margin of 7.2% (-70bp YoY; -180bp QoQ) missed

our estimate of 7.7% due to unfavorable product mix. PAT declined ~3% YoY to

~INR657m (est. of ~INR685m).

Earnings call highlights:

a) RE’s classic model enjoys a waiting period of three

months, while other models have 1-1.5 months of waiting period. b) Top-20

cities continue to grow at 15%. d) Management indicated that it still has

enough headroom to further improve efficiencies by optimizing sourcing. c)

Current production capacity of 60k units/month should remain stable until

third plant is commissioned by 2QFY18 with initial capacity of 25-30k

units/month. For FY19, it maintained target of 900k/annum. d) Price increase

of 1% was taken in Aug-16 for RE bikes. e) RE plans to launch one new product

in FY18. f) Discounting in CVs at ‘super high’ levels.

Valuation and view:

We upgrade our EPS for FY17/18 by 2%/7% to factor in higher

RE volumes and strong margins. EIM trades at 26x/20.6x FY18E/19E EPS. Maintain

Buy

with a target price of INR33,436 (FY19 SOTP-based).

Financials & Valuations (INR b)

2016 2017E

Y/E Dec

Net Income

61.7

71.3

EBITDA

16.9

22.6

Net Profit

13.4

17.4

EPS (INR)

492.9

642.1

EPS Gr. (%)

73.7

62.9

BV/Sh. (INR) 1,276

1,777

RoE (%)

35.8

42.1

RoCE (%)

21.3

27.9

Payout (%)

0.4

0.5

Div. Yield,%

0.4

0.5

2018E

91.5

30.3

25.1

925.4

44.1

2,532

42.9

31.3

0.6

0.6

Estimate change

TP change

Rating change

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 6129 1524

Aditya Vora

(Aditya.Vora@MotilalOswal.com); +91 22 6129 1533 /

Venil Shah

(Venil.Shah@motilaloswal.com); +91 22 3982 5445

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.