7 NOVEMBER 2016

SECTOR: AUTO ANCILLARY

Sterling Tools Limited

BSE SENSEX

27458.99

S&P CNX

8497.05

(INR CRORES)

CMP: INR913 TP: INR1207 (+32%)

Buy

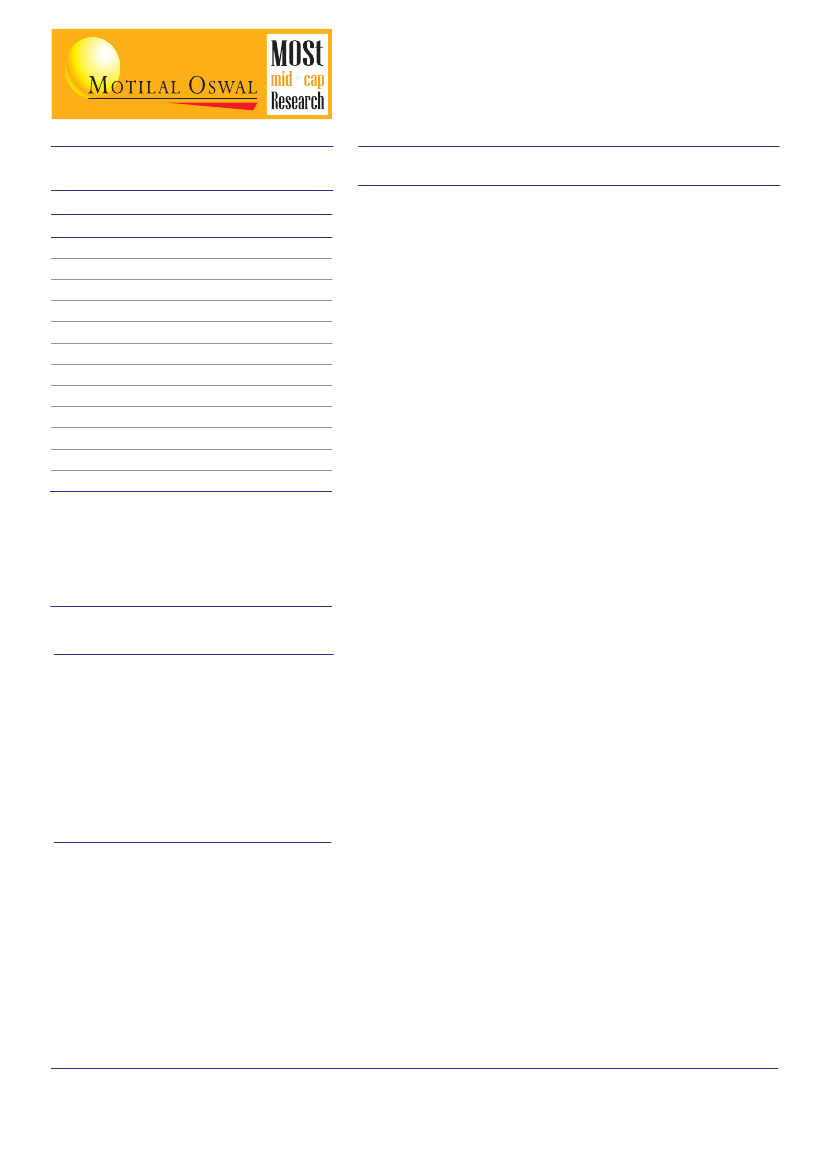

Y/E MARCH

Revenue

EBITDA

EBITDA Margin

NP (Adj.)

EPS (Adj.)

EPS Growth

BV/share

Core ROE (%)

Core ROCE (%)

P/E (x)

P/BV (x)

FY16

367

61

16.7%

29

41.6

34%

189

23

24

22.0

4.8

FY17E

414

72

17.3%

35

51.0

21%

224

25

27

17.9

4.1

FY18E

466

83

17.8%

41

60.3

18%

267

25

27

15.1

3.4

KEY FINANCIALS

Diluted Shares (cr)

Market Cap. (Rs cr)

Market Cap. (US$ m)

Past 3 yrs Sales Growth (%)

Past 3 yrs NP Growth (%)

0.7

625

94

10%

43%

STOCK DATA

52-W High/Low Range (INR)

Major Shareholders (as of Sep 2016)

Promoter

Institutions

Public & Others

Average Daily Turnover(6 months)

Volume

Value (Rs cr)

1/6/12 Month Rel. Performance (%)

1/6/12 Month Abs. Performance (%)

1030/365

70.2

0.4

29.4

7,133

0.6

18/89/138

14/81/140

We recommend to BUY Sterling Tools Limited (STL) for a

target of INR 1,207 - 20x on FY18E EPS (+32% Upside).

One of the largest fastener manufacturers in India:

Sterling Tools

is one of the largest manufacturer of fasteners in India, with a market

share of ~28%. The company is supplier of high tensile (HT) fasteners

to Honda Motorcycle Scooter India Private Limited (HMSI) and Maruti

Suzuki India Limited (MSIL). In top line 2-wheeler accounts for 25%

, passenger vehicles (~15%), commercial vehicles (~25%), and farm

equipment (~7%-8%) of total sales. STL's other customers include

Tata Motors, Ashok Leyland, Daimler, FIAT, Hero Motocorp,

Mahindra & Mahindra, Volvo, Eicher, TAFE and General Motors. Sales

to OEM form ~85%, after market ~8% and exports constitutes ~7%

of total revenue. STL has a capacity of 45,000 MT spread across

three plants currently running at 70-75% utilisation. The company has

started work on the phase-I expansion for a new plant in Gujarat.

Total capex for the project will be INR 50cr likely to be commissioned

by September 2017.

Triggers in place for an uptick in automobiles sales:

Good

monsoons and 7th pay commission have accelerated the volume growth

for the leading automobile companies across segments. STL's major

principal's Maruti Suzuki and HMSI reported 13.5% YoY and 23.5%

YoY volume growth respectively for 3 month period Aug-Oct 2016.

Passenger vehicles, 2 wheelers, commercial vehicles or tractors all

are poised to post strong volume growth in FY17. STL's strong market

positioning in automobile fastener segment having sizeable market share

in OEMs lends heft to its growth prospects for foreseeable future.

Strong financials:

The company delivered a CAGR of 10% in revenues

during FY13-16; during the same period PAT delivered a CAGR of

43% aided by improving margins and cash flows. Strong focus on

costs and tight control over working capital has yielded desired operating

efficiencies for the company. Sound balance sheet management has

led to sharp improvement in return ratios over the years. [ROE 11% in

FY13 to 23% in FY16, ROCE:15% in FY13 to 24% in FY16].

Valuations & View:

Conducive macro factors like good monsoons,

7th pay commission roll out, passage of GST, increasing localization

by OEMs will propel STL on growth path going forward. We expect

earnings growth of 20% over FY16-18E. STL trades at 15.1x FY18E

EPS of INR 60.3. We initiate coverage on the stock with a 'BUY'.

We value the company at 20x FY 18E EPS with a target price INR

1,207, giving an upside of 32%.

Dharmesh Kant (Dharmesh.Kant@motilaloswal.com); Tel: +91 22 30102470

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.