Market Overview

Prices of groundnut and palmolein oil plunged at the

wholesale oils and oilseeds owing to slackened demand

from retailers. However, other edible and non-edible

oils moved in a tight range in limited deals and settled

at previous levels. Easing demand from retailers

against ample stocks position on increased supplies

from producing regions, mainly led to decline in

groundnut and palmolein oil prices.

Government will release 10 lakh tonnes of wheat from

buffer stock to sell in the open market to boost

domestic availability and check prices. 12 lakh tonnes

of wheat has so far been imported by private traders

this fiscal, which will also ensure sufficient availability

of stock in the open market. Private imports could

touch 30 lakh tonnes this fiscal, while ruling out any

possibilities of further cut in import duty or the

government importing wheat on its own account.

Crude palm oil prices went up as traders created fresh

positions amid uptick in domestic demand and

restricted supplies from producing belts. Rise in crude

palm oil prices at futures trade to fresh positions built

up by participants due to pick-up in demand in the spot

market against tight stocks position on restricted

supplies from growing regions.

Mentha oil prices eased further as traders engaged in

trimming their positions, tracking a weak trend at spot

market. Cutting down of positions by participants amid

a weak trend at spot market on sluggish demand from

consuming industries against adequate stocks position

on higher supplies from Chandausi in Uttar Pradesh

mainly kept mentha oil prices down at futures trade.

Malaysian palm oil futures rose supported by concerns

about lower output despite a weaker performance by

rival vegetable oils. U.S. wheat futures fell more than 1

% and soybean and as markets took cues from U.S.

Department of Agriculture export sales data.

Commodity

Turmeric

Jeera

Soybean

Soy Oil

R M Seed

CPO

Sugar

Wheat

Mentha Oil

Cotton

Exchange

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

MCX

NCDEX

NCDEX

MCX

MCX

Expiry

Nov

Nov

Nov

Nov

Nov

Nov

Dec

Nov

Nov

Nov

Price

7378.0

17470.0

3087.0

669.7

4538.0

518.4

3426.0

2006.0

931.1

18430.0

%

Change

0.6%

1.6%

0.2%

0.2%

0.3%

0.4%

0.1%

-1.3%

-1.4%

0.6%

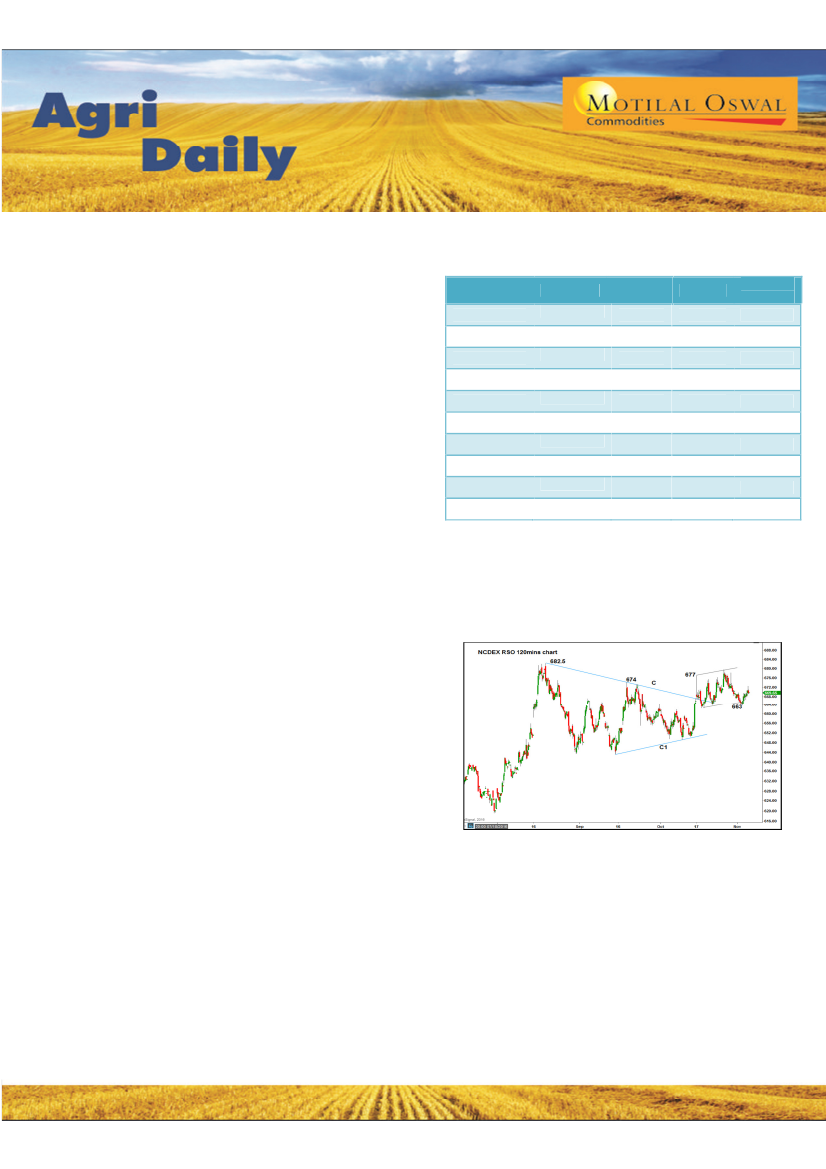

Chart of the Day: NCDEX RSO

As shown, NCDEX RSO has recently breached consolidation

range marked by C –C1 and is sustaining well above the

same indicating bullish move ahead. As long as immediate

support near Rs.663-659.50 zone is held, dip buying is

advised targeting Rs.682 on the higher side.

1

Please refer to disclaimer at the end of the report.