Monday, January 09, 2017

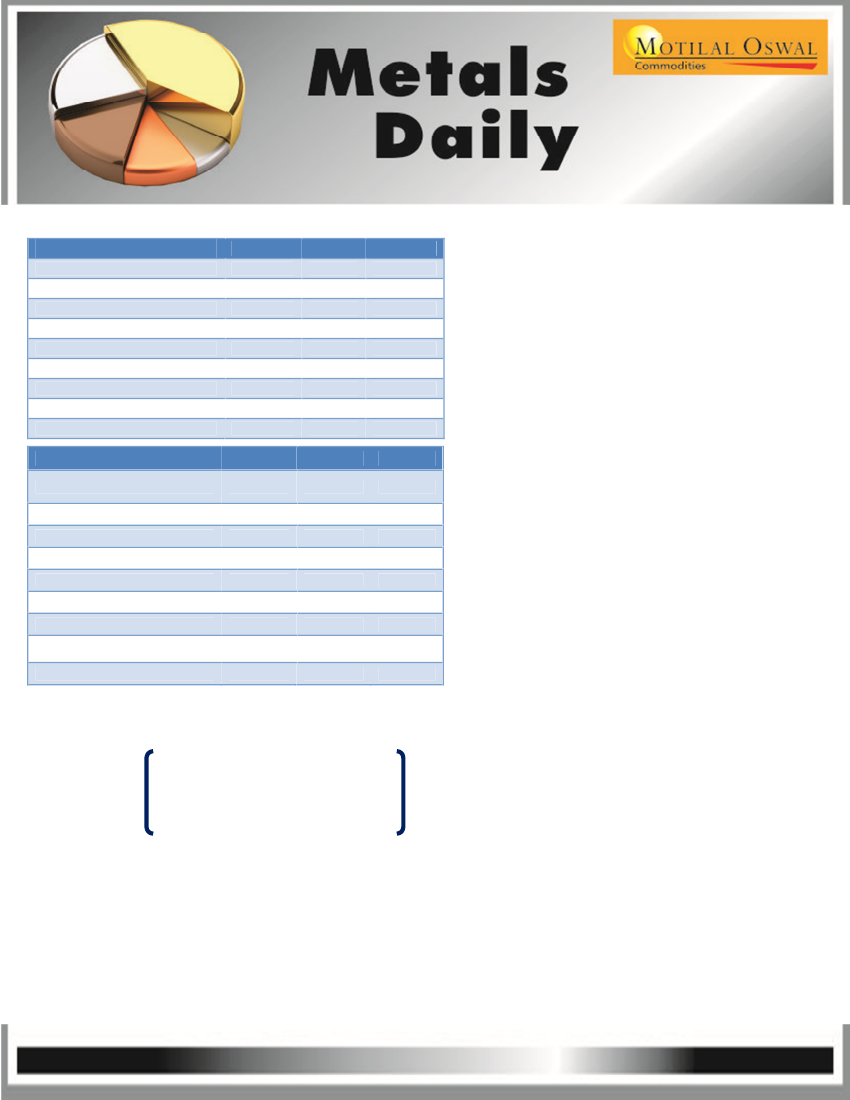

Commodity

Gold / US Dollar FX Spot

Silver / US Dollar FX Spot

Crude oil $ Spot

COMEX Copper $

LME Copper (3M)

LME Aluminum (3M)

LME Nickel (3M)

LME Lead (3M)

LME Zinc (3M)

Last

1172.7

16.5

54.0

343.5

5612.5

1713.0

10370.0

2066.0

2635.0

Chg.

-7.7

-0.1

0.2

-1.9

17.5

-5.0

75.0

-3.5

10.0

% Chg.

-0.6%

-0.5%

0.4%

-0.6%

0.3%

-0.3%

0.7%

-0.2%

0.4%

Market Overview (Economy)

Asian markets are edging higher following

positive close on the Wall Street as US

employment data lifted sentiment

Non-farm payrolls increased less than

expected but wage growth was at the

strongest since 2009 at 2.9% y/y.

Data over the weekend showed China’s

foreign-exchange reserves fell for a sixth

straight month.

IN currencies, the dollar rallied post the jobs

data and the rally is expected to continue

this week. The yuan has opened 0.3% lower

which will pressure the INR as well.

Equity

BSE Sensex Index

S&P CNX NIFTY

Hang Seng Index

Shanghai SE Composite Index

Nikkei 225 Index

DAX Index

CAC 40 Index

Dow Jones Industrial Average

Index

NASDAQ 100 Index

Last

26759.2

8243.8

22503.0

3154.3

19520.7

11599.0

4909.8

19963.8

5007.1

Chg.

-119.0

-30.0

46.3

-11.1

-73.5

14.1

9.2

64.5

42.1

% Chg.

-0.4%

-0.4%

0.2%

-0.4%

-0.4%

0.1%

0.2%

0.3%

0.8%

Precious Metals

Gold prices are trading flattish after a

positive close last week but better US

employment data will weigh on prices this

week

The US economy added 156k jobs in

December, which were fewer than expected

175k. Headline unemployment edged higher

to 4.7%

Average hourly earnings however increased

by 2.9% year-on-year, a post-recession

high.

US service and manufacturing PMI last week

also beat expectations

Chicago Federal Reserve President Charles

Evans hinted that the Fed could raise

interest rates three times this year.

The US economy added 156k jobs in

December, which were fewer than

expected 175k

.

1

Please refer to disclaimer at the end of the report.