Eveready Industries

BSE SENSEX

27,253

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

8,432

EVRIN IN

72.7

18.3 / 0.3

318 / 192

-2/-4/-16

57

56.0

9 November 2016

2QFY17 Results Update | Sector: Others

CMP: INR243

TP: INR332(+37%)

Buy

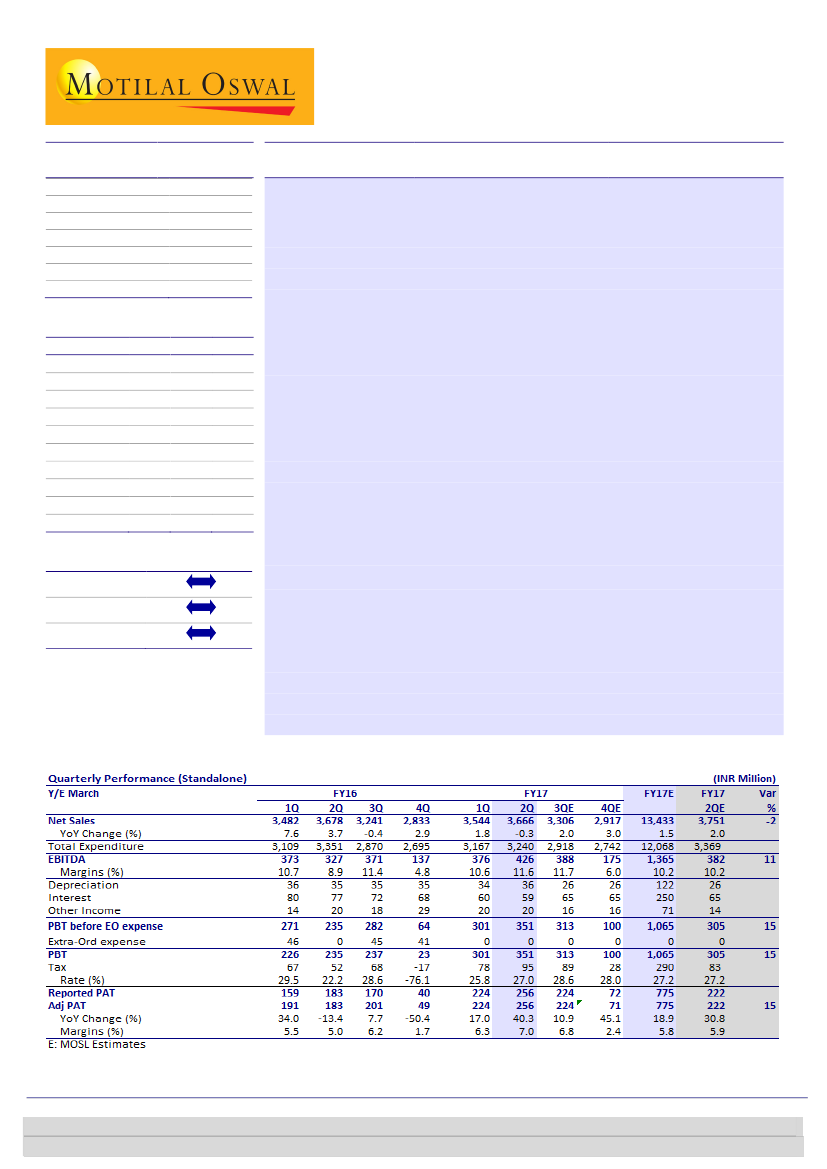

PAT growth healthy; new product category growth key trigger

Healthy margin expansion:

Eveready Industries’

(EVRIN)

2QFY17 revenue was

flattish at INR3,666m (est. of INR3,751m) due to weak rural demand and

flattish growth across battery/flashlights businesses. LED business grew 92%

YoY, offset by 55% YoY decline in CFL business, leading to small blended growth

in the electrical segment. EBITDA margin expanded 274bp YoY to 11.6% (est. of

+10.2%) in 2QFY17. EBITDA grew 30% YoY to INR426m (est. of INR382m) due to

favorable product mix, overall cost conservation and improved lighting

category margins. Adjusted PAT grew 40% YoY to INR256m (est. of INR222m).

Healthy LED sales growth:

Total LED sales grew 92% YoY to INR506m from

INR263m in 2QFY16. Volume-wise, 6m pieces were sold (+3x YoY), of which

~50% were government orders. It won EESL orders for LED tube lights worth

INR180m, which would be executed in 3Q/4Q and thus drive growth in 2HFY17

New product categories to drive growth:

EVRIN has launched a range of

products in the small appliances segment (value for money positioning). The

company expects to clock revenues of INR1b in FY18 from the category. It is

appointing new distributors/dealers in northern/eastern markets. In

luminaries, it intends to launch new products from 3QFY17 and ramp-up sales

in FY18. Luminaries is expected to be a high-margin business.

Valuation and view:

We expect the government’s move to ban certain

denomination notes to cause liquidity crunch for dealers for a month or so, but

not impact demand (small-ticket item). We keep estimates unchanged: 6%

revenue CAGR and 190bp EBITDA margin expansion over FY16-18, driving 25%

PAT CAGR. We value the stock at 23x (50% premium over 5year median P/E led

by increase in return ratios and entry into newer product categories) FY18E;

maintain

Buy

with TP of INR332.

Financials & Valuation (INR b)

Y/E Mar

2016 2017E 2018E

Net Sales

13.2

13.4

15.0

EBITDA

1.2

1.4

1.6

PAT

0.7

0.8

1.1

EPS (INR)

9.2

10.7

14.5

Gr. (%)

8.3

16.2

34.9

BV/Sh (INR)

28.4

35.6

45.4

RoE (%)

16.2

33.5

35.7

RoCE (%)

15.2

23.8

26.3

P/E (x)

26.1

22.5

16.7

P/BV (x)

8.5

6.8

5.3

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +912239825422/Chitvan

Oza

(chitvan.oza@MotilalOswal.com); +912230102415

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.