16 December 2016

C

orner

O

ffice

the

Tata-Mistry boardroom battle

A compilation of key developments

The Tata Group, India’s largest conglomerate group, has recently witnessed several differences

of opinion among its top management. On October 24, 2016, Tata Sons announced the ouster

of Mr Cyrus Mistry as its Chairman (though he remains a director on the board). Non-

performance, attempting to gain control, and taking critical decisions without keeping Tata

Sons’ board informed were cited as the reasons. On requisition from Tata Sons, various Tata

Group companies have called for an EGM to evict Mr Mistry as a director. Institutional

investors’ votes are likely to play a decisive role in the outcome of this resolution in some of

the companies. We summarize the series of events /relevant information that investors might

find handy for their decision making.

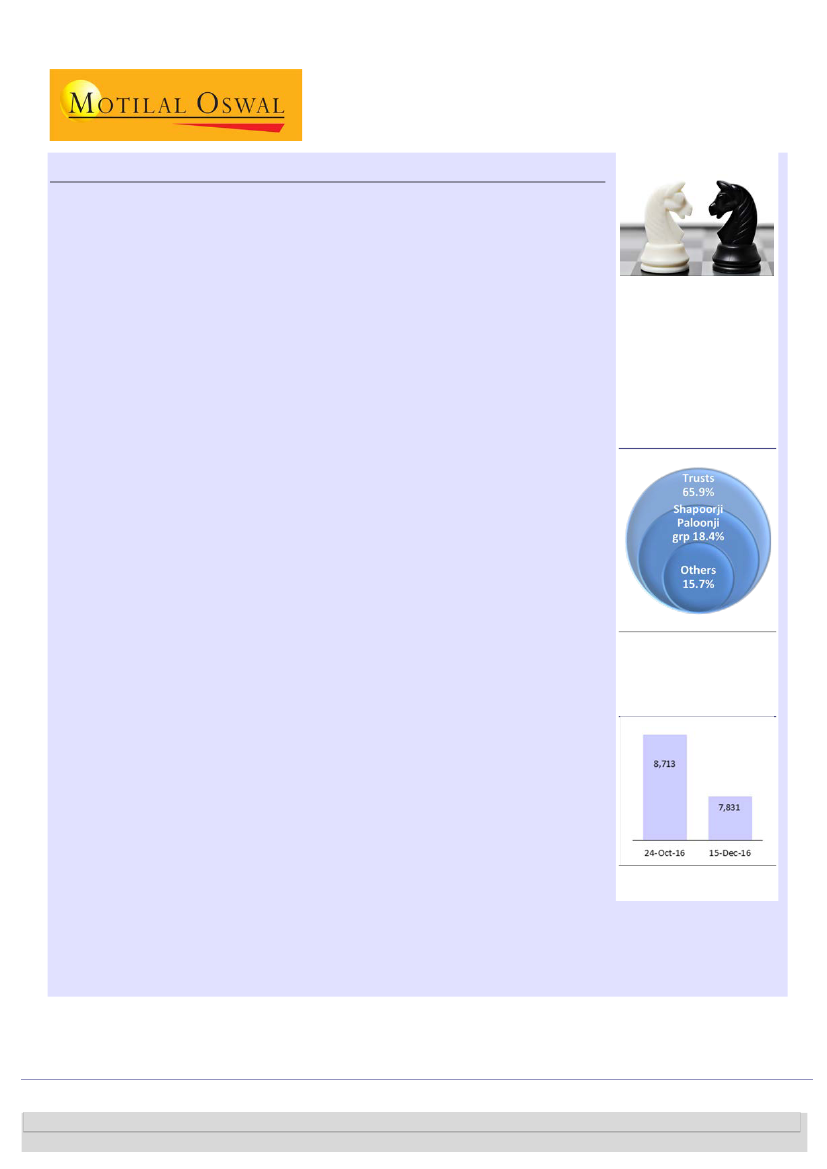

Tata trusts have significant say in India’s largest group

The Tata Group, which includes among others, 26 listed entities accounting for ~7%

of the BSE’s total market capitalization, is India’s largest conglomerate group. Tata

Sons is the Group’s unlisted holding company. About 66% of Tata Sons’ equity

capital is held by philanthropic trusts endowed by members of the Tata family. Tata

trusts have the power to appoint one-third of Tata Sons’ directors. Any item that

requires approval of Tata Sons’ board needs to be ratified by a majority of its trust-

nominated directors. Further, Tata trusts have the power to nominate majority of

members on the committee constituted for appointment/removal of the Chairman.

Tata Sons ousts Mr Mistry from Chairmanship

On October 24, 2016, Tata Sons’ board ousted Mr Cyrus Mistry from Chairmanship,

citing non-performance, attempting to gain control, and taking critical decisions

without keeping the board informed. Since then, Mr Mistry has made counter-

representations citing legacy issues, lack of freedom, and other issues relating to the

Group’s functioning.

Institutional investors to play decisive role at EGMs

Mr Mistry was the Chairman of seven listed Tata Group companies before being

ousted as Chairman of Tata Sons. Since then, he has lost three of these

chairmanships. Further, six listed Tata Group entities have called EGMs to evict Mr

Mistry from directorship. Such a resolution requires a simple majority approval of

shareholders voting. We note that institutional ownership (Refer Exhibit 2) is

significantly high in all the companies (except TCS); institutional investors, will

therefore, play a critical role.

SHP of Tata Sons Ltd.

Market cap of 26 listed Tata

grp Cos (INR b)

Source: Capitalline

Sandeep Gupta

(S.Gupta@MotilalOswal.com); +9122 3982 5544

Mehul Parikh

(Mehul.Parikh@MotilalOswal.com); +91226129 1558

/

Somil Shah

(Somil.Shah@MotilalOswal.com); 9122 3312 4975

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.