Cement

Sector Update | 13 December 2016

Cement

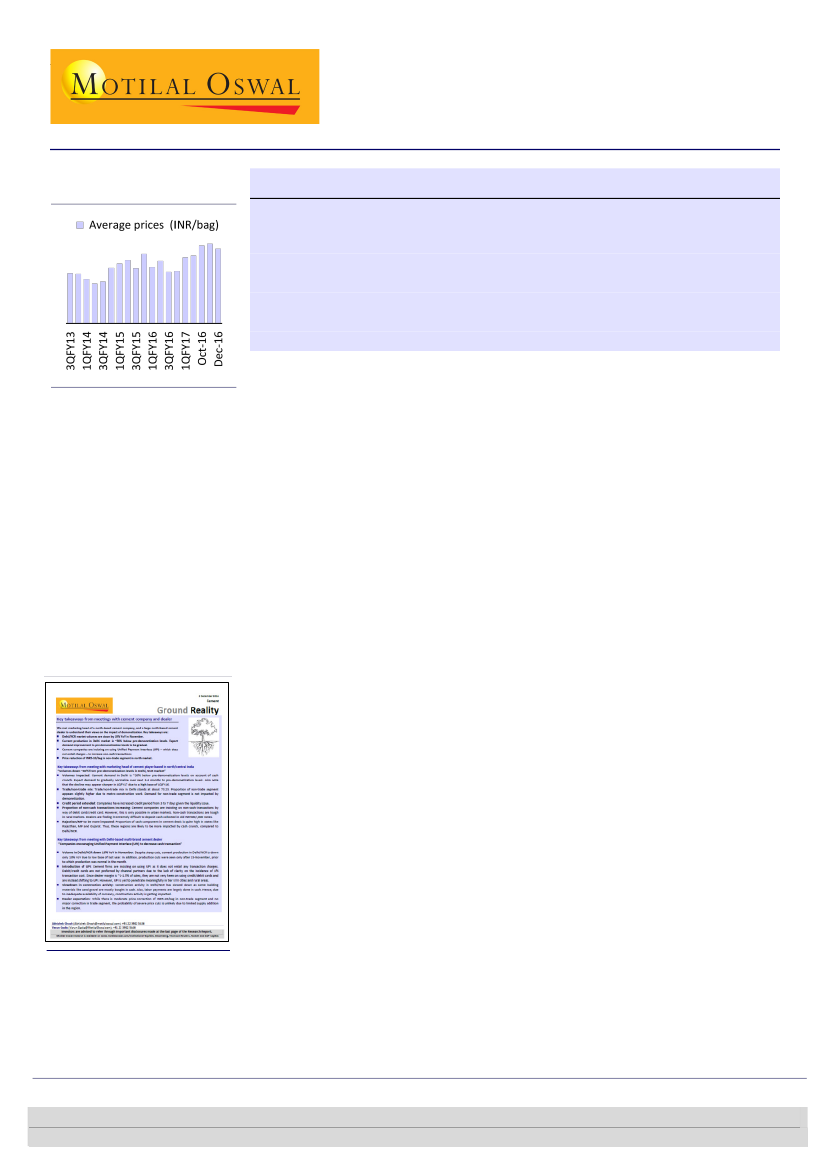

All India cement prices declined

MoM

Prices decline across regions

Likely to remain under pressure in December

All-India average realization is down by INR5/bag MoM in December due to price

declines across regions.

Price decline across regions is ~INR2-6/bag due to demand weakness. Also, price hikes

in select regions have been rolled back due to poor demand.

Prices in east are likely to decline further due to volume push by companies like

Holcim and Lafarge to meet year-end targets.

Prices under pressure due to subdued demand

All-India average price for December is down by INR5/bag MoM due to declining

demand trends across regions. The decline in prices is slightly higher in east as

excess supply and weak demand hurt prices in Chhattisgarh. Prices in east are

expected to remain weak for rest of December due to higher volume push by

companies like Holcim and Lafarge to meet year-end demand. Price decline is least

in south at INR1/bag driven by production discipline. The decline in central market

too is on account of lower construction activity in U.P. North witnessed price decline

of INR5/bag, led by lower prices in Jaipur (-INR15/bag) as construction activity

reduced meaningfully due to cash crunch. Prices in west declined by INR5/bag MoM

on account of weak real estate demand in Mumbai/Ahmedabad and commissioning

of new supply in the region.

Please refer to our Ground

Reality report based on

interaction with the channel

Regional trends in 1H of December

North:

Prices in the region increased by INR10/bag in the first week of

November post the festival season. However, demand weakness post

demonetization led to reversal of price hike. The decline is more pronounced in

cities like Jaipur (-INR15/bag from November levels). While Delhi has witnessed

price decline of INR5/bag MoM in December, dealers suggest that demand

there has declined by ~10% YoY in November.

Central:

Select cities like Bhopal have seen negligible price reduction from

November levels. However, cities like Lucknow have witnessed some price

correction due to weak construction activity led by cash crunch.

West:

After seeing sharp improvement in September, cement prices in the

region largely sustained till the first week of November. However, due to weak

real estate demand in Mumbai/Ahmedabad, prices have come under pressure.

Additionally, ABG Cements clinker unit started production in end-September,

further pressurizing prices in the region. However, as only partial impact of price

hikes in September were seen in 2QFY17, average prices in 3Q may be

sequentially better if current prices sustain

.

Abhishek Ghosh

(Abhishek.Ghosh@motilaloswal.com); +91 22 3982 5436

Varun Gadia

(Varun.Gadia@motilaloswal.com); +91 22 3982 5446

Investors are advised to refer through important disclosures made at the last page of the Research Report.

1

13 December 2016

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.