Allcargo Logistics

BSE SENSEX

26,052

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

S&P CNX

8,033

AGLL IN

252.1

41.3/ 0.6

222 / 135

-1/6/-16

50

30.2

23 November 2016

2QFY17 Results Update | Sector: Logistics

CMP: INR164

TP: INR196 (+20%)

Buy

Steady performance in challenging environment

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

Net Sales

56.6

57.9

62.2

EBITDA

5.2

5.1

5.7

PAT

2.7

2.7

3.2

EPS (INR)

10.8

10.6

12.8

Gr. (%)

17.2

(2.2) 21.4

BV/Sh (INR)

87.5

71.1

81.2

RoE (%)

13.2

13.3

16.8

RoCE (%)

11.2

10.9

13.7

P/E (x)

15.2

15.5

12.8

P/BV (x)

1.9

2.3

2.0

EV/EBITDA (x)

8.7

7.8

6.4

Estimate change

TP change

Rating change

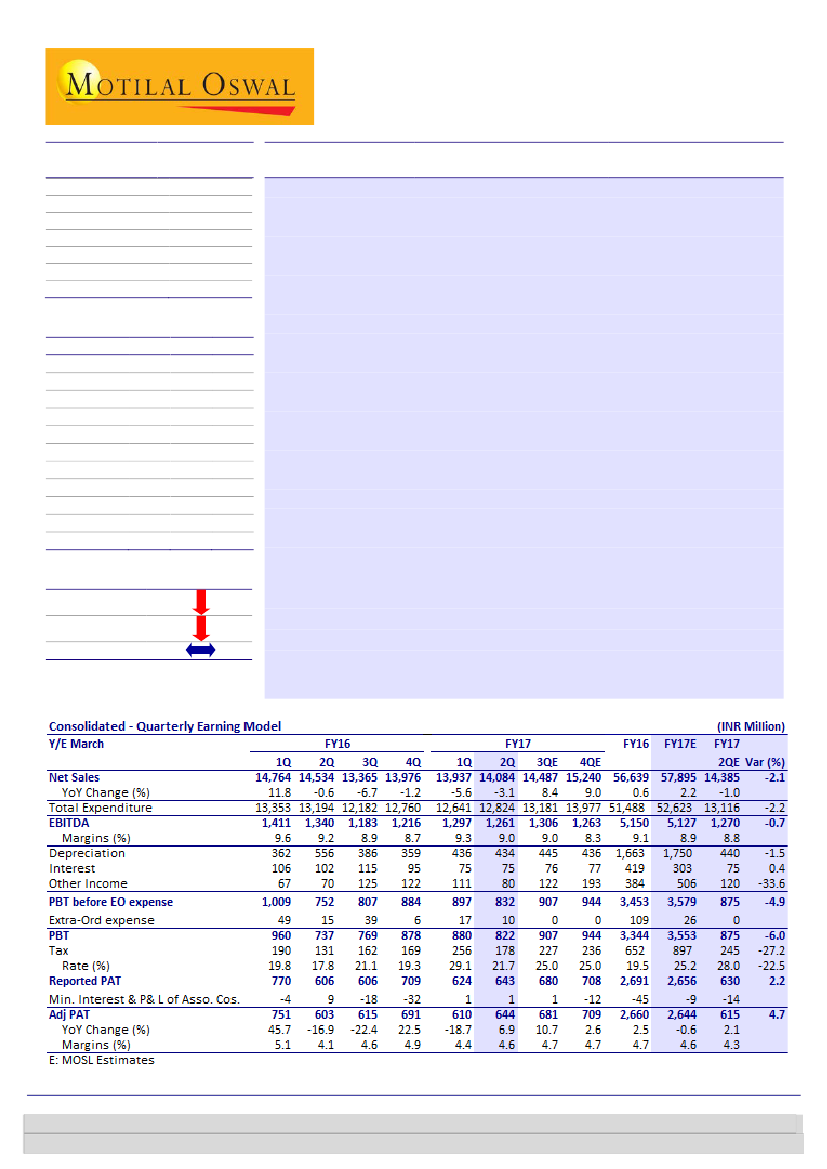

Allcargo’s (AGLL) EBITDA declined 6% YoY (-3% QoQ) to INR1.26b (est. of INR1.27b)

due to slowdown in the project logistics business and transfer of certain business in

JV. Reported EBIT stood at INR827m (est. of INR830m; +5% YoY; -4% QoQ), while

PAT was INR643m (est. of INR630m; +6% YoY; +3% QoQ) driven by a lower tax rate

of 21.7% (est. of 28%; 29% in 1QFY17).

MTO volumes up 8% YoY, despite weak macros:

AGLL’s MTO volumes grew

8% YoY to 127,463 TEUs in 2QFY17, despite muted global trade. Growth

continued to come from the key markets of India, China and South East Asia.

Realizations declined 9% YoY led by falling freight rates, while EBIT margin

increased to 4.1% (v/s 3.9% in 2QFY16).

Margin improvement for CFS segment:

CFS volumes stood at 69,260 TEUs (flat

YoY, -7.8% QoQ). CFS revenue stood at INR1.1b (+5% YoY, +1% QoQ).

Realizations were INR15,494/TEU, as against INR15,726 in the year-ago period.

EBIT/TEU stood at INR5,732 (v/s INR5,080 in 2QFY16), helped by handling of

specialized cargo in Chennai CFS.

P&E impacted by slowdown in project logistics business:

P&E segment’s EBIT

stood at INR110m (-21% YoY; -38% QoQ) led by management’s conscious

decision to move away from low RoCE business, resulting in sale of aged assets.

Valuation and view:

With (a) current businesses largely in steady state and minimal capex

requirement and (b) strong balance sheet and ~8-9% FCF yield, AGLL is well

placed to invest in DFC/GST-led opportunities.

We value AGLL at FY18E EV/EBITDA of 8.5x and arrive at fair value of INR196.

On FY18E, the stock trades at P/E of 12.8x and EV/EBITDA of INR6.4x. Maintain

Buy.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Abhishek Ghosh

(Abhishek.Ghosh@motilaloswal.com); +91 22 3982 5436

Abhinil Dahiwale

(Abhinil.Dahiwale@MotilalOswal.com); +91 22 3980 4309