18 January 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

27,236

-0.2

Nifty-50

8,398

-0.2

Nifty-M 100

15,243

0.0

Equities-Global

Close

Chg .%

S&P 500

2,268

-0.3

Nasdaq

9,355

0.7

FTSE 100

7,220

-1.5

DAX

11,540

-0.1

Hang Seng

9,702

0.4

Nikkei 225

18,814

-1.5

Commodities

Close

Chg .%

Brent (US$/Bbl)

56

1.5

Gold ($/OZ)

1,217

1.2

Cu (US$/MT)

5,731

-1.9

Almn (US$/MT)

1,802

0.3

Currency

Close

Chg .%

USD/INR

68.0

-0.2

USD/EUR

1.1

1.1

USD/JPY

112.6

-1.4

YIELD (%)

Close 1MChg

10 Yrs G-Sec

6.4

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

17-Jan

MTD

FIIs

0.0

-0.5

DIIs

-0.1

0.3

Volumes (INRb) 17-Jan MTD*

Cash

202

203

F&O

3,537

3,474

Note: YTD is calendar year, *Avg

YTD.%

2.3

2.6

6.2

YTD.%

1.3

1.1

1.1

0.5

3.3

-1.6

YTD.%

0.8

5.6

3.8

5.8

YTD.%

0.1

1.9

-3.7

YTDchg

-0.1

-0.1

CY16

2.9

5.3

CY16*

220

3,447

Today’s top research ideas

Shriram City Union Finance (INITIATING COVERAGE): The

Quintessential NBFC; Tapping the untapped market

SCUF is a diversified NBFC with strong expertise in low ticket size and high growth

products like MSME and 2W lending. At INR0.5m, the average MSME ticket size of

the company is significantly lower than business loans of other banks/NBFCs.

Banks find it economically infeasible to cater to this segment with such small ticket

loans, resulting in modest competition for SCUF. SCUF is the country’s largest two-

wheeler financier by volumes, disbursing ~75,000 loans a month. While AUM grew

at 42% CAGR over FY05-13, growth was badly hit due to wind-down of the gold loan

portfolio and a sluggish rural economy. However, with the necessary infrastructure

in place as well as improving credit demand, we expect SCUF to record 19% AUM

CAGR over FY16-19E driven by strong growth in MSME and personal loans.

With robust capitalization (Tier I of 23%+), improving return ratios (3.7% ROA,

16.8% ROE by FY19E) and robust AUM CAGR, we expect stock to deliver 35% return

over next 12 months. Buy with a target price of INR2,500 (2.5x FY19E BVPS).

Research covered

Cos/Sector

Shriram City Union Fin.

NIIT Technologies

Dewan Housing

LIC Housing Finance

AVIATION

Results Expectation

Key Highlights

The Quintessential NBFC; Tapping the untapped market

Stellar cash generation; Offset by patchy growth trajectory

Temporary impact from demonetization; cost of funds down sharply

Growth continues to be driven by the non-core businesses

Dec-16 domestic air passenger growth at 23.4% YoY;

KPIT Technology

Piping hot news

Tax breather for foreign investors

Quote of the day

In a commodity business, it’s very hard to

Foreign portfolio investors (FPI) can now breathe easy with the Income Tax (I-

be smarter than your dumbest

T) Department on Tuesday putting in abeyance its controversial circular on

competitor.

taxing India-dedicated funds. Experts said clarity was necessary on the issue at

the earliest so that FPIs were certain.

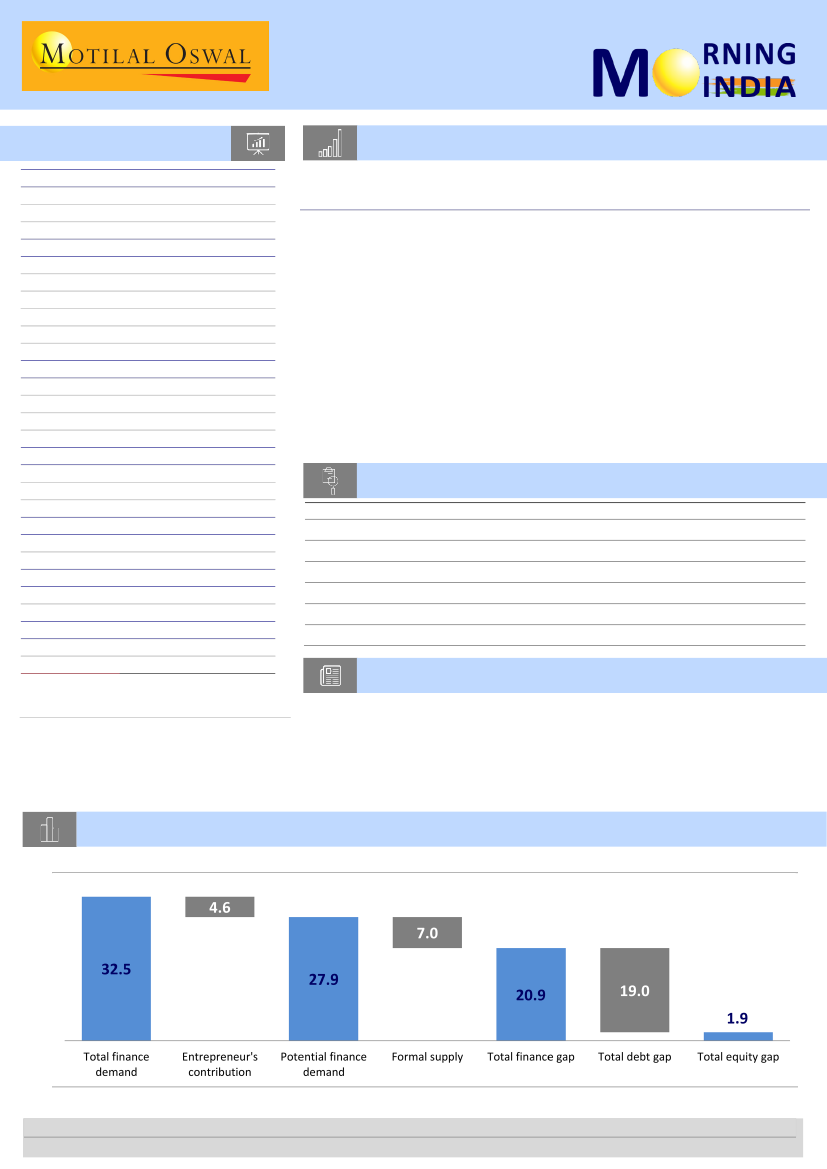

Chart of the Day: SCUF - MSME sector lacks sufficient access to formal financing (INR t)

Overall finance gap in the MSME sector (INR t)

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.