2 November 2016

2QFY17 Results Update | Sector: Cement

J K Cement

Buy

BSE SENSEX

27,527

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,514

JKCE IN

69.9

63.5 / 1.0

990 / 425

5/48/34

22

33.0

2018E

46.2

9.0

4.0

56.9

59.8

311.0

19.9

11.9

14.4

15.9

2.9

9.2

CMP: INR909

TP: INR1,107 (+22%)

Revenues strengthened by white cement

Stable realizations and better performance in white cement drive profits:

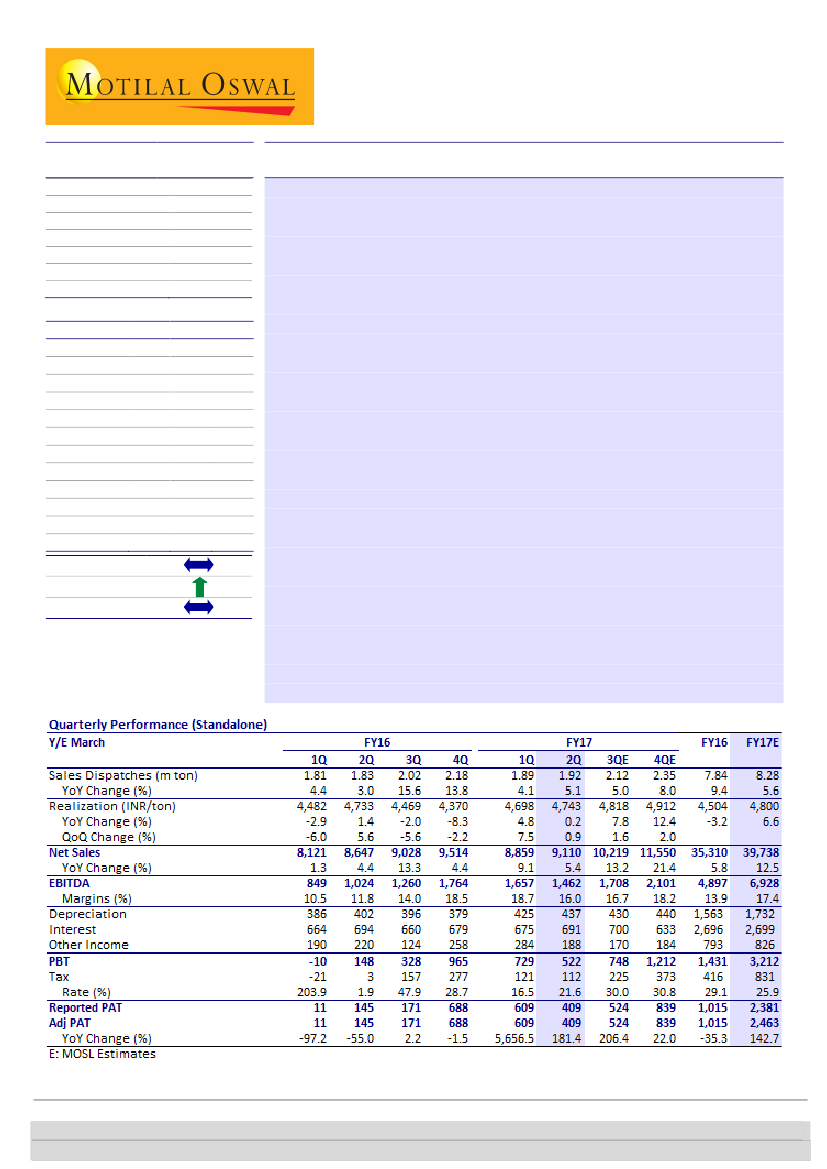

2QFY17 revenues grew 5% YoY to INR9.1b (13% above estimate). Grey cement

revenue was flat YoY at INR6b, while white cement revenue increased 19% YoY

to INR3.1b (highest quarterly revenue). Grey cement volume growth of 3.6%

YoY was led by better performance in north, partially offset by lower volume in

south. White cement volume growth was strong at 16% YoY. Blended

realizations improved 1% QoQ (flat YoY), led by better pricing in north. PAT

increased 181% YoY to INR409m, led by lower tax outgo.

Margin expansion led by cost savings:

EBITDA grew 43% YoY (-12% QoQ) to

INR1.46b, translating into margins of 16% (-2.7pp QoQ, +4.2pp YoY). Grey

cement margin contracted 6.1% QoQ (+3.9pp YoY) to 10.9% on account of

rehab-related cost for south operations and one-time cost of INR100m in

2QFY17. White cement margin expanded 5.9pp YoY to 30%. Blended

EBITDA/ton stood at INR761 (-13% QoQ, +36% YoY), while grey cement

EBITDA/ton was INR398 (+49% YoY, -35% QoQ).

Management commentary

: 1)

White cement volume likely to grow at

~22%/15% YoY for FY17/FY18E. 2) White cement capacity can be enhanced by

0.2m tons at north operations to cater to higher demand. 3) West market and

Karnataka have witnessed price increases of INR40/bag and INR20/bag,

respectively, since Aug-16. This should bode well for its south operations. 4) RIL

has reduced petcoke prices by INR200/t effective 1-Nov-16.

Preferred leverage play on earnings growth in north-west markets:

With

lower immediate capex and FCFE of INR3.5-4b in FY17-18, there remains

visibility of deleveraging from the FY16 peak of INR27b (1.6x). We maintain our

Buy

rating with a target price of INR1,107 (EV of USD127/ton on blended

capacity, 10x FY18E grey cement EBITDA and 9x FY18E white cement EBITDA).

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

Sales

35.3

39.7

EBITDA

4.9

6.9

NP

1.0

2.5

Adj EPS (INR)

14.5

35.6

EPS Gr. (%)

-18.8 145.5

BV/Sh. (INR)

232.4 262.2

RoE (%)

6.3

14.4

RoCE (%)

6.2

9.2

Payout (%)

32.2

16.4

P/E (x)

62.6

25.5

P/BV (x)

3.9

3.5

EV/EBITDA (x)

17.8

12.5

Estimate change

TP change

Rating change

Abhishek Ghosh

(Abhishek.Ghosh@motilaloswal.com); +91 22 3982 5436

Varun Gadia

(Varun.gadia@motilaloswal.com); +91 22 3982 5446

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.