3 November 2016

2QFY17 Result Update | Sector: NBFC

Cholamandalam Invst. & Fin.

BSE SENSEX

27430

BLOOMBERG

Equity Shares (cr)

52-Week Range (Rs)

1,6,12 Abs.Perf.(%)

M.Cap. (Rs cr)

S&P CNX

8485

CIFC:IN

15.6

1243/590

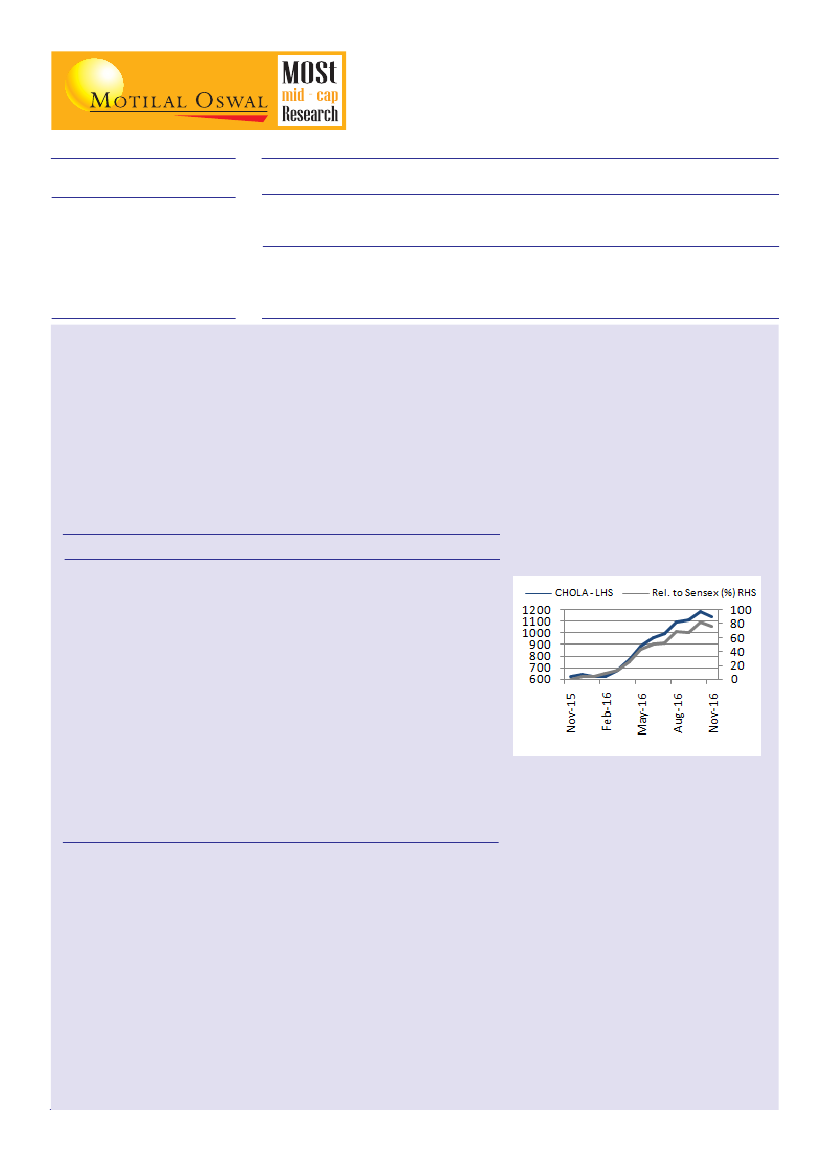

-2/36/84

16,264

CMP: INR1136

YEAR NET INC PAT

END

FY16

FY17E

FY18E

EPS

TP: INR1320 (+16%) Accumulate

EPS

Gr.(%)

31

34

32

PE

(X)

31.2

23.2

17.6

ABV

(INR)

221

266

331

P/BV

(X)

4.8

4.1

3.3

P/ABV ROAA

(X)

5.1

4.3

3.4

(%)

2.3

2.3

2.6

ROAE

(%)

16.7

17.5

18.9

(INRCr) (INRCr) (INRCr)

2142

2511

2989

567

762

1003

36

49

64

Result Highlights: In-line; AUM growth continues, lower provisioning drives PAT growth of 42%

Chola's Net Income grew by 17% to INR 593cr backed by AUM growth of 19% to INR 31,832cr. PAT has grown by

42% YoY to INR 171cr aided by lower provisioning (decline of 33% YoY) and is in line with our estimate of INR 172cr.

A recovery in the CV industry (50% of Chola's AUM) translated into resumption of growth for Chola over the last four

quarters. Disbursement growth was strong during the quarter at 21%. Consequently AUM growth was at a 10 quarter

high of 19%. The LCV/SCV loan book (32% of AUM) witnessed a recovery in growth to 8% while the HCV segment

(18% of AUM) witnessed 47% growth. Home finance (30% of AUM) grew at 18%. We expect the turnaround in AUM

growth for LCV/SCV book to sustain going forward as the industry comes out of a three year downturn combined with

transport operators witnessing highest capacity utilisation since FY12.

GNPAs were stable QoQ at 3.5% against 3.6% on 4 month basis.

2QFY16

506

1QFY17 2QFY17

560

226

334

80

254

89

165

18

30

8.4

40

3.6

2.5

17.8

593

252

341

77

263

92

171

19

21

8.4

43

3.5

2.4

17.7

YoY

17

21

14

(33)

44

47

42

QoQ

FY16 FY17E

YoY

17

22

14

(28)

34

34

34

INRCr

Net Income

6 2,142 2,511

11

845 1,033

Operating Expenses 208

Operating Profit

Provisions

Profit Before Tax

Tax Provisions

Net Profit

Loan Growth (%)

Disbursements (%)

NIMs (%)

C/I Ratio (%)

298

115

183

63

120

10

21

8.5

41

2 1,296 1,478

(4)

4

4

4

427

309

869 1,169

302

567

24

21

8.7

39

3.5

2.3

16.7

406

762

18

24

8.4

41

3.4

2.3

17.5

Gross NPAs (%) - 4m4.4

ROA (%)

ROE (%)

2.0

14.3

Valuation and view

Chola's branch network (637) has gone up over 4x since FY10 and is up 70% since FY12 whereas, peers have increased

their branches by just 20% over the same period. This is reflected in Chola's higher cost/income ratio at 43% vs peer

group average of 32%. However, with the recovery in the CV cycle (especially LCVs), Chola shall enjoy significant operating

leverage which would enable it to grow its profits at 30% CAGR over FY16-18E.

The management expects home loans business to grow aggressively in coming years and reach the size of its Home

Equity business (LAP) over a five year period, thereby lowering Chola's dependence on the vehicle finance business.

Diversification of loan book towards home loans, sustained recovery in the CV cycle and a decline in credit costs should

transform the business to 3.0% ROA from the current ROA of 2.4% in coming years. We value the company at 3.5x its Sep

2018 ABV and arrive at a target of INR 1,320 (earlier INR 1,160 at 3.5x FY18 ABV). We maintain our "Accumulate" rating on

the stock, as it has witnessed a steep run up over the last six months and now trades at a premium to its vehicle financing

peers.

Jehan Bhadha (jehan.bhadha@MotilalOswal.com); Tel: +91 22 33124915 Dharmesh Kant (Dharmesh.Kant@motilaloswal.com); l:+912230102470

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.